Financial markets are conducive to acronyms. FANG, FAANG, and FAAMG prove as much.

As WisdomTree analyst Matt Wagner points out, there’s another acronym gaining some attention: FANAMA. That refers to Facebook, Amazon, Netflix, Alphabet, Microsoft, and Apple. Those are growth stocks with stellar long-term track records, though the group has lagged broader markets since cyclical value stocks bounced back starting a year ago.

“Since last September, cyclically sensitive stocks have rallied relative to the growth favorites of the last few years,” notes Wagner. “The average return of FANAMA was a not-too-shabby 28.09%. But that return lagged the S&P 500 by 3.08%. Had the trailing 12-month return for Amazon been a calendar year, that would have been its first return below 10% since 2014.”

FANAMA is clearly home to some stocks that investors love, but as Wagner notes, investors shouldn’t become too enamored of what this group (or any other stock, for that matter) did in the past.

“Just as we are all aware that diet and exercise will make us healthier, we are also aware of the common behavioral biases that make us extrapolate recent patterns into the future—recency bias—or that make us hold onto a loser for too long—the disposition effect,” Wagner said. “Our awareness of these biases and the challenges of market-timing buy/sell decisions is why WisdomTree favors systematic, rules-based investment strategies that mitigate them.”

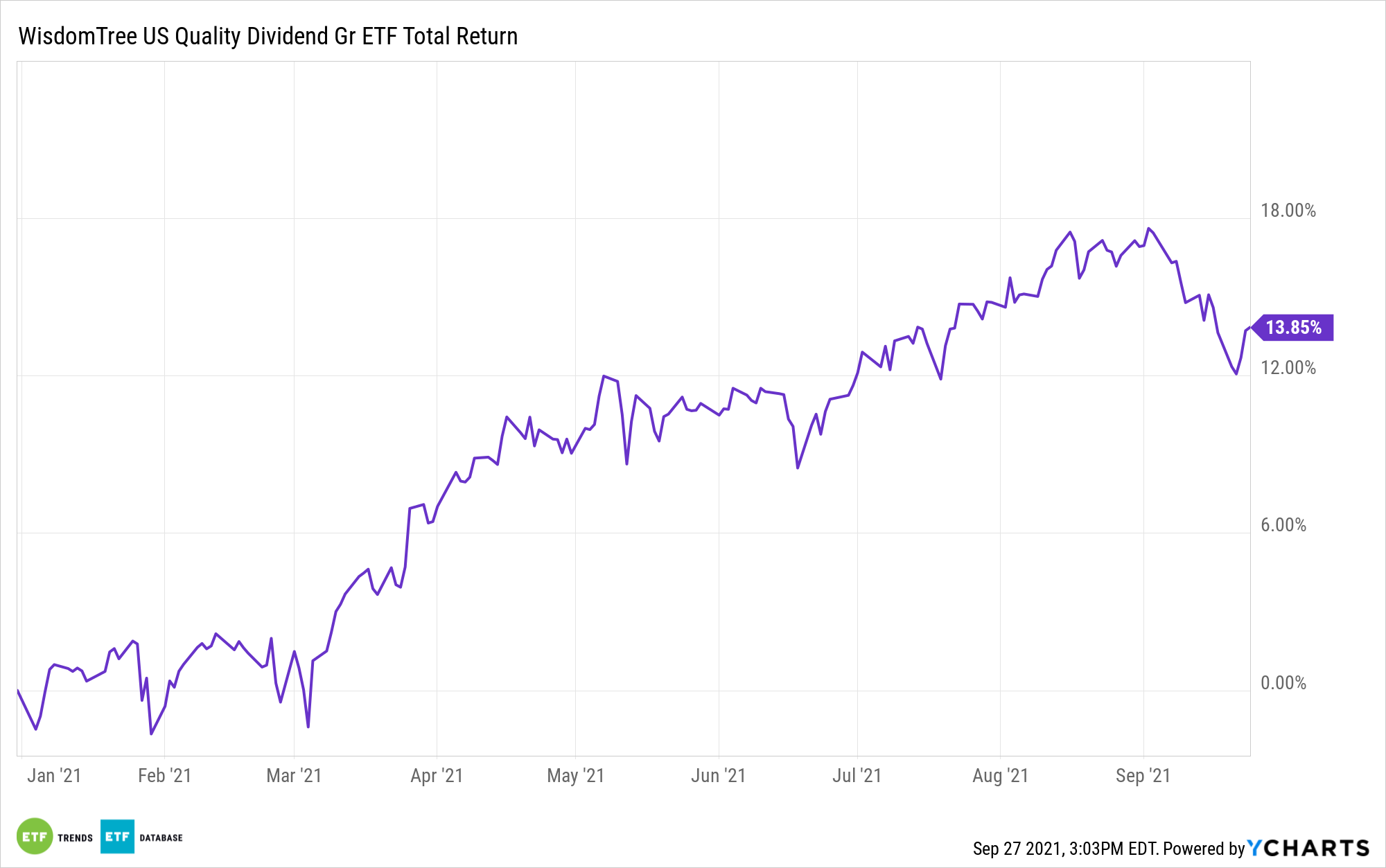

A concept to consider is quality dividend growth stocks, accessible with the WisdomTree US Quality Dividend Growth Fund (DGRW). DGRW tracks the WisdomTree U.S. Quality Dividend Growth Index, which separates itself from old guard dividend benchmarks by focusing neither on yield nor for how long companies have increased payouts.

Rather, DGRW’s index focuses on earnings and quality attributes, including return on assets (ROA) and return on equity (ROE). Plus, with Microsoft and Apple combining for over 10% of DGRW’s weight, investors can retain some FANAMA exposure.

“The annually rebalanced Index holds a diverse basket of 300 dividend paying companies that have high profitability, low leverage and strong growth characteristics,” says Wagner. “We think an approach such as this can fulfill, or round out, a core position in a portfolio without making any outsized bet on single names.”

DGRW’s quality lean is evident at the sector level, where the fund allocates more than 46% of its combined weight to technology and healthcare stocks. Those two sectors are among the steadier sources of S&P 500 dividend growth. Conversely, DGRW is lightly allocated to capital-intensive sectors, such as utilities, real estate, and energy. That trio represents barely more than 2% of the fund’s weight.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.