Many equity-focused investors may not be aware of this, but the U.S. dollar is one of this year’s best-performing currencies.

In fact, the dollar is standing out against the backdrop of other traditional hedges (gold and some bonds) vexing investors. While some investors believe the dollar and stocks move inverse of each other, a strong dollar can be positive for equities in some circumstances, including with currency-hedged exchange traded funds.

Currency-hedged ETFs garnered plenty of attention during the Federal Reserve’s tapering regime and subsequent strong dollar environment in 2013-14. However, these funds could be worth revisiting today for investors seeking ex-U.S. equity exposure. The WisdomTree Developed International Factor Portfolio provides exposure to multiple currency hedging strategies.

A Stronger Dollar

The WisdomTree model portfolio could be alluring for advisors and clients for another reason: The dollar is benefiting from elevated turbulence in the domestic bond market this year.

“Since the start of the year the dollar has been more likely to rise when bond market volatility is rising,” notes BlackRock. “At the same time, rising bond market volatility has increasingly been correlated with higher equity volatility. Put differently, the dollar and equities are frequently responding to the same underlying factor, but in different directions.”

On the other hand, the model portfolio provides strong dollar benefits as they relate to ex-U.S. developed market stocks – an asset class that’s almost too inexpensive to ignore these days.

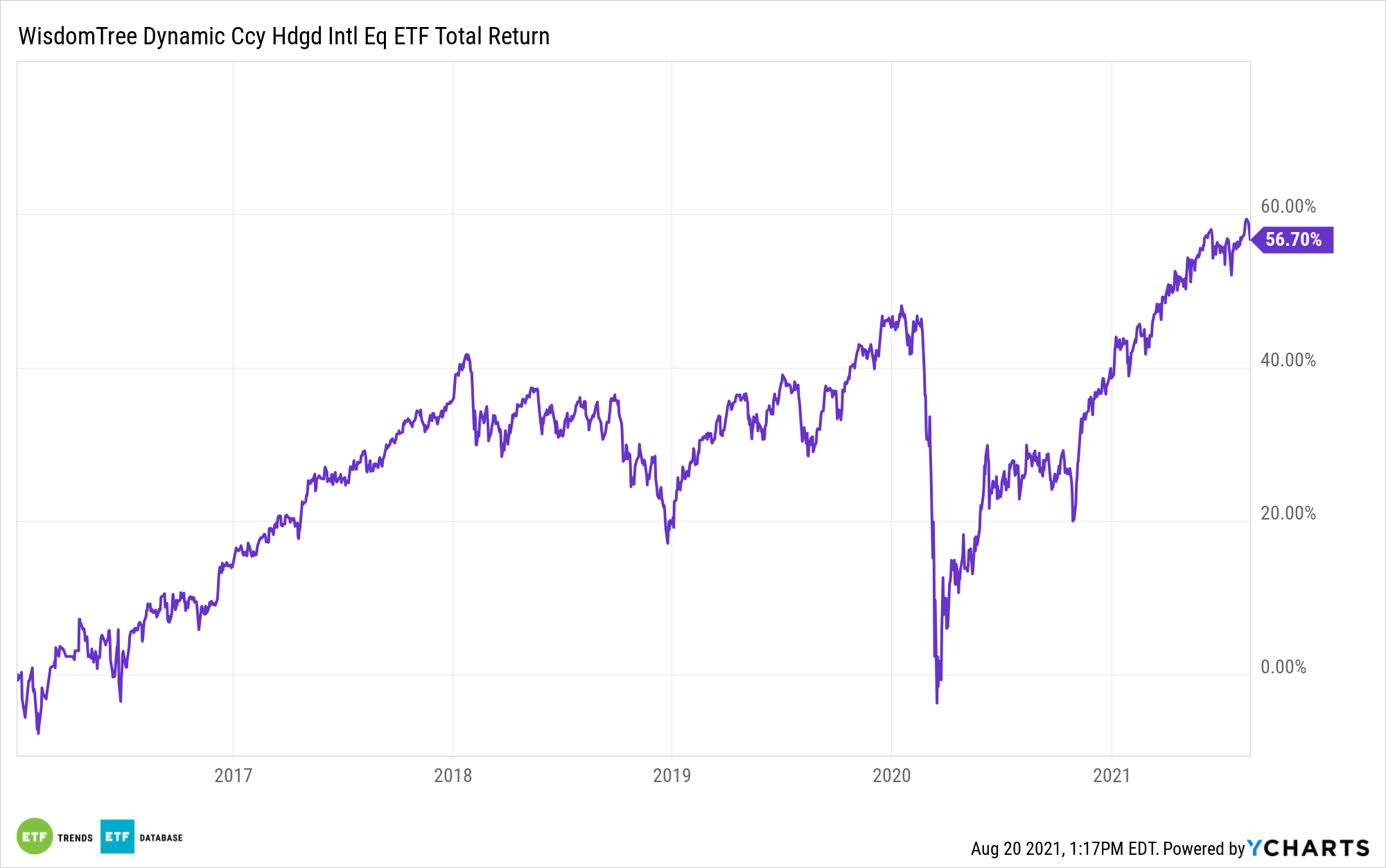

The WisdomTree Dynamic Currency Hedged International Equity Fund (CBOE: DDWM) is the largest holding in the model portfolio at weight of 30%. The $165.53 million DDWM offers several advantages in a strong dollar setting.

