Cloud computing is rapidly asserting itself as one of the premier disruptive technologies.

Advisors can capitalize on that theme to the benefit of client portfolios with WisdomTree’s new Disruptive Growth Model Portfolio.

“The WisdomTree Disruptive Growth ETF Model Portfolio targets structural growth themes that are believed to drive innovation across different industries and segments of society in the future,” according to the issuer. “The themes and affiliated ETFs selected for inclusion will typically have above-market growth projections. The model portfolio seeks maximum long-term capital appreciation and may include both WisdomTree and non-WisdomTree ETFs.”

As WisdomTree notes, increasing the allure of the cloud thesis is the view that FAANG stocks could be supplanted by MT SAAS – Microsoft, Twilio, Salesforce, Amazon, Adobe and Shopify.

“The pandemic of 2020 accelerated adoption of cloud computing, and Bessemer believes we are amid a major technology dislocation. WisdomTree agrees with this conclusion: the most promising technology stocks are defined by the MT SAAS basket: Microsoft, Twilio, Salesforce, Adobe, Amazon, and Shopify,” according to WisdomTree research.

Wager on WCLD: Analyzing This Top ETF

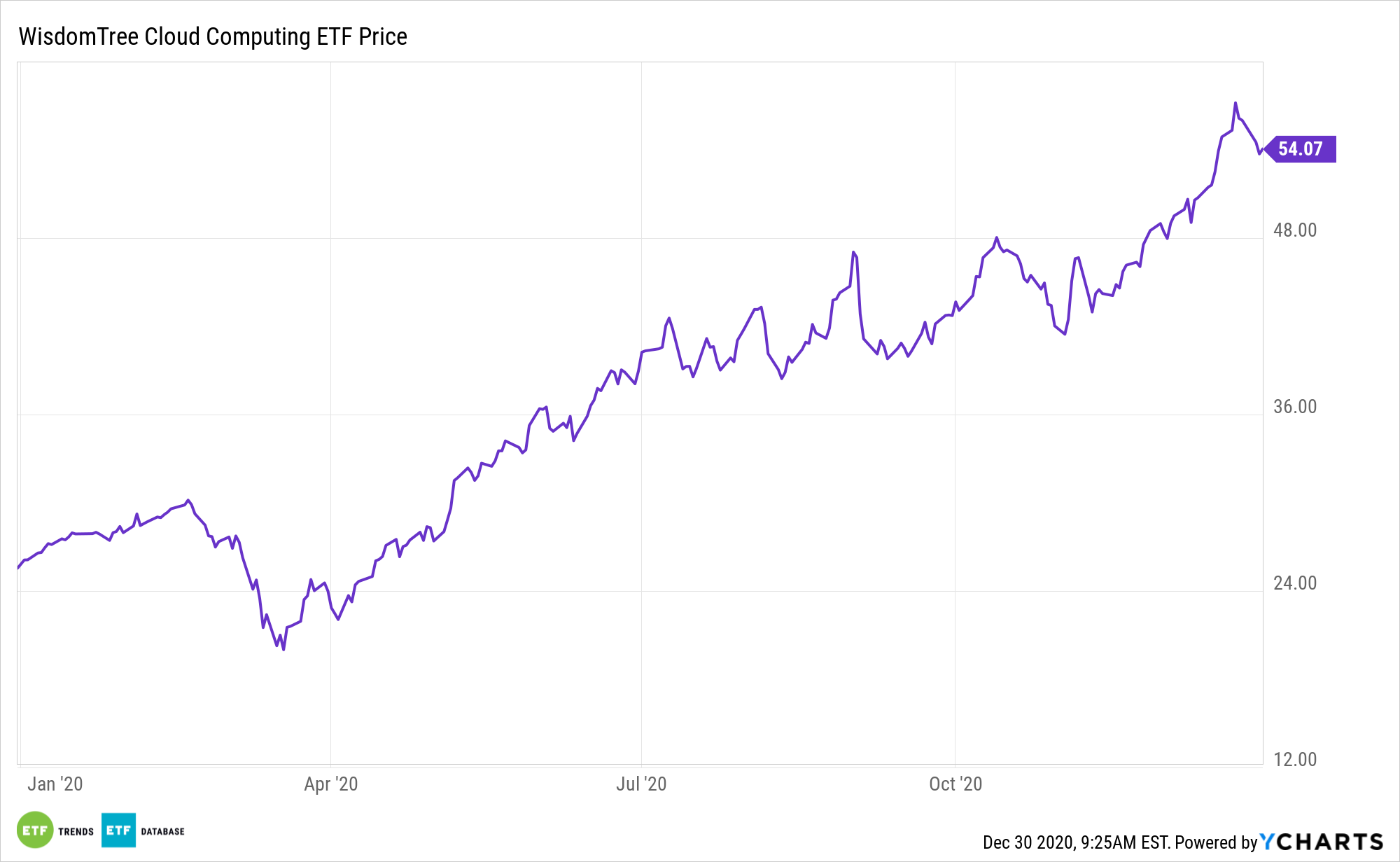

The WisdomTree Cloud Computing ETF (WCLD), the best-performing cloud computing exchange traded fund this year, is one of the key components in the WisdomTree Disruptive Growth Model Portfolio.

The WisdomTree Cloud Computing Fund seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

“MT SAAS is a mix of application (CRM, ADBE, SHOP) and infrastructure (MSFT, TWLO, AMZN) companies, incumbent giants (MSFT, AMZN) and hypergrowth challengers (CRM, ADBE, SHOP, TWLO), all sharing the same characteristics of cloud delivery models, cloud business models, high growth, and compelling long-term margin potential,” according to Bessemer, the company behind WCLD’s underlying index.

The cloud computing industry refers to companies that (i) license and deliver software over the internet on a subscription basis (SaaS), (ii) provide a platform for creating software applications which are delivered over the internet (PaaS), (iii) provide virtualized computing infrastructure over the internet (IaaS), (iv) own and manage facilities customers use to store data and servers, including data center Real Estate Investment Trusts (REITs), and/or (v) manufacture or distribute infrastructure and/or hardware components used in cloud and edge computing activities.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.