Domestic small caps often tempt investors with elevated growth prospects, but the trade-off usually is elevated valuations. Investors can find bargains on smaller stocks outside the United States, particularly in Japan.

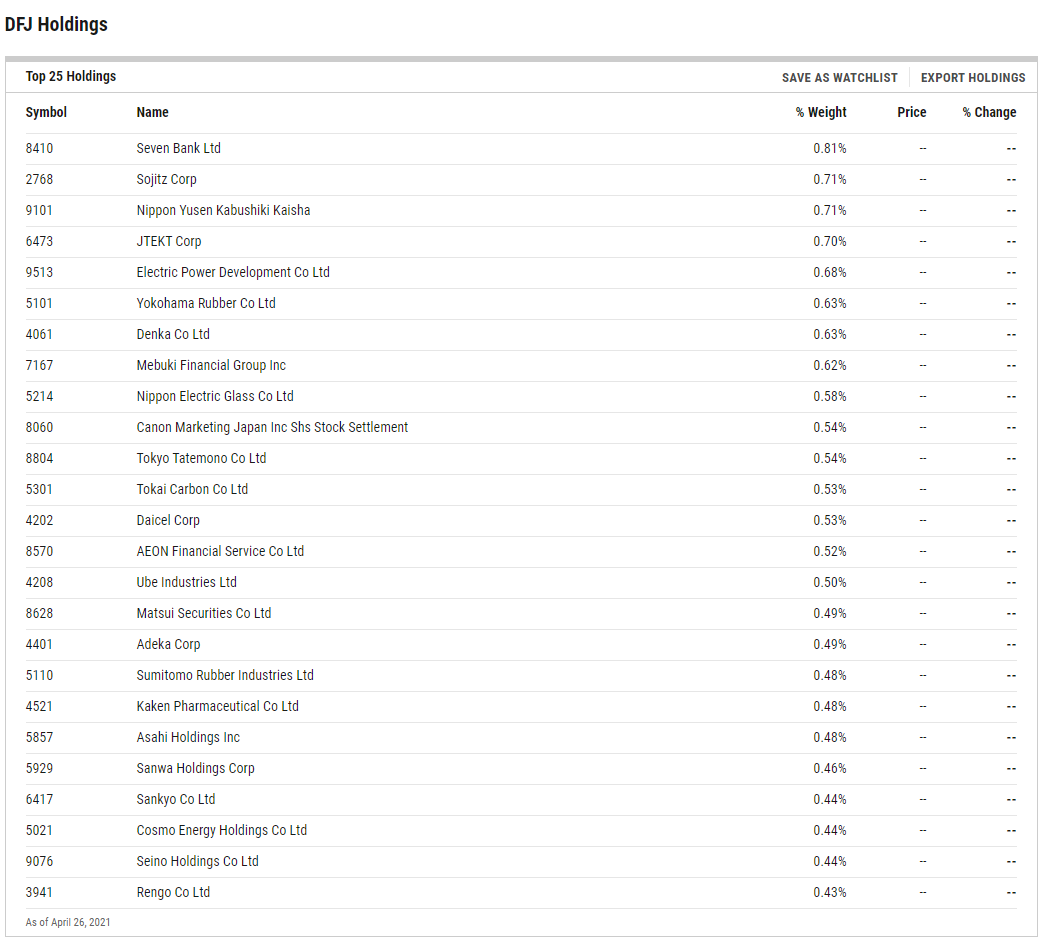

Enter the WisdomTree Japan SmallCap Dividend Fund (NYSEArca: DFJ). DFJ tracks the WisdomTree Japan SmallCap Dividend Index.

“The Index is then created by removing the 300 largest companies by market capitalization from Japanese companies that meet the underlying liquidity and size screens, as of the annual Index rebalance. Companies are weighted in the Index based on annual cash dividends paid,” according to WisdomTree.

That methodology makes DFJ not only a credible value play, but a destination for investors looking to access rising dividends in the Land of the Rising Sun. In fact, improving balance sheets and Japanese companies’ increasing willingness to part with cash in the name of buybacks and dividends are among the primary reasons to embrace stocks there, small cap and otherwise.

To ‘DFJ’ for Value…and Growth

The opportunity set before investors today with Japanese small caps is among the most attractive in the small stock universe. That list of options even includes emerging markets small caps.

“Global stocks and bonds are both expensive. U.S. stocks are trading at particularly elevated valuations with the CAPE ratio standing at 35x (vs. a 10-year average of less than 27x) while the Barclays Bloomberg U.S. Aggregate index offered a negative real yield at the end of February,” according to GMO. “No wonder investors are scouring the earth for attractively priced assets and alpha opportunities. We believe Japan Value and Small Cap Value stocks offer both – a compelling beta opportunity with room for active investors to add value.”

