Much has changed this year in markets and the investment world has pivoted in several ways to try to capture returns and income in a challenging environment for equities and bonds. Strategies that were once out of favor in the last decade have now become some of the most popular, including dividends, particularly high-yield ones, according to Jeremy Schwartz, global CIO at WisdomTree Asset Management.

“Dividends have been THE factor of 2022, but still look relatively reasonably priced,” Schwartz tweeted recently.

Schwartz went on to demonstrate the strong returns that high dividend factor strategies have offered in 2022 compared to other popular factors, such as value, quality dividend growth, and minimum volatility.

Image source: Jeremy Schwartz’s Twitter

All dividends are not created equal, however. In this challenging economic and market environment, the highest paying dividend companies within the S&P 500 have performed the strongest while companies that don’t pay dividends performed the weakest. All-in-all there ended up over 3000 basis points (30%) of difference between the top performing quintile of S&P 500 dividend yielding companies and the zero dividend yielding companies.

Image source: Jeremy Schwartz’s Twitter

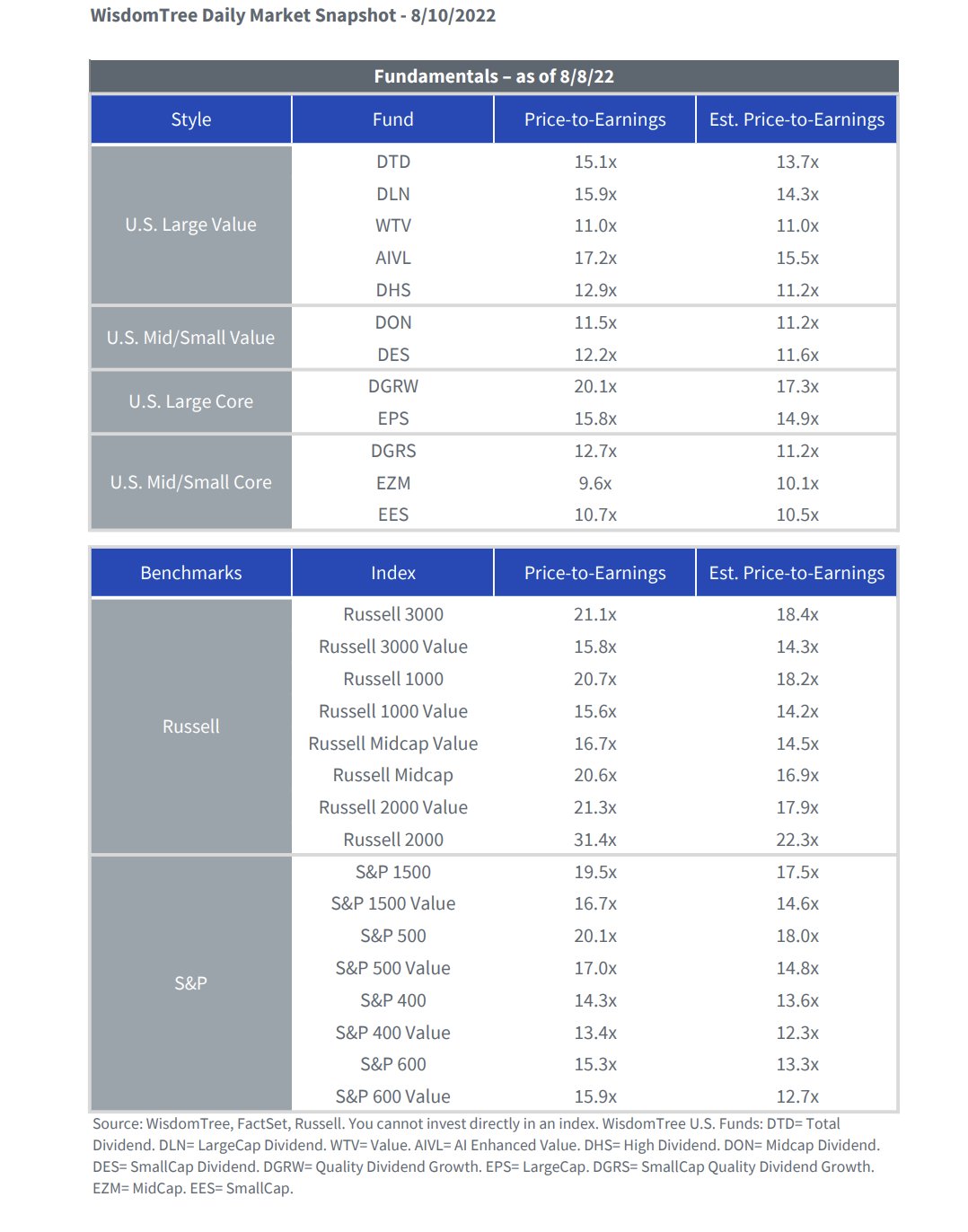

With valuations on the move this year, particularly for some of the previously top-performing, growth-heavy companies, it’s important to dig into how dividend valuations stack up against their traditional value and core benchmarks. Schwartz collated a list of WisdomTree’s dividend ETFs and their estimated and actual price-to-earnings valuations alongside the estimate and actual price-to-earnings of the Russell and S&P benchmarks. The result? Some significant discount opportunities within dividend ETFs, particularly within mid- and small-cap spaces but even within the value plays.

Image source: Jeremy Schwartz’s Twitter

WisdomTree offers a suite of dividend ETFs for investors looking for exposure to U.S. equities, whether within core allocations or with a value focus. Options include the WisdomTree US Quality Dividend Growth Fund (DGRW), which invests in large-cap U.S. equity companies that are growing their dividends and applies both quality and growth screens to securities, and the WisdomTree U.S. LargeCap Dividend Fund (DLN) that invests in large-cap companies that pay dividends within the U.S. equity market.

The broader WisdomTree U.S. Total Dividend Fund (DTD) invests in companies from all market caps that pay dividends within the U.S. equity market, while the WisdomTree U.S. Midcap Dividend Fund (DON) offers mid-cap exposure, and the WisdomTree U.S. SmallCap Dividend Fund (DES) offers small-cap exposure.

There is also the popular WisdomTree U.S. High Dividend Fund (DHS) that invests in high dividend-yielding U.S. equity companies for investors looking for higher-yielding opportunities.

For more news, information, and strategy, visit the Modern Alpha Channel.