First, the ETF provides exposure to stocks in 21 countries and a dozen currencies, confirming that it covers a lot of bases at the geographical and currency levels. Second, DDWM’s currency methodology is dynamic, meaning WisdomTree can trim long dollar exposure if the greenback slumps. Third, DDWM is dividend weighted – a plus when plenty of developed markets outside the U.S. are boosting payouts.

Confirming that it indeed benefits from a strong dollar, DDWM is beating the widely followed MSCI EAFE Index by 300 basis points this year.

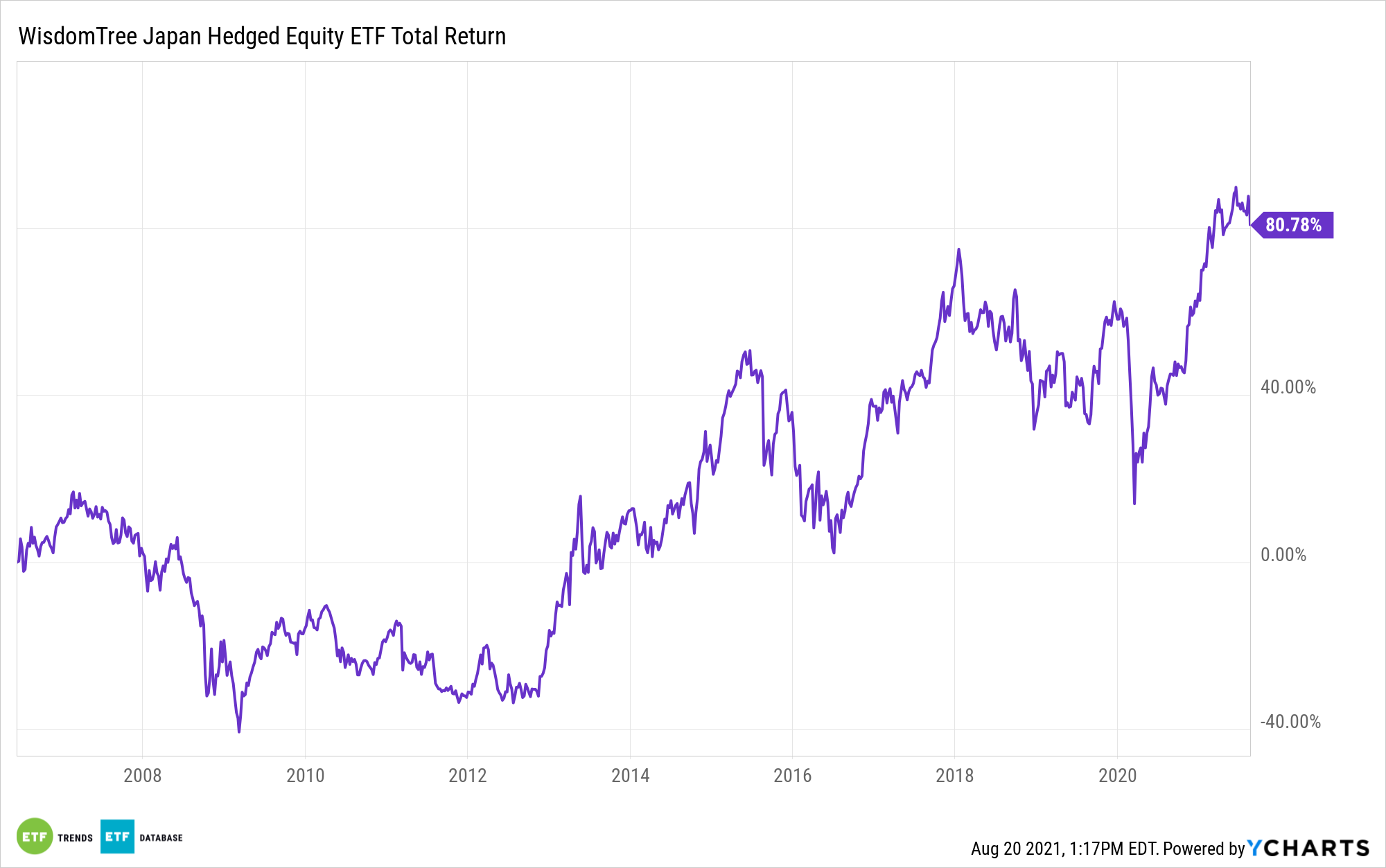

The other currency hedged holding in this model portfolio is the WisdomTree Japan Hedged Equity Fund (NYSEArca: DXJ). DXJ, which benefits as the dollar strengthens against the Japanese yen, accounts for 5% of the model portfolio.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.