By Blake Heimann

Research Analyst

The S&P 500 is down over 10% and the Nasdaq 100 is down over 20%. Investors are looking for places to hide after experiencing what has been the worst first half year since 1970.

Since late June, we have come off the bottoms and have seen risk assets outperform. This has primarily been driven by market narratives surrounding the Fed pivot to a less hawkish position in future meetings. Fed Chairman Jerome Powell’s commentary in July, stating the target Fed Funds Rate is now at or near the ‘neutral rate’ (the rate at which Fed policy is neither accommodative nor restrictive) really sparked this shift in narrative.

Other Fed members were quick to cover his tracks as markets rallied, warning that continued rate hikes will be necessary to quell inflation. This is a global issue. The Bank of England hiked rates by 50 basis points (bps) this August, all while expecting inflation to reach over 13% in October. The European Central Bank also hiked its policy rate by 50 bps in July, with the market forecasting another 50 bps in September to stymie double-digit inflation in the eurozone.

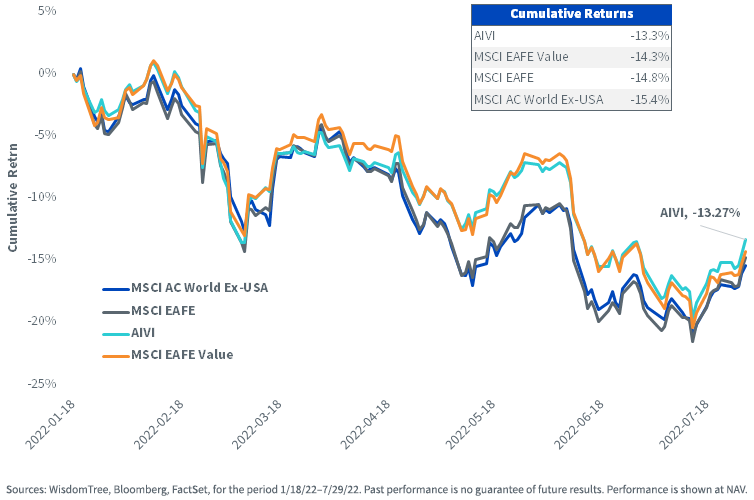

An area that has held up relatively well in the face of inflation and geopolitical instability has been value-oriented equities. AIVL and AIVI, the WisdomTree AI Enhanced Value Funds, have outperformed their competition since being repurposed to their new strategies on January 18, 2022.

AIVL Cumulative Returns Since 1/18/22

For the most recent standardized performance click here.

AIVI Cumulative Returns Since 1/18/22

For the most recent standardized performance click here.

Previously ex-financials Funds, AIVL and AIVI have been repurposed as AI-driven, large-cap value strategies, deployed within a universe of U.S. equities and developed markets ex-U.S., respectively. Leveraging the expertise of Voya’s Machine Intelligence Team, the strategies are managed by portfolio managers, quants, data scientists, fundamental equity analysts and machine learning professionals. In addition, 26 ‘virtual analysts’ and 45 ‘virtual traders’ drive the security selections using artificial intelligence (with human oversight), based on over 10,000 data points engineered into 250+ features, spanning company and industry fundamentals, ESG metrics, analyst estimates, macro and more.

The virtual analysts and traders are trained on years of historical data, identifying and learning unique patterns across combinations of these features to identify buy and sell opportunities, as well as position sizing. This results in a strategy that offer unique, idiosyncratic alpha opportunities within the value space that can address unique themes, such as oversold firms with strong industry relative growth or favorable valuation metrics.

By ‘teasing’ the models and results, we can start to make sense of the most common patterns identified by the AI. By performing feature analysis and clustering, common patterns can be organized into themes that can offer a more robust analysis of performance than some of the traditional methods.

