With inflationary poised to surge and Treasury yields already having done so, these are tricky times on the fixed income front.

Advisors can find relief with the WisdomTree Fixed Income Model Portfolio.

“This model portfolio is focused on a diversified stream of income. It seeks to benefit from secular trends we see evolving in the fixed income markets in a risk-conscious manner. The model portfolio focuses on select opportunities in core sectors, while strategically allocating among sectors and extending the model portfolio’s reach globally,” according to WisdomTree.

Some recent clues indicate this model portfolio is a relevant near-term consideration for advisors.

“As a reminder, Yellen said that ‘it may be that interest rates will have to rise somewhat to make sure our economy doesn’t overheat,’ but she quickly pivoted away from that statement later on,” notes Kevin Flanagan, WisdomTree head of fixed income. “The background on Secretary Yellen’s initial comment is that she was asked if the current, and proposed, spending from the Biden administration could create a setting where inflation could need to be reined in.”

Inflationary Clues Abound

Rising inflation concerns add to the allure of the WisdomTree model portfolio. In fact, several factors indicate prices are likely to continue rising. Those include soaring commodities prices, supply chain issues, pent-up consumer demand, and base effects.

“There is no question the inflation debate is currently gaining momentum in the markets, specifically the fixed income arena,” said Flanagan. “Is inflation looming on the horizon, and will any potential increase prove to be “transitory,” as the Federal Reserve (Fed) believes, or will it be more sustainable? In fact, it appears as if the trend has already begun as April year/year CPI posted its highest reading since 2008.”

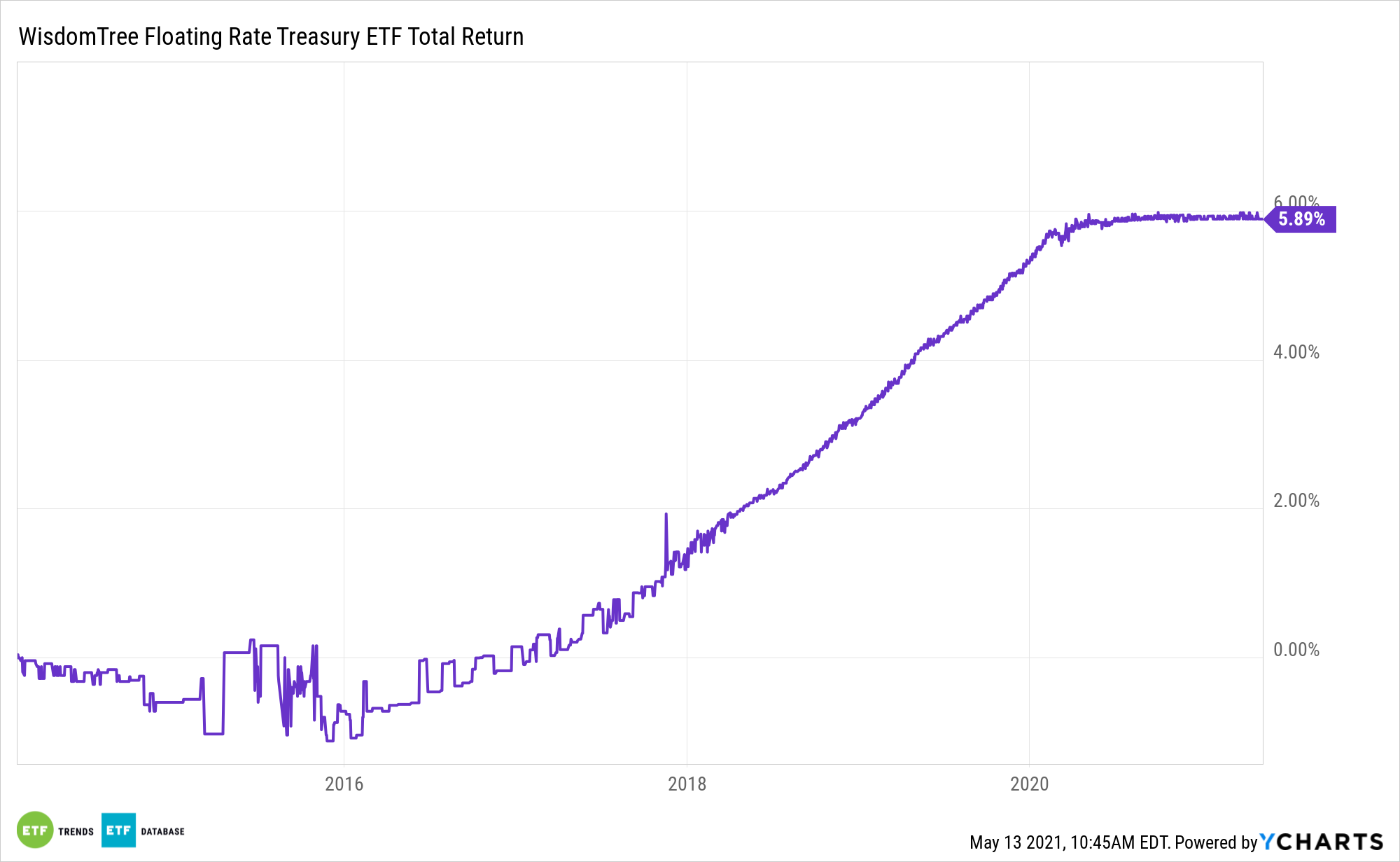

This might appear to be the right environment to consider Treasury inflation protected securities (TIPS), but floating rate notes (FRNs) may be an even better option. The WisdomTree Bloomberg Floating Rate Treasury Fund (NYSEArca: USFR) is one ETF options in this arena.

“Floating rate Treasuries can help investors reduce transaction costs and extend the holding period of their investments. From an operational perspective, floating rate Treasuries can be an important addition to the investment opportunity set available to today’s investor,” according to WisdomTree.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.