In what feels like a heartbeat, inflation expectations changed to the upside – a scenario that spotlights advantages in alternative investments and commodities.

Advisors looking to allocate to those asset classes can consider model portfolios, including WisdomTree’s series of Endowment Model Portfolios.

“By thoughtfully integrating equities, bonds and alternative investments, WisdomTree has created variations of each model with differing risk profiles. WisdomTree’s bespoke approach seeks to ensure that there is a model portfolio for a range of investors, from the conservative to the aggressive,” according to the issuer.

The issuer has created options for investors with varying risk tolerances. WisdomTree offers five levels of risk tolerance in this model portfolio series – conservative, moderately conservative, moderate, moderately aggressive, and aggressive. The moderately aggressive version of this model portfolio allocates 20% of its lineup to alternatives, including commodities.

The Right Inflation-Fighting Tool?

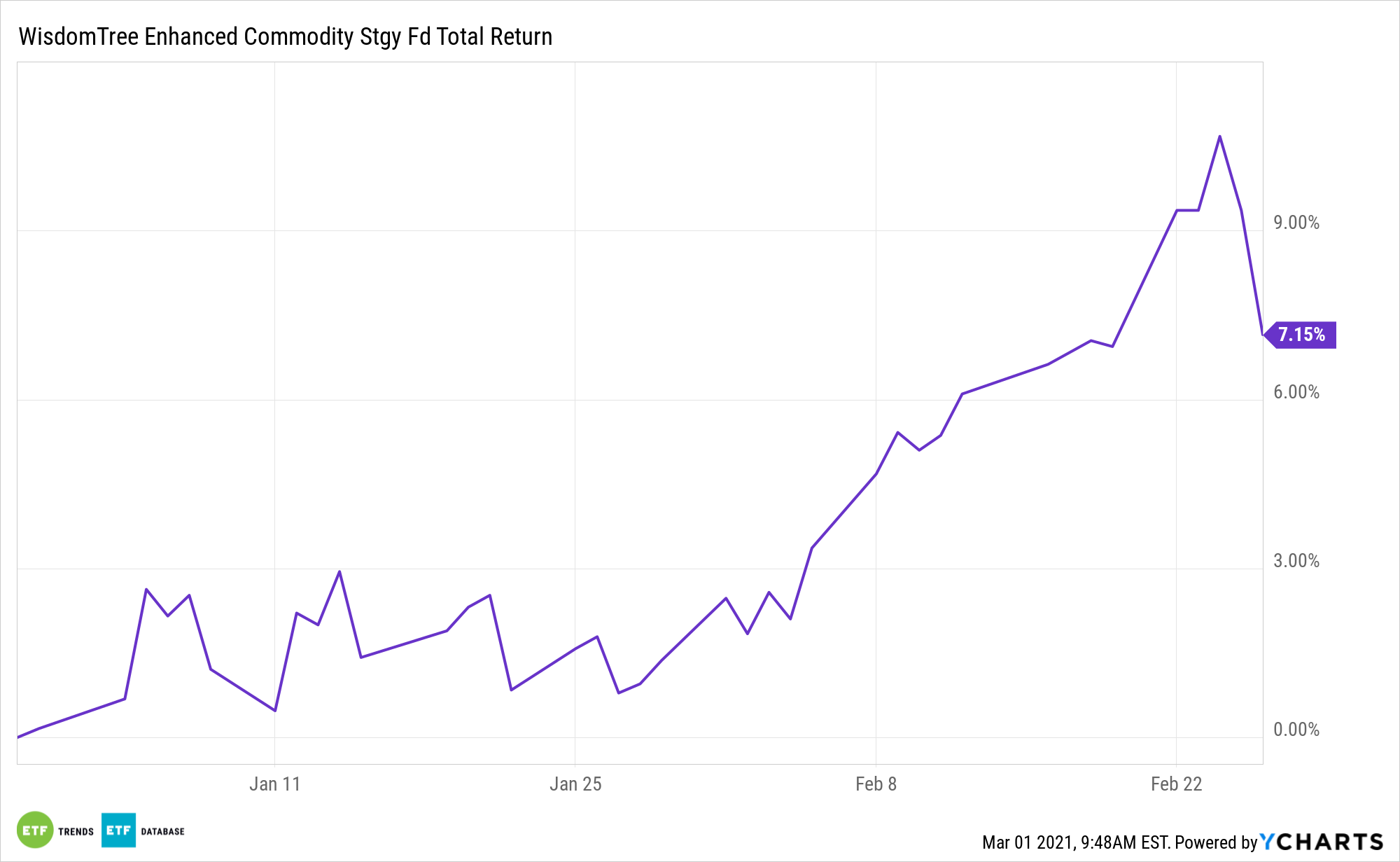

Recent market action suggest this is the right model portfolio for the current environment.

“In addition, investors have witnessed rising price trends in purchasing managers’ surveys and, perhaps more importantly, in actual commodities,” according to WisdomTree research. “According to data from the International Monetary Fund, the Global Price Index of All Commodities has experienced a rather noticeable V-shaped recovery of its own, finishing 2020 at its highest level in more than two years… And guess what? According to real-time commodity gauges, both futures and spot prices have continued this ascending trajectory here into the first two months of the new year.”

The WisdomTree Continuous Commodity Index Fund (GCC) is a newer, outperforming holding in the model portfolio.

GCC seeks to reflect the performance of the index, over time, less the expenses of the fund and the master fund’s overall operations. The master fund invests in a portfolio of index commodities, as well as holding cash and United States Treasury securities and other high credit quality short-term fixed income securities for deposit with the master fund’s Commodity Broker as margin.

The Continuous Commodity Total Return Index is a broad-based commodity index that reflects the price movement of 17 exchange-traded futures contracts. By holding cash and safe haven government debt, investors also have a safety component built-in, since commodities are typically uncorrelated with equities.

“GCC emphasizes a diversified nature of commodities compared to the traditional well-established commodity indexes like the S&P GSCI Index (SPGSCI), which could have as much as 70%–80% of risk driven by exposure to the energy sector. Our approach maximizes this diversification with strategic weights roughly balanced between precious metals, industrial metals, agriculture and energy,” adds WisdomTree.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.