By Jeremy Schwartz, CFA, Global Head of Research; Kara Marciscano, CFA, Senior Research Analyst

Our world was already becoming increasingly dependent on digital infrastructure, and then the COVID-19 pandemic catapulted digital transformation to the top of the priority list.

Security and privacy are at the epicenter of this complex and interconnected network of systems and devices. Individuals, enterprises and nations will need to invest to protect, defend and audit the integrity of these systems and the data that resides within them.

We view the cybersecurity industry as well positioned to meet the growing need to ensure that accelerated technology adoption is not outpaced by an increase in cybersecurity threats. In an effort to capture this new age of growth for the cybersecurity industry, we are excited to announce the launch of the WisdomTree Cybersecurity Fund (WCBR), which provides exposure to the companies we view as having the highest exposure to critical cybersecurity trends and the greatest potential for future growth.

WisdomTree Cybersecurity Fund – A Collaboration Between WisdomTree and Team8

WCBR seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Team8 Cybersecurity Index (WTCBR).

To construct the Index, we leverage data from specialists in cybersecurity, Team8—a global venture group driven by research, relationships and market validation at the intersection of cyber, data, artificial intelligence and fintech.

Our collaboration with Team8 is based on a shared view about the rapid evolution of the cybersecurity market, the products and solutions that will meet the demand of this evolving need, and the right approach to track the market that intersects with these ideas.

We believe the best way to capture and keep pace with changes is to understand the underlying trends and identify the products and services that are positioned to provide creative and effective solutions to threats.

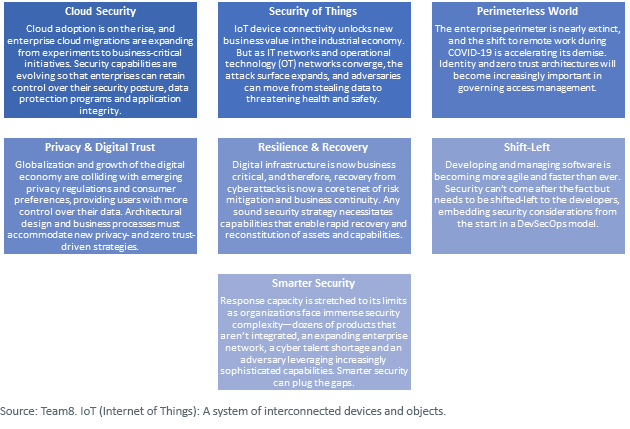

Team8 has defined seven cyber themes (detailed below) that they believe are critical to the cybersecurity industry today and that will continue to be critical in the coming years. Our proprietary methodology systematically selects the companies we believe have the greatest exposure to these focus areas.

Our Unique Cybersecurity Investment Approach

The two key tenets of our cybersecurity methodology are designed to increase exposure to companies that are exhibiting both: 1) fast revenue growth and 2) involvement in an array of cybersecurity development themes.

Companies that are deriving 50% or more of their revenue from cybersecurity products and services are assigned a focus score, quantified by a company’s exposure across cyber themes defined by Team8, and a growth score, quantified by the revenue growth that a company exhibits.

We select companies that meet both our growth and focus screens. We then over-weight high-growth companies with greater exposure across themes, while reducing weight in slow-growth companies with limited theme exposure.

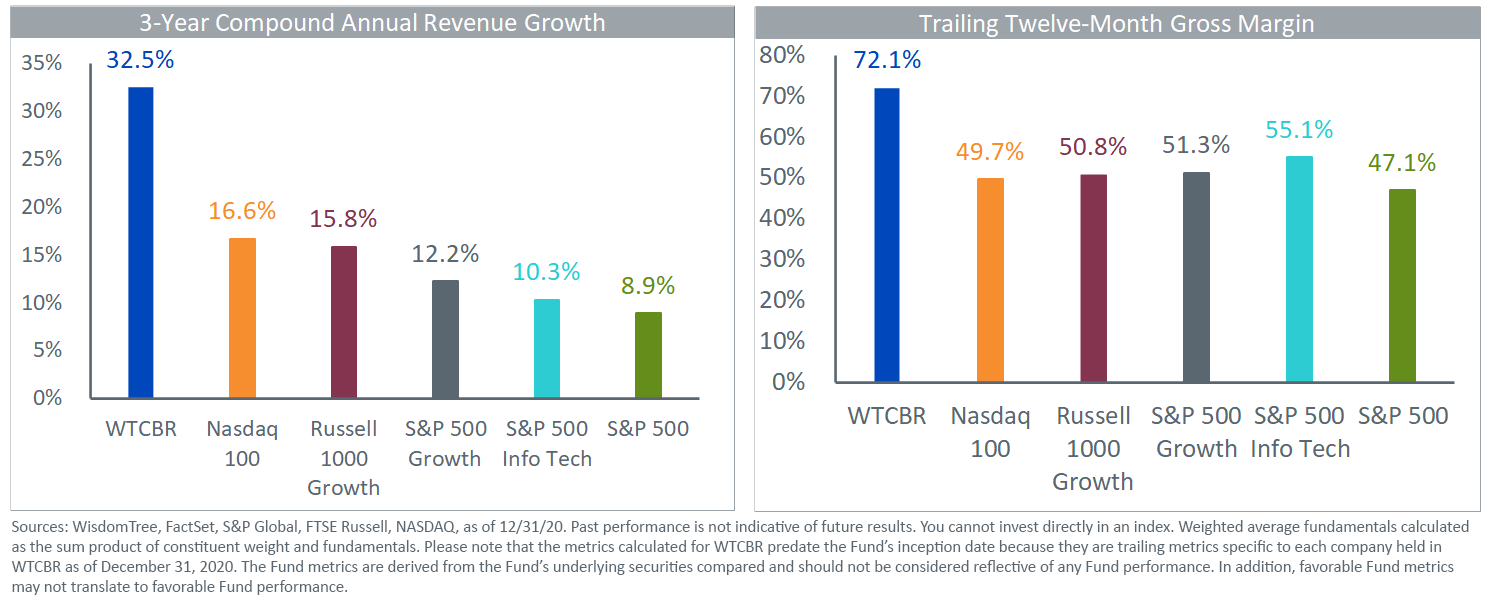

We believe our rules-based approach provides investors with pure-play exposure to high-growth businesses at the forefront of fortifying our networks and systems. This differentiated basket of stocks has less than 1% overlap with the Nasdaq 100 Index and is generating revenue growth rates and margins above benchmarks for growth and technology.[1]

For definitions of the indexes in the charts, please visit our glossary.

Fortify Your Portfolio with WCBR

The cybersecurity industry is amidst a historic shift—the growing importance of cybersecurity cannot be understated on an individual, organizational or national level.

We believe accelerated digital transformation will drive attractive relative growth and returns for the cybersecurity industry for years to come. To capitalize on this trend, we recommend the WisdomTree Cybersecurity Fund as a way to capture pure-play exposure to this rapidly evolving industry.

Originally published by WisdomTree, 1/28/21

1 As of 12/31/20, the Nasdaq 100 Index held 0.5% of its weight in the companies held in WCBR. Benchmarks for growth and technology include the Nasdaq 100 Index, the S&P 500 Information Technology Index, the S&P 500 Growth Index and the Russell 1000 Growth Index.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are Internet related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.