It’s long been said that U.S. equities are expensive and that valuations are more attractive in international stocks, including emerging markets fare.

Advisors can tap into that theme with model portfolios, including the Emerging Markets Multi-Factor Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs. The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETF,” according to WisdomTree.

“By and large, there is not much you can do if you want a really low P/E in the U.S.—not with the S&P 500 Index loitering around 3,800, its forward P/E at 23,” said Jeff Weniger, WisdomTree head of equity strategy, in a recent note. “To get there, you might consider turning to emerging markets (EM).”

An Attractive Model Portfolio for the Current Climate

The emerging market space has attracted the attention of some big money managers. For example, Ashmore Group Plc, JPMorgan Chase & Co. and UBS Group AG have all been supporting a bullish case for emerging-market equities so far in 2021, predicting the category to be a prime beneficiary of the post-coronavirus economic recovery process.

Market watchers point to Asia’s relative success in containing the pandemic. China has even returned to positive growth in 2020. Additionally, vaccine breakthroughs in China, India, and Russia, along with renewed demand for commodities and Joe Biden’s $1.9 trillion stimulus plan are all contributing to the broader optimism.

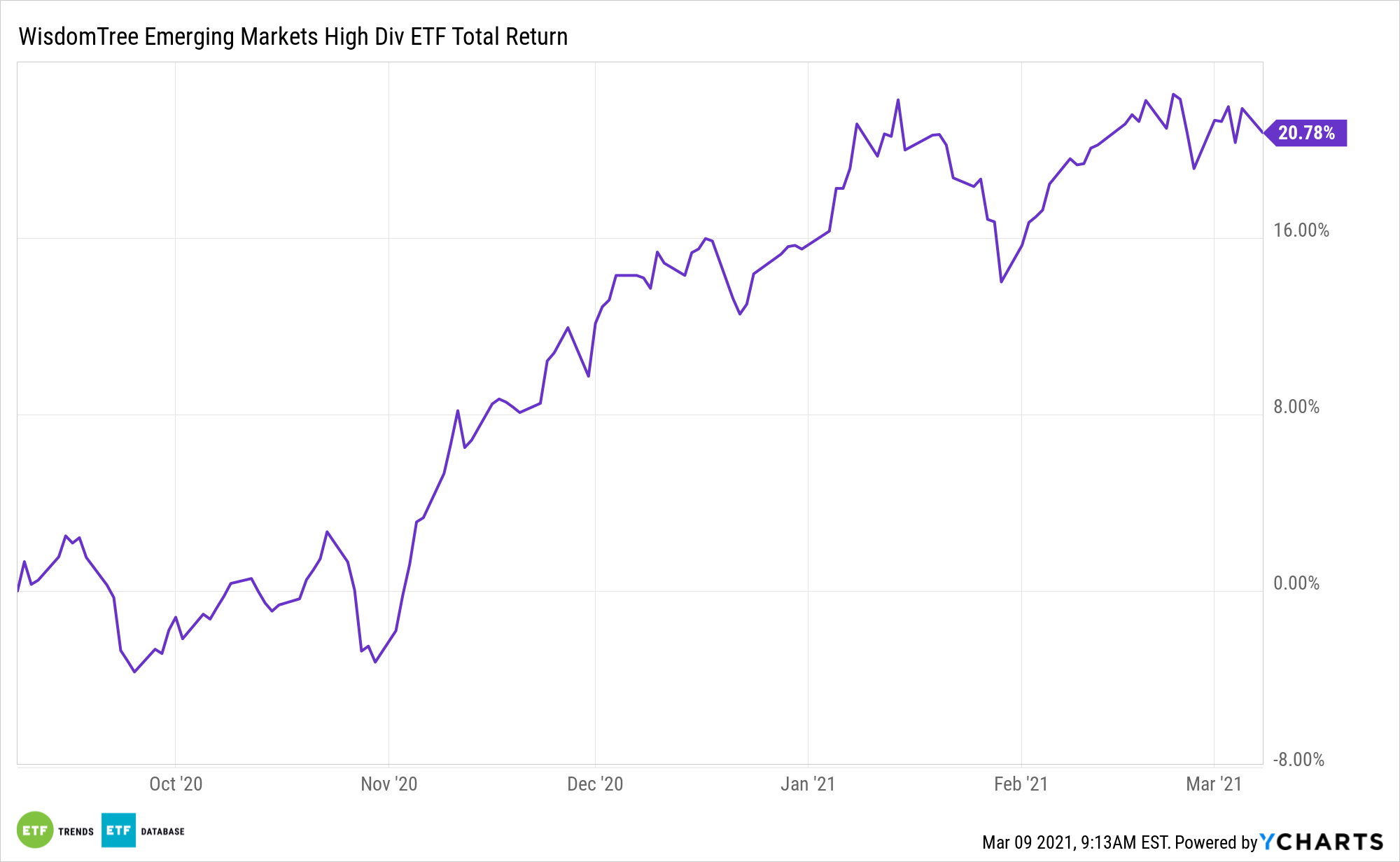

Buoyed by favorable return on equity (ROE) traits, the WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM) and the WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEArca: DGS) are individual ETFs for investors to consider.

ROE “is a touch lower than the S&P 500for both DGS and DEM, yet the two Funds trade at 10.1 and 8.4 times forward earnings, respectively. In 2021, those multiples could be about as rare as a Bigfoot sighting,” adds Weniger.

DGS is one of the largest dedicated emerging markets small-cap ETFs. The fund tries to mitigate some of the volatility expected with emerging markets small-caps by allocating about half its weight to Taiwan, China and South Korea. Taiwan and South Korea are two of the least volatile emerging markets.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.