Emerging markets equities are one asset class that has enjoyed both momentum and analyst support in the early days of 2021.

Advisors can build a foundation for success in the group with the WisdomTree Emerging Markets Multi-Factor Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs. The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETF,” according to WisdomTree.

China’s sturdiness, particularly when accounting for a global health pandemic, is one point underscoring the utility of this model portfolio.

“While most developed markets, including the U.S., hope to exit recession by the end of the second quarter, China ended 2020 with economic growth of 2.3%,” according to Morgan Stanley Wealth Management. “Even more significant, government stimulus wasn’t a major driver of this growth, giving policymakers more room to act if the economy stalls. Equally important, its exports to the U.S. have rebounded to 2018 levels, as of December—evidence of having weathered the hit from U.S. tariffs and trade tensions in 2018-19. Moreover, its share of total global exports climbed to 14.3% last year, an all-time high.”

EM Model Portfolio: A Fine Weak Dollar Idea

If the Federal Reserve holds fast to its commitment to keep rates low, the U.S. dollar may grow weaker and weaker. This in turn will help translate into more strength for the local currencies of emerging markets.

“Since commodities produced in emerging markets are often priced in U.S. dollars, we expect continued U.S. dollar weakness and strong commodity prices to help keep many emerging market stocks buoyant. Plus, emerging market inflation is low while many countries’ finances are healthy, supporting continuing positive indicators around global currency dynamics,” notes Morgan Stanley.

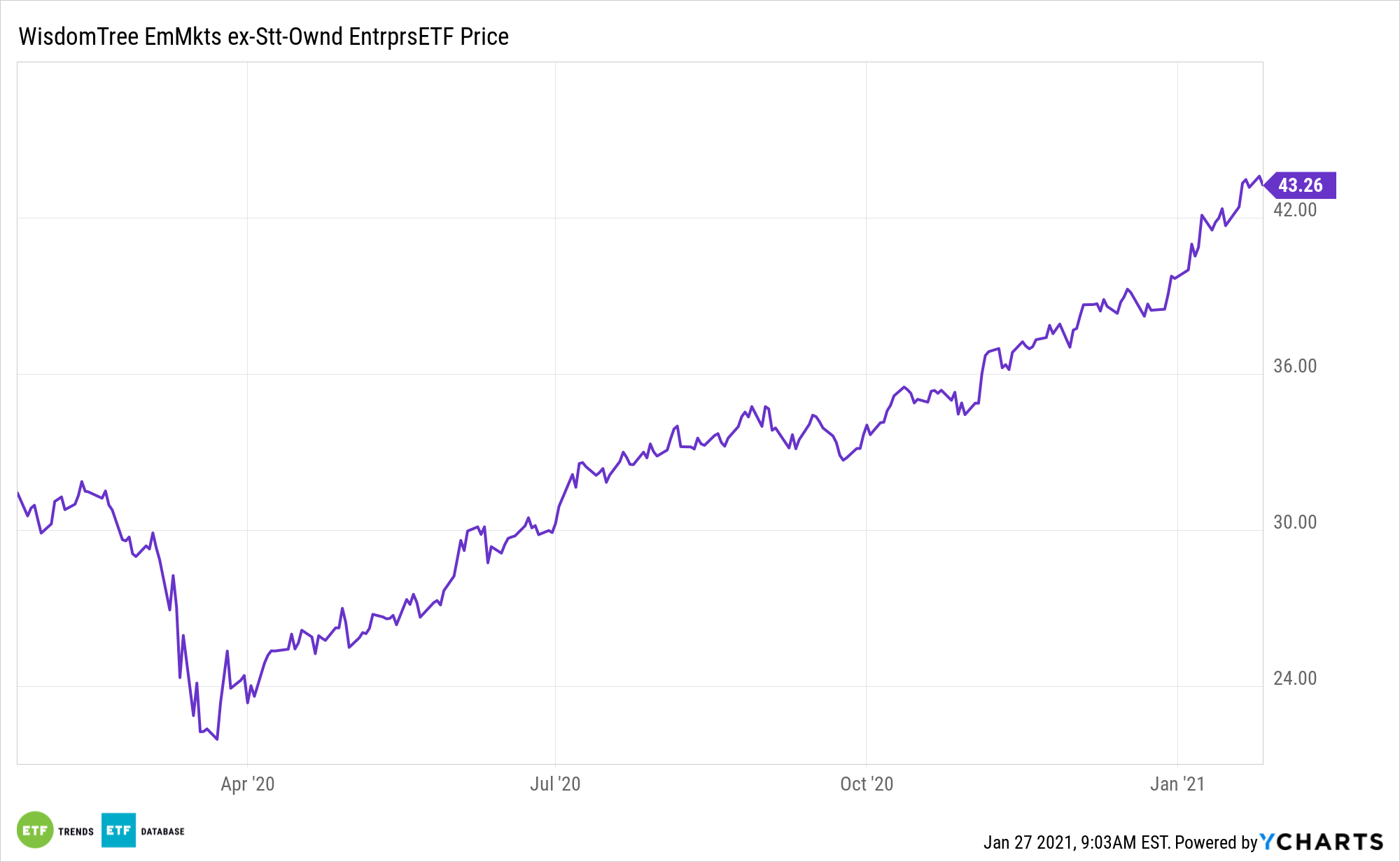

There are other perks to the portfolio. One of the benefits of the WisdomTree model portfolio is its exposure to the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE). XSOE steers clear of state-controlled companies as well as Chinese companies at the center of de-listing controversies.

XSOE also features robust consumer exposure, a trait tailor made for 2021.

“The growing middle class should drive continued global economic growth, especially in other emerging markets in Asia. Morgan Stanley & Co.’s economics team is forecasting 2021 China GDP growth of 9% and overall emerging market growth of 7.4%. Potential sales growth for emerging markets companies suggests profits could soar 30%-35%,” adds Morgan Stanley.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.