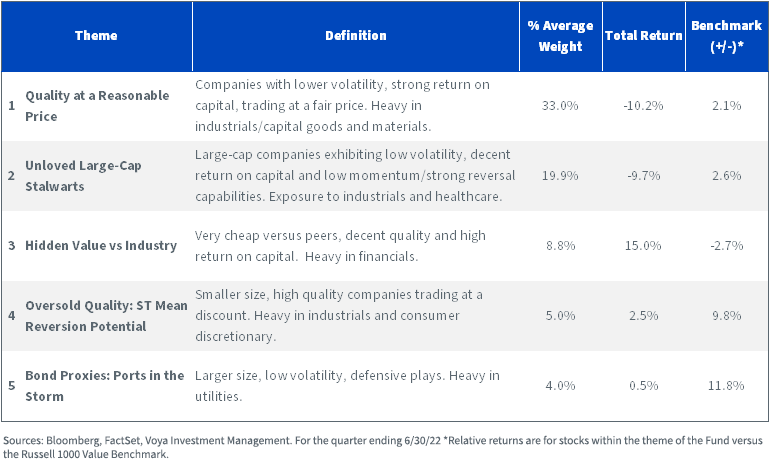

Looking at these AI-specific themes for AIVL compared to the Russell 1000 benchmark, the Fund allocated significant weight across a range of interesting themes that outperformed the benchmark. The first of these consists of firms deemed as having quality characteristics at a reasonable price. With an average allocation of 33%, this theme made up the largest allocation among themes for the second quarter. Although the group still had a negative return for the period, compared to the benchmark total return for the period, this group outperformed by 2.1%. Some of the themes with smaller allocations had much stronger performance relative to the benchmark—namely some mean reversion plays within the quality space, as well as defensive plays within the utilities sector.

AIVL Top Themes 3/31/22–6/30/22

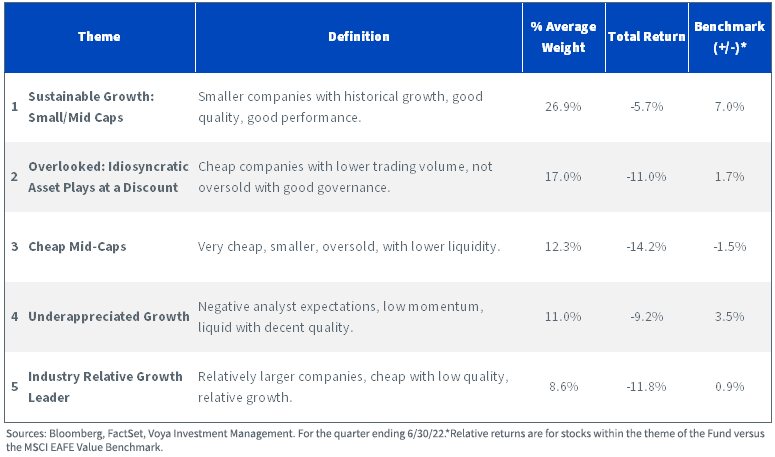

Likewise, by comparing AIVI to the MSCI EAFE Value benchmark, we see the largest theme allocation consisted of firms at the smaller end of the large-cap spectrum, with sustainable growth metrics represented by quality earnings, longer periods of consistent growth, as well as strong governance scores. When compared to the benchmark total return, this group within the Fund outperformed by 7%.

AIVI Top Themes 3/31/22–6/30/

In a similar exercise, we can get a more granular view by analyzing company features as well as the model parameters closely associated with them, to begin to understand their interaction. This interaction forms the basis for a particular company’s selection, as well as offering insight as to why it may be assigned a specific theme.

