Video game retailer GameStop and, to a lesser extent, movie theater chain AMC Entertainment, set the investment community ablaze earlier this year as those stocks notched breathtaking rallies stoked by members of Reddit’s “Wall Street Bets” message board.

In the span of seven months, GameStop went from sub-$4 to flirting with $485. Sounds exhilarating and it was…for the investors that caught that ride up. One very real problem, however, is that GameStop still faces murky business prospects.

“What does the Street make of GameStop? The consensus has the firm losing $2.14 per share in 2021 and 55 cents again in 2022. Will it make money in 2023, or ever again?,” says Jeff Weniger, WisdomTree head of equity strategy. “Unless your kids start agitating for you to drop them off in front of Sears, the way I did it in ’92, it seems like a business model that has a bumpy road ahead.”

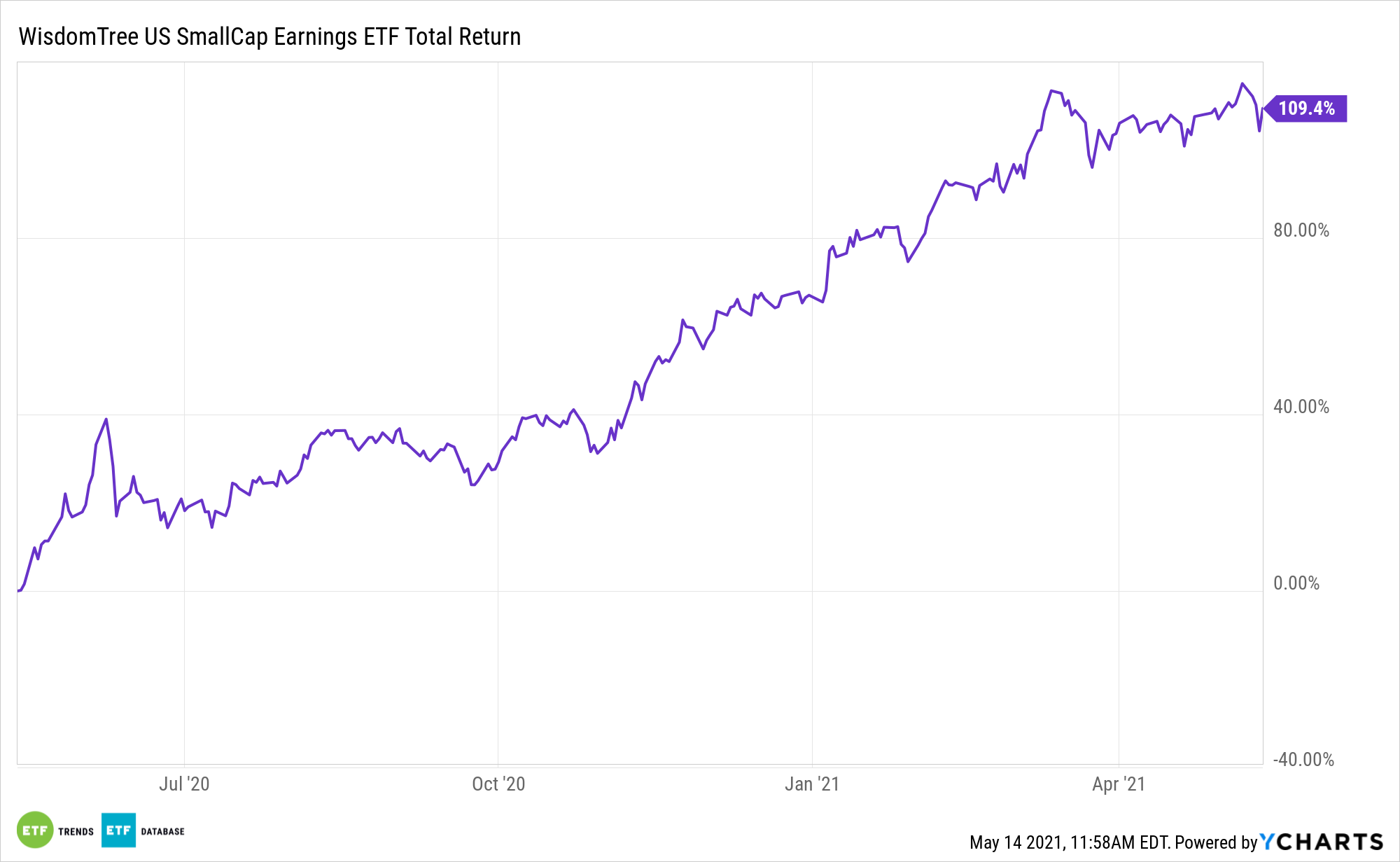

On a related note, another problem some investors may be facing is more exposure to the AMCs and GameStops of the world than they realize – a situation the WisdomTree U.S. SmallCap Fund (NYSEArca: EES) can help ameliorate.

Avoiding Problem Children with ‘EES’

Typically, investors embrace small caps for growth prospects and are willing to deal with a lack of profitability. That’s fine when markets favor that strategy, but in the current environment, there’s renewed emphasis on companies’ profitability prospects.

EES is built for that. The WisdomTree U.S. SmallCap Index, the ETF’s underlying index, “is a fundamentally weighted index that measures the performance of earnings-generating companies within the small-capitalization segment of the U.S. Stock Market,” according to WisdomTree.

In plain English, EES components are small caps that are profitable. Adding in Bed, Bath & Beyond, Ligand Pharmaceuticals, or National Beverage Corp with AMC and GameStop as meme names, renders just a 0.22% portfolio weight for EES. That’s well below the Russell 2000, Russell 2000 Value, and Russel Microcap Indexes.

Data confirm the EES advantage in a GameStop retreat scenario.

“The Russell 2000 Value Index still has 0.54% in GameStop. Not a lot, indeed, but it matters if this stock decides to ’round trip’ this whole episode, back to $4 per share. It means that one holding would drag 52–53 basis points (bps) off the Index’s performance,” adds Weniger.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.