Investors looking for innovative companies and disruptive growth opportunities without excessive exposure to the technology sector would do well to check out healthcare.

Arguably, healthcare is the most innovative sector aside from tech and the one with the next largest arena of disruptive growth opportunities. However, many traditional healthcare exchange traded funds don’t adequately tap into that theme.

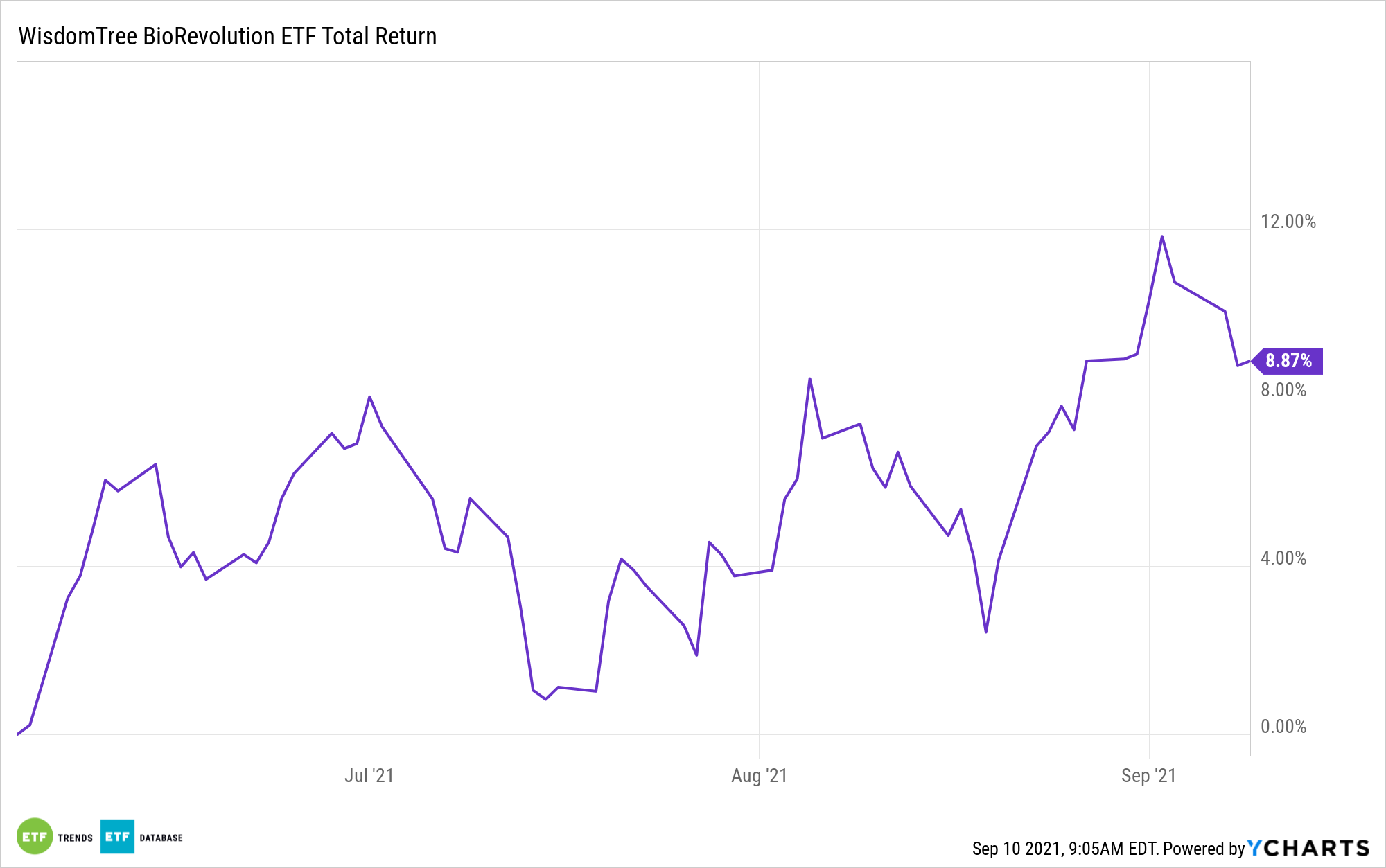

Investors seeking a fresh view on healthcare growth opportunities may want to consider the WisdomTree BioRevolution Fund (WDNA). WDNA, which is just a few months old, follows the WisdomTree BioRevolution Index (WTDNA). In plain English, WDNA is a prime avenue for accessing advancements in DNA sequencing and genomics advancements, among other healthcare growth segments.

“All of life is made up of the same building blocks of DNA. At its core, the BioRevolution is a new and rapidly growing set of tools that are increasingly allowing us to read, write and hack that code of life with greater speed and precision and a rapidly decreasing cost,” says Dr. Jamie Metzl. That has huge implications — not only in healthcare, but across a range of economic sectors throughout our lives and the world.

Metzl made those remarks in a recent interview with Jeremy Schwartz, WisdomTree global head of research. Metzl is an author, genomics expert, and a member of the World Health Organization’s advisory committee on human genome editing.

Wonderful WDNA Thesis

Some investors are often skittish about embracing new ETFs, but when it comes to genomics, waiting around for a fund to age can mean missing out on gains because this is a rapidly evolving field. To that point, WDNA is levered to some exciting trends, underscoring its potential regardless of its rookie status.

“What we are seeing is a super-convergence of technological advances, which is continually accelerating the magnitude and speed of change,” Metzl tells Schwartz. “Over past decades, the sequencing of the human genome has helped unlock new approaches to understanding how our bodies work and delivering quality health care. Now we’re seeing people literally bring the genetics revolution into their bodies through the miraculous messenger RNA, or mRNA, vaccines.”

Perhaps surprisingly, in addition to its healthcare weight, WDNA features exposure — in modest fashion — to the materials, consumer staples, and energy sectors. That provides some leverage to exciting themes mentioned by Metzl, including advancements in animal husbandry, data storage, and “the shift from digging up or cutting down raw materials to growing them.”

Bottom line: WDNA is one of the more compelling stories in healthcare ETFs today, and its age is nothing but a number.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.