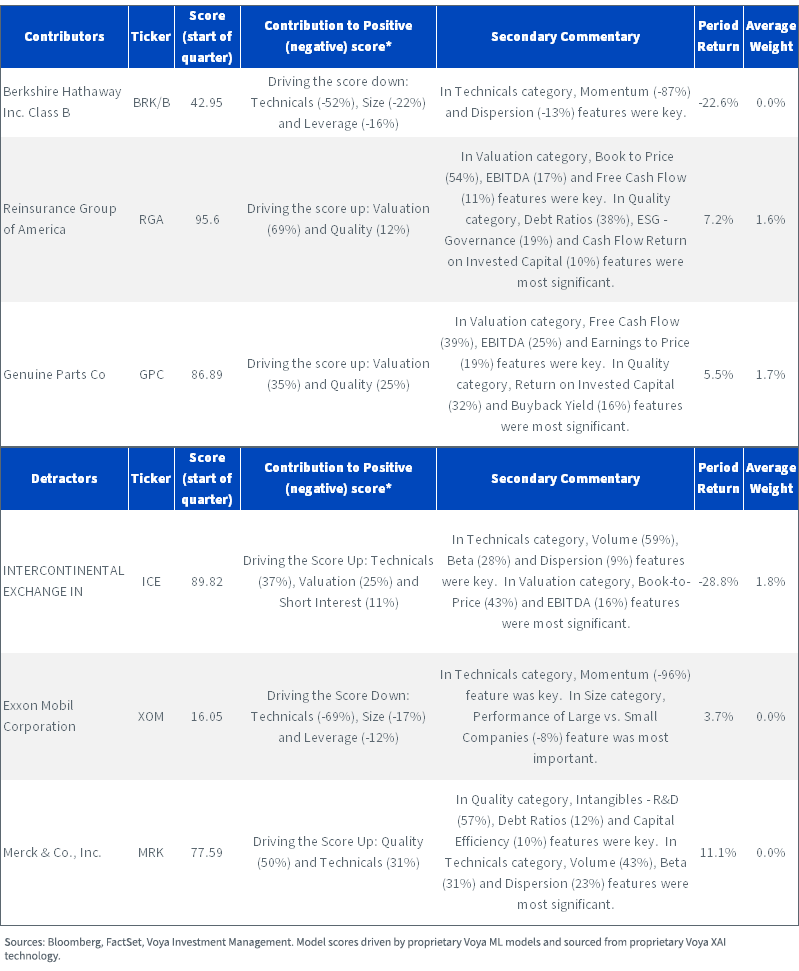

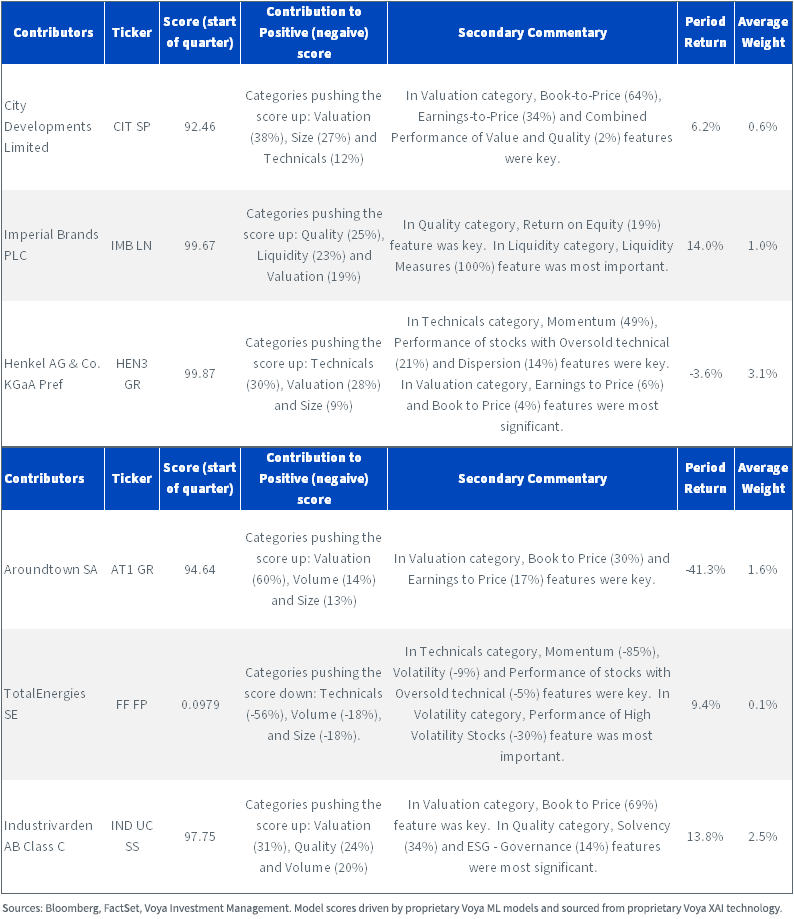

As shown below, each company in the universe is assigned a score by the virtual analysts and virtual traders from 0 to 100, indicating the overall favorability for an allocation. You’ll notice the low scores tend to have extremely low or zero allocations, while those with higher scores have a larger allocation. For the top contributors, the model scores demonstrated a level of accuracy that led to a positive impact on performance of the Fund. On the other hand, this was not the case for detractors, as the scoring was not aligned with the resulting company performance for the quarter. It is important to note that complete entry and exit of a position may not have fully played out as of Q2 reporting.

AIVL Return Contributors & Detractors 3/31/22–6/30/22

AIVI Return Contributors & Detractors 3/31/22–6/30/22

In the “Contribution to Positive (Negative) Score” column, you’ll find a handful of characteristics of each company that either had a significantly positive or negative impact on the overall score.

For AIVL, good quality and low valuation metrics had a notable impact on raising a company’s score. Specific fundamentals like price-to-book, EBITDA and ROIC were a few of the common drivers here. In terms of detracting from a company’s score, poor quality metrics, high valuations, as well as unfavorable technicals were some of the commonalities.

For AIVI, we see a similar story in terms of low valuations and good quality impacting a company’s score positively, but high volatility and low liquidity were a couple of the notable factors that detracted from scores for select companies.

In this detail lies the true potential advantage of leveraging AI for investments—the ability for dynamic rules to be derived and consistently updated, forming a robust, ever-changing pattern recognition machine that can identify unique combinations of factors that have demonstrated great opportunity in the past. Given the complex macro backdrop, the dynamism offered by the AI-driven investment strategies AIVL and AIVI have thus far shown great promise. For those looking to diversify or change their current large-cap value exposure, the sophisticated strategies of WisdomTree AI Enhanced Value Funds may be a great option for the second half of the year.

Important Risks Related to this Article

AIVI: There are risks associated with investing, including the possible loss of principal. Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on a quantitative model and the model may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

AIVL: There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on a quantitative model and the model may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.