DFJ offers a highly cyclical tilt, devoting 55% of its combined weight to industrial, consumer discretionary, and materials stocks. That levers the fund to vibrancy within the world’s third-largest economy.

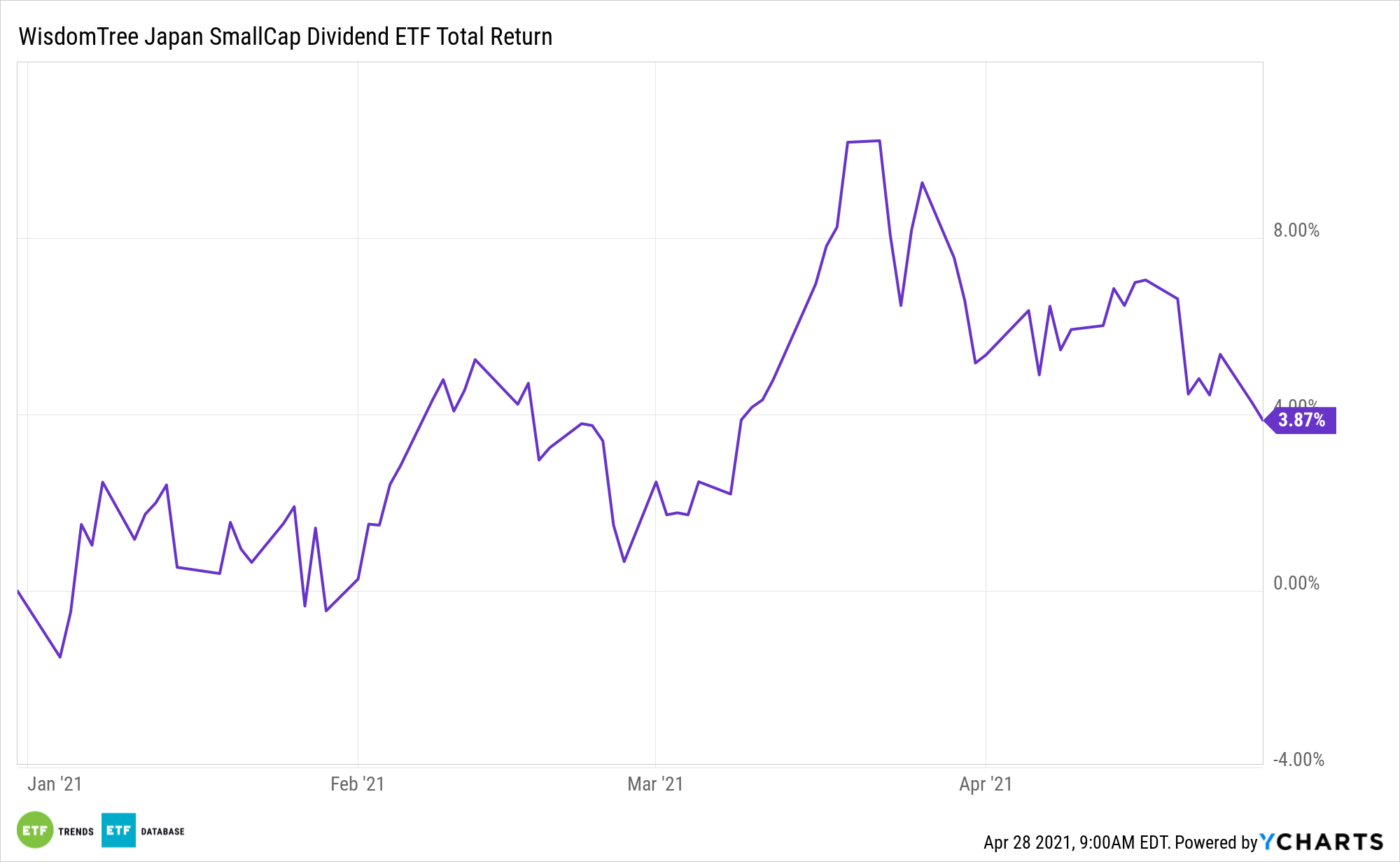

Additionally, DFJ is a value comeback story, similar to the one playing out today with domestic value stocks.

“Japanese equities aren’t homogeneous. Value stocks have underperformed dramatically in Japan as they have in other regions for years, leaving their valuations compelling,” notes GMO. “In addition, while small cap companies have rallied strongly in the U.S. and emerging markets over the last few months, they have not in Japan.”

DFJ is up 25.19% over the past year.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.