The MSCI China Index is off 18% from its February high. That’s dangerously close to a 20% slide, which officially defines a bear market.

Slumps like that may be enough to chase some investors from equities in the world’s second-largest economy, but hasty decisions like that could ultimately prove regrettable, particularly when many market observers are reiterating that portfolios should feature China exposure.

Advisors can deliver that exposure in non-direct fashion with WisdomTree’s emerging markets multi-factor model portfolio. That’s part of a trio of model portfolios comprised of multi-factor exchange traded funds focusing on domestic, ex-U.S. developed markets, and emerging markets equities.

“This model uses factor-tilted equity ETFs designed to provide improved risk factor diversification,” according to WisdomTree. “Our multi-factor models are available in U.S., Developed International, and Emerging Market versions, and can be used as standalone equity models or as complementary sleeves aimed at improving the overall diversification profile of an existing portfolio.”

China Exposure via ETFs

The emerging markets model portfolio is comprised of five fundamentally-weighted ETFs, including three from the WisdomTree stable. Each are broad-based funds, but each also features, to varying degrees, strong China exposure.

That’s an important point for advisors considering China – something some clients may be interested in given the post-pandemic strength of that economy.

“China has emerged from the pandemic with renewed confidence – just as it did after the global financial crisis,” according to BlackRock. “Growth has bounced back to trend and foreign direct investment inflows are surging. A stable economic backdrop has made authorities more comfortable emphasizing structural reforms over short-term growth targets, in our view.”

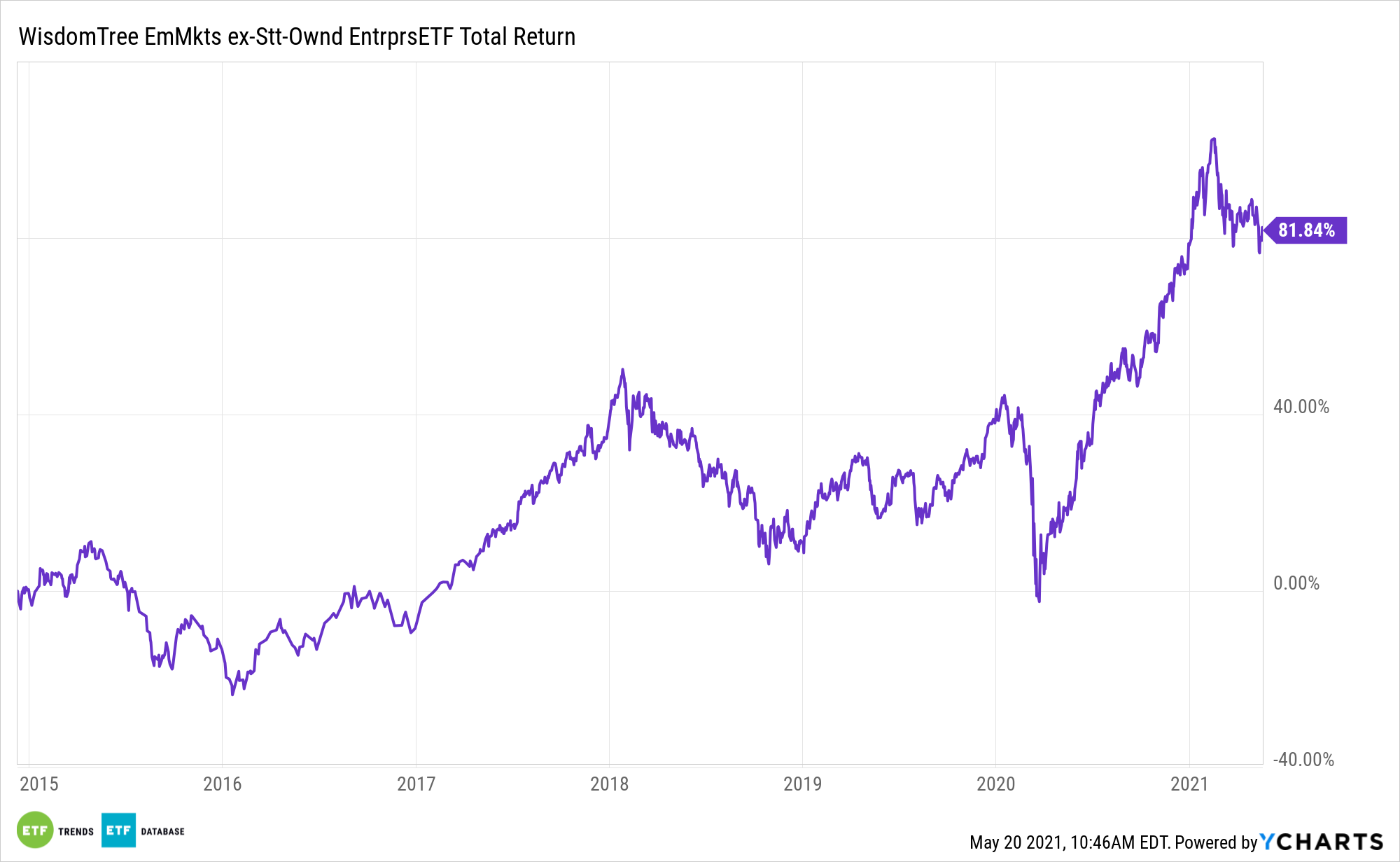

China is also prioritizing issues such as pollution reduction and lowering dependence on tech imports. Those are government policies, but ones more attainable through private sector investment. The aforementioned model portfolio leverages that theme via the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE).

Though XSOE offers sizable China exposure, it excludes lumbering state-controlled companies that often reduce a strategy’s quality profile.

“China wants to become a more productive economy with each unit of incremental GDP generating proportionately less pollution, inequality and financial risk (debt),” says BlackRock. “We believe China will prioritize reforms that emphasize these goals as policymakers view them as mission-critical in achieving a more prosperous and powerful country.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.