A previous spike in 10-year Treasury yields and the arrival of inflation are among the factors making life difficult for advisors on the fixed income front in 2021.

Interest rates are also still low, making some previously beloved income-generating assets difficult to justify in client portfolios. The good news is that there are still places to turn to, including the WisdomTree Fixed Income Model Portfolio.

While no model portfolio is foolproof, the WisdomTree Fixed Income Model Portfolio intends to provide the right balance of income, credit opportunities, and perhaps some protection against Federal Reserve tapering – all of which are relevant considerations in the current environment.

“Pressure, external—and in some cases perhaps internal—seemed to be building for the Fed to begin their discussions about when/how to begin tapering their current quantitative easing (QE) program,” said Kevin Flanagan, WisdomTree head of fixed income strategy, in a recent note. “While the May employment data continued to show progress being made within the nation’s labor markets, it fell short of creating any urgency for the Fed to shift course in the immediate future.”

Why This Model Portfolio Matters Today

As noted above, the specter of inflation is one of the primary issues vexing fixed income investors in 2021. The WisdomTree model portfolio has some avenues for grappling with rising consumer prices, including exposure to corporate debt and floating rate note (FRN) exchange traded funds.

Fed Chairman Jerome Powell is proving somewhat hesitant in his inflation commentary, but data indicate the pace of consumer price increase is gaining steam and some of the scenarios contributing to inflation – namely labor participation – may take time to work through.

Last month “the unemployment rate fell -0.3 pp to 5.8%, this had more to do with a decline in the civilian labor force as the ‘participation rate’ dropped during the month. Based upon the May jobs data, the employment part of the equation still has a way to go, especially in Powell’s eyes,” adds Flanagan.

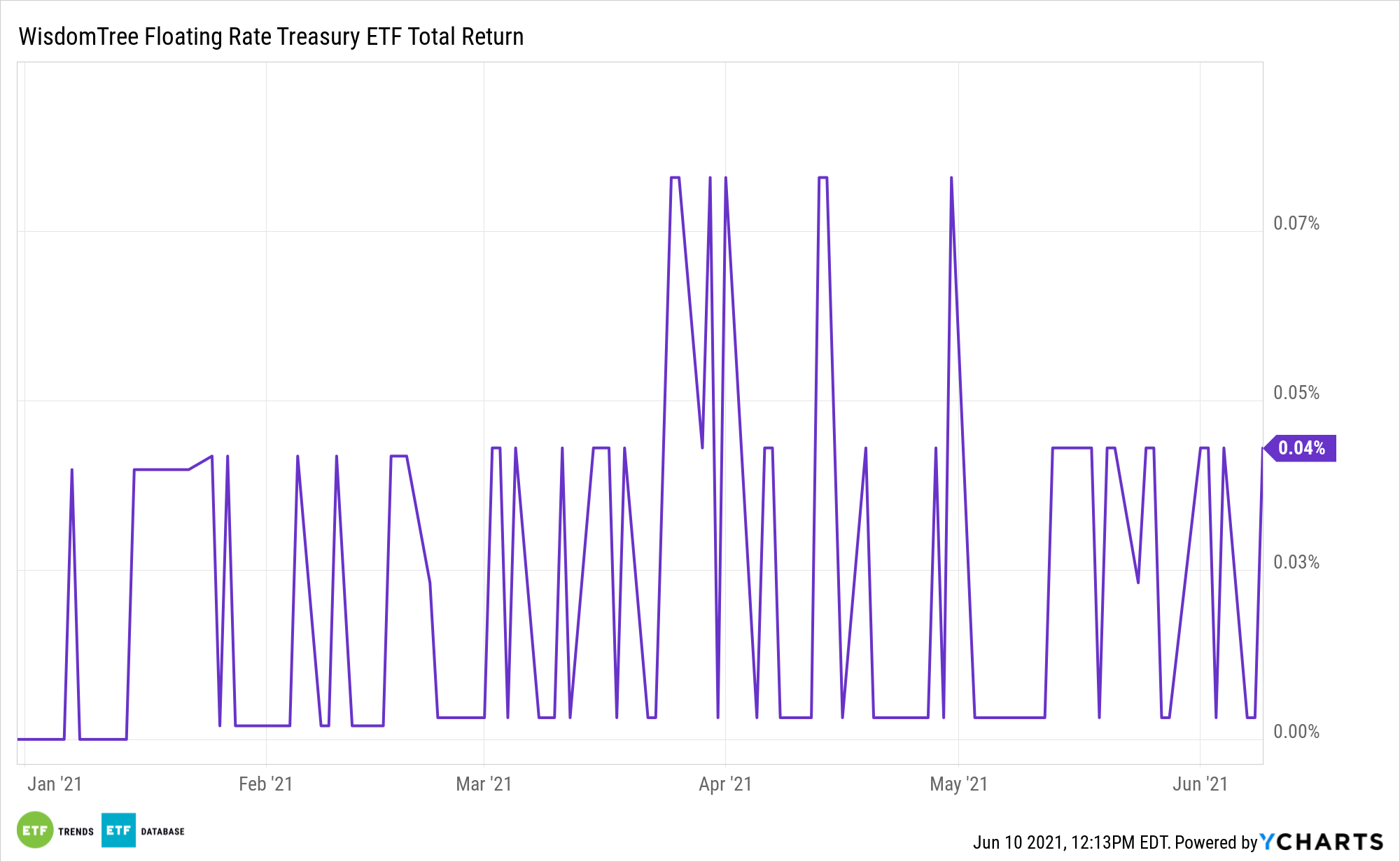

Bottom line: advisors would do right by clients by continuing to prepare for inflation. One of the inflation-fighting vehicles in the WisdomTree model portfolio is the WisdomTree Bloomberg Floating Rate Treasury Fund (NYSEArca: USFR).

FRNs are benchmarked to short-term interest rates and usually pay lower coupons than fixed rate bonds, yet they typically soar in value when Treasury yields climb.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.