With U.S. stocks climbing, clients may be content to stand pat with offerings in their home market. Yet forward-thinking advisors may want to consider the benefits of international diversification.

That objective is readily attainable with the WisdomTree Developed International Multi-Factor Model Portfolio.

International developed market stocks possess attractive valuations, and could become more tantalizing as these countries effectively increase coronavirus vaccination rates.

See also: Wary of High Valuations? Look to Model Portfolios

“The vaccination rollout has met with numerous issues in the EU, and the region now faces rising cases and renewed lockdowns as a result,” notes WisdomTree.

Some Interesting International Ideas

One way to approach international equities is to ensure an investor is compensated for the risk. Enter the WisdomTree Global ex-U.S. Dividend Growth Fund (NYSEArca: DNL).

DNL follows the fundamentally weighted WisdomTree Global ex-U.S. Quality Dividend Growth Index.

“The Index is comprised of the 300 companies in this universe that have the best-combined rank of growth and quality factors. The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three-year historical averages for return on equity and return on assets. Companies are weighted in the Index based on annual cash dividends paid,” according to WisdomTree.

