By Christopher Gannatti, CFA

Global Head of Research

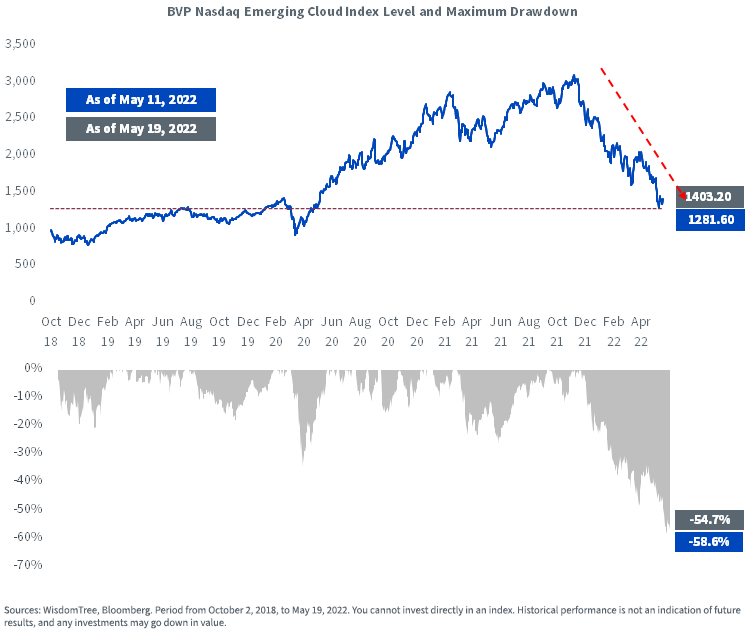

The drawdown in many stocks focused on cloud computing software has been, in a word, unbelievable. In basically one month’s time, from April 11 through May 11, the BVP Nasdaq Emerging Cloud Index (EMCLOUD)—a group of cloud-oriented companies—has lost roughly 30% of its value.

In figure 1, we see:

- The drawdown of EMCLOUD from the peak in November 2021, when the U.S. Federal Reserve began to discuss removing liquidity from the market in a serious way, has been more than 50%.

- From November 9, 2021, to May 11, 2022, the period of “maximum drawdown” to date, we had a 58.6% drop over 126 days.

- On May 11, the closing level of EMCLOUD fell below the closing levels observed for the first time in July 2019.

Figure 1: The Drawdown in Cloud Computing Share Prices Has Been INTENSE

Knowing this, the primary question comes back to the following, which we can simplify into two outcomes:

- Cloud computing as a delivery mechanism through which customers subscribe to software is the wrong business model, and customers will vote with their wallets and go to something different.

- Customers are at least equally excited, if not even more excited, about cloud computing as a delivery mechanism through which they can subscribe to software.

Company Results Support Outcome #2 over Outcome #1

While we are never able to view the future with certainty, the evidence that we can interpret today would tend to indicate that outcome #2 has a higher probability of becoming true.

The big players are still growing—FAST.

One of the risks we monitor in cloud computing regards the biggest players shifting from engines of growth to something more like “utilities”—the concept being that everyone able to adopt cloud computing has done so, so the future growth stabilizes.

- Amazon Web Services (AWS) indicated revenue growth of 37%, $18.4 billion.

- Microsoft indicated that the part of its cloud business most directly comparable to AWS grew revenues at 46% year-over-year. It should be noted that it only had a 7% market share in 2016, so getting to 20% in this short time has been impressive.

- Google Cloud indicated year-over-year revenue growth of 44%, to $5.8 billion.

M&A Activity Is Still Active

While it is true that not every cloud-focused company is involved in M&A, even amidst the share price performance turmoil of 2022, companies are still active.

- Google Cloud has announced its intention to buy Mandiant, a cybersecurity firm, for $5.4 billion. The rationale is to provide its cloud customers with more robust cybersecurity solutions at a time when this is at the forefront of many customers’ minds.

- Shopify has announced its intention to buy e-commerce fulfillment specialist Deliverr for $2.1 billion.

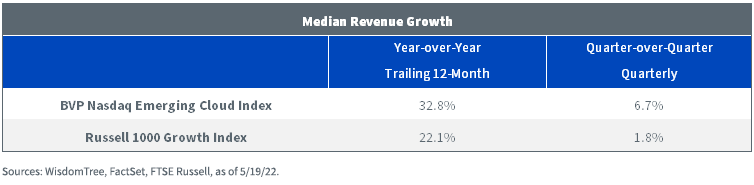

Cloud Computing Stocks Are Still Delivering Elevated Growth Rates

Conclusion: The Cloud Business Model Is Still Robust Amid Substantial Lowering of Equity Valuations

Some of us might have thought that there has been so much discussion about Western central banks shifting policy from extremely “easy” to extremely focused on mitigating the risk of runaway inflation that this must have been priced into equity markets. The recent behavior of software-oriented cloud computing companies would tell us something different—adjustments are clearly still being made. Our bottom line is this—these subscription-oriented businesses are still largely growing their revenues, even if that growth is nowhere near what would have been seen during the pandemic period in 2020. Those with a time horizon of the next few months may have an extremely uncertain outcome. Those with a time horizon in the range of 5, 7 or 10 years—as long as the cloud business model continues to find favor—may see this downdraft as an interesting opportunity.

Originally published on June 3, 2022 by WisdomTree

For more news, information, and strategy, visit the Modern Alpha Channel.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.