How riskier assets perform following Election Day remains to be seen, but some market observers believe the safest bet will remain domestic stocks.

Advisors can tap into that theme with WisdomTree’s Core Equity Model Portfolio, which is part of the issuers broader suite of Modern Alpha model portfolios.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity ETFs,” according to WisdomTree.

Over the near-term, more fiscal stimulus could boost the case for this model portfolio.

“The economic recovery has leveled off following a strong initial rebound. For the past several months, equities have traded in tandem with the likelihood for further fiscal stimulus and have stagnated as the outlook for such stimulus has dimmed,” according to WisdomTree research.

Why Now for this Model Portfolio

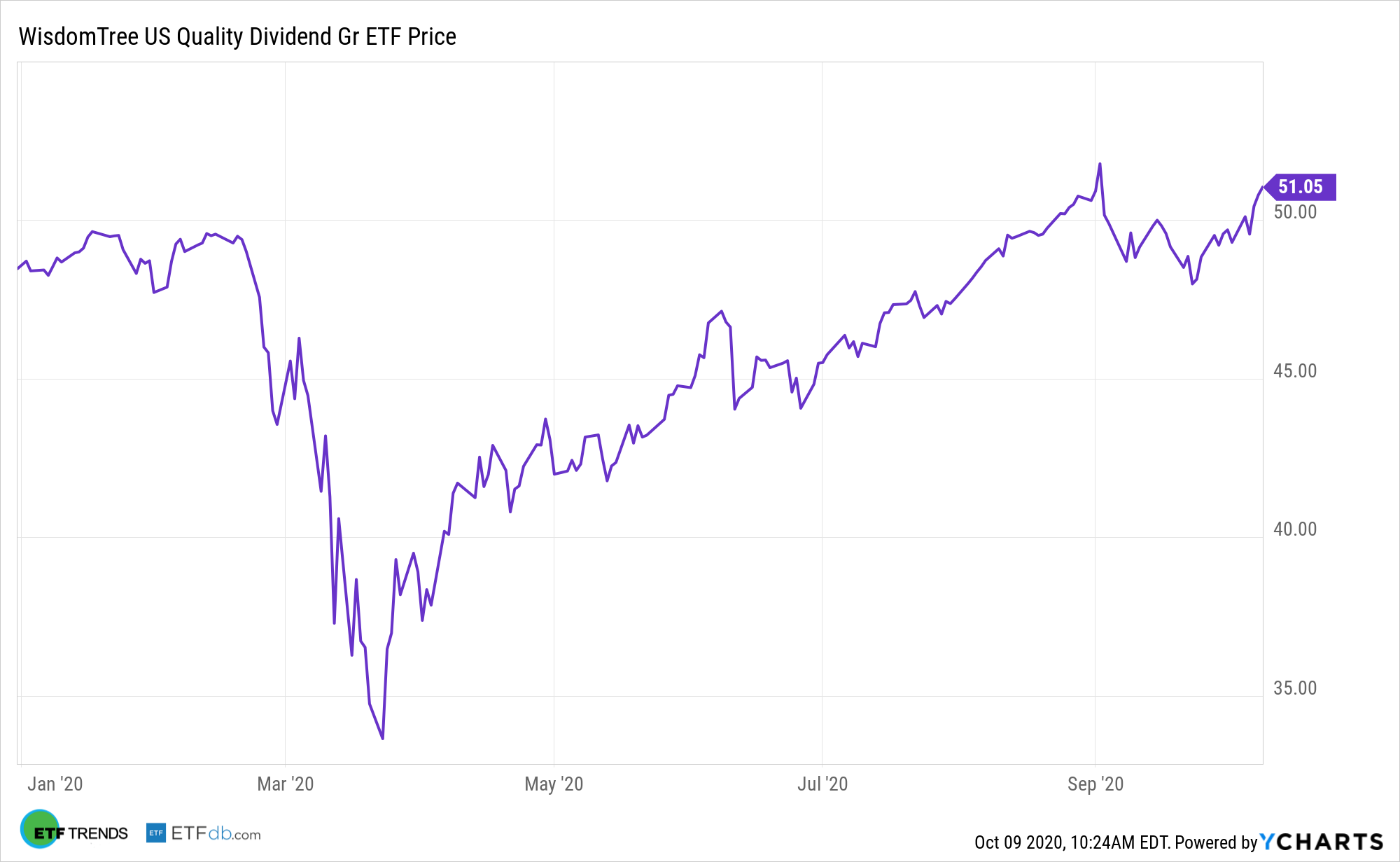

One of the components in the Core Equity Model Portfolio is the WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW).

DGRW seeks to track the price and yield performance of the WisdomTree U.S. Quality Dividend Growth Index. The index is a fundamentally weighted index that consists of dividend-paying U.S. common stocks with growth characteristics.

A pair of famed investment factors underscore the fourth-quarter case for DGRW and the aforementioned model portfolio.

“Quality still remains undervalued and serves as the anchor of our equity models, and we look to the election results to once again potentially be a catalyst for value outperformance,” notes WisdomTree.

With its steady income kicker and quality emphasis, DGRW can help investors growth exposure going into Election Day and year end, which could prove to be a prescient strategy.

“High-flying growth names have seen some of the wind come out of their sails in September but still remain well in the black for the year,” notes WisdomTree. “The election remains the great wild card, with the Senate nearly as large a factor as the White House. Between the two sides there are stark differences in tax policies, growth initiatives and regulatory regimes that will have far-reaching ramifications for all corners of the equity markets.”

DGRW is particularly relevant at a time when so many high-yield firms cut or suspended payouts in the first half of 2020. Companies in the highest quintile of dividend yield – those whose ability to pay may become stretched in challenging markets – account for more than double the number of dividend cuts and eliminations versus those in the bottom quintile with more modest dividend yields.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.