As smaller stocks surge, advisors are looking for quality solutions to position client portfolios for a rally that could be lengthy.

A firm starting point is WisdomTree’s Core Equity Model Portfolio, which features broad-based exposure to domestic and international mid- and small-cap fare.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity ETFs,” according to WisdomTree.

For long-term investors, the model portfolio’s mid-cap exposure is exceedingly relevant.

“This category of companies is actually made up of many reputable businesses and they tend to perform quite well. In fact, the S&P MidCap 400 Index, which tracks 400 middle capitalization companies, has outperformed both the S&P 500 (a group of the 500 large-cap companies) and the Russell 2,000 (an index of 2,000 small-cap companies) over the past 10, 15, and 20 years,” according to Business Insider.

The Don of Mid-Cap ETFs

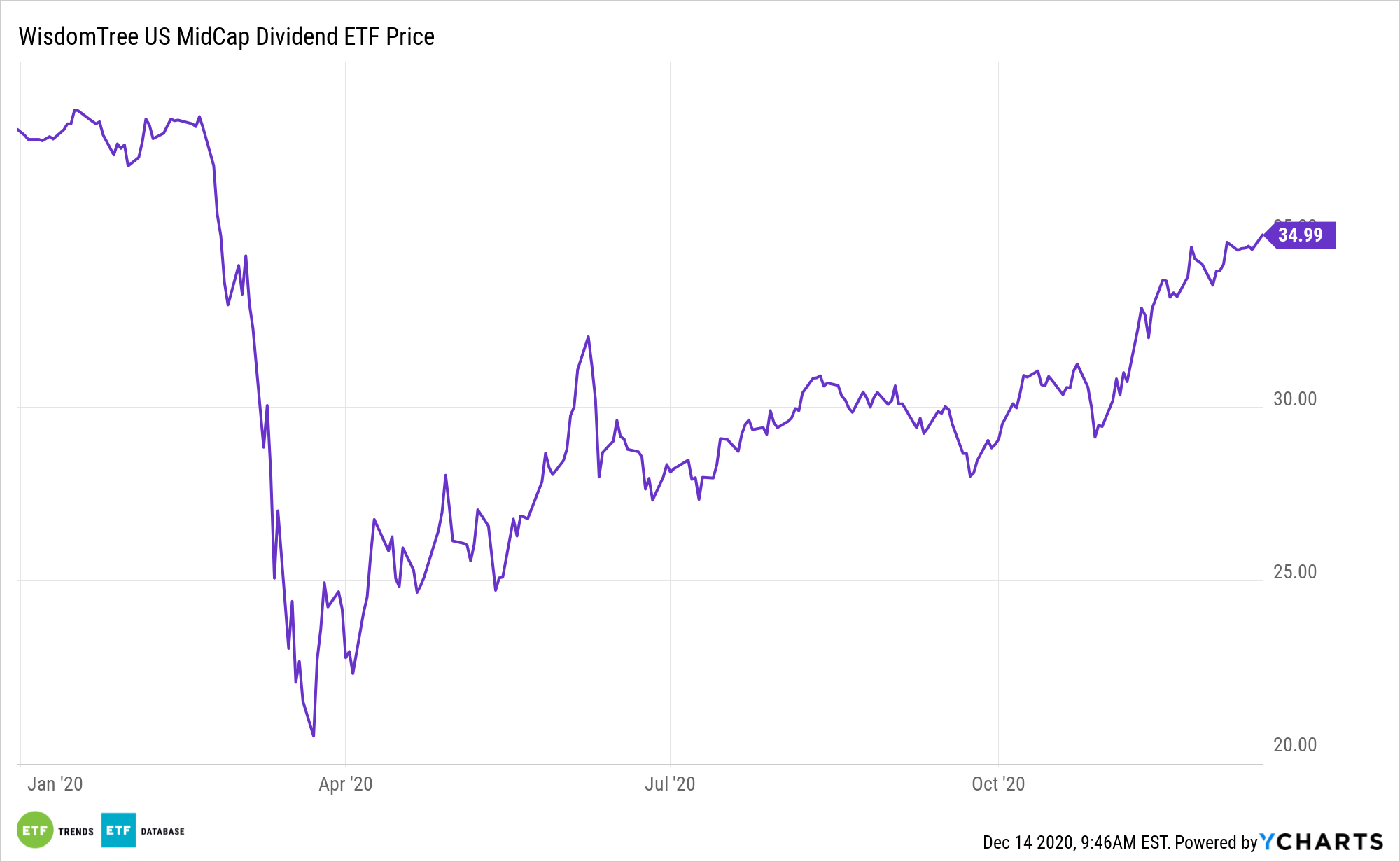

The model portfolio’s mid-cap exposure comes by way of the WisdomTree U.S. MidCap Dividend Fund (NYSEARCA: DON), which has long been one of the top mid-cap funds, both active and passive.

While some market observers believe there are inefficiencies associated with smaller stocks, including mid-caps, DON’s methodology can help quell some of those inefficiencies.

DON tracks the WisdomTree U.S. MidCap Dividend Index. That benchmark is “dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year, based on the most recently declared dividend per share,” according to WisdomTree.

Mid-cap companies are slightly more diversified than their small-cap peers, which allows them to generate more consistent revenue and cash flow, along with more stable stock prices. Yet, they are not so big that their size slows down growth.

“While large-caps get much of the attention from income investors, many mid-caps are doing well enough that they can share profits with stockholders. While they reinvest earnings back into the business, they can also pay out substantial dividends,” according to Business Insider.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.