When advisors evaluate model portfolios, factors including cost, efficiency, and diversification often top their checklists. Durability and longevity could be joining that list.

Advisors looking for solutions for client longevity risk may want to consider the Siegel-WisdomTree Longevity Model Portfolio, which is part of a pair of model portfolios developed by WisdomTree in partnership with Wharton School professor Dr. Jeremy Siegel.

“WisdomTree collaborated with our Senior Investment Strategy Advisor—Dr. Jeremy Siegel, Professor of Finance at Wharton School—to construct portfolios designed to challenge the traditional 60/40 portfolio approach by attempting to improve the current income generation and longevity profiles,” according to WisdomTree.

The Siegel-WisdomTree Longevity Model Portfolio is appropriate for advisors serving clients that need to trim some equity exposure, those need some additional income, and those looking for some protection from inflation.

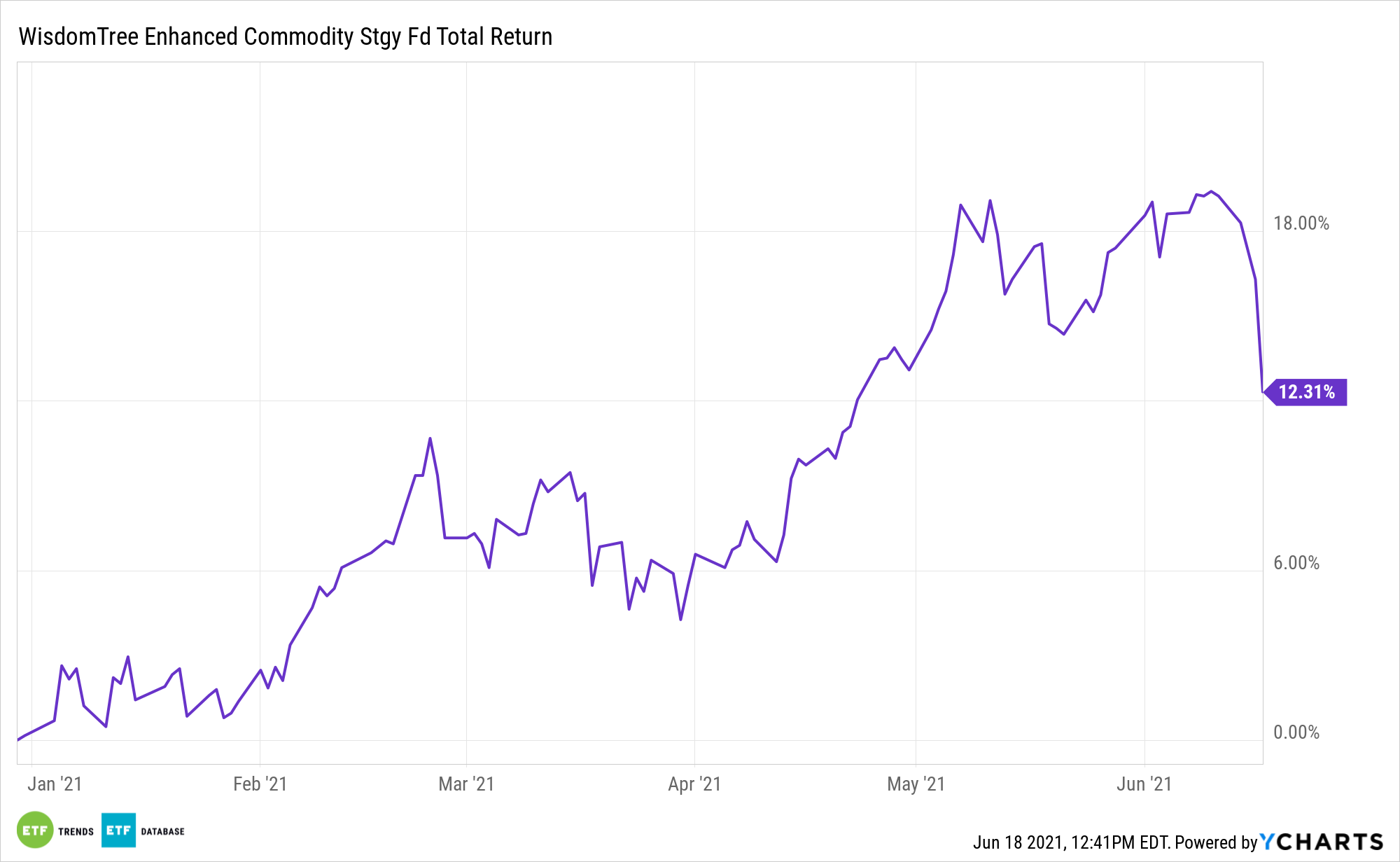

Regarding the latter point, which may be crucial after the Consumer Price Index jumped in April and May, the model portfolio features two commodities exchange traded funds, one of which is the diverse WisdomTree Enhanced Commodity Strategy Fund (GCC).

Longevity Means Income Is Essential

An element of a client’s longevity is ensuring he or she has the necessary income in retirement and that the client doesn’t outlive their savings. That task is getting trickier in today’s low-yield environment, but the Siegel-WisdomTree Longevity Model Portfolio augments some of that risk.

Its biggest fixed income holding is the WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (NYSEArca: AGGY), which can generate higher levels of income than traditional aggregate bond strategies. The model portfolio also features exposure to preferred stocks – an ideal asset class for low-yield climates.

When it comes to equity income, the model portfolio has that in spades as eight of the 12 equity ETFs it holds are dedicated dividend funds. That roster of funds spans not only multiple market caps, ensuring clients can capitalize on the size factor, but multiple geographies, too. That adds important diversification traits while positioning clients to take advantage of higher yields and dividend growth in markets outside the U.S.

The model portfolio sports a trailing 12-month dividend yield of 2.36%, according to WisdomTree data. That’s well above the comparable yields on 10-year Treasuries and the S&P 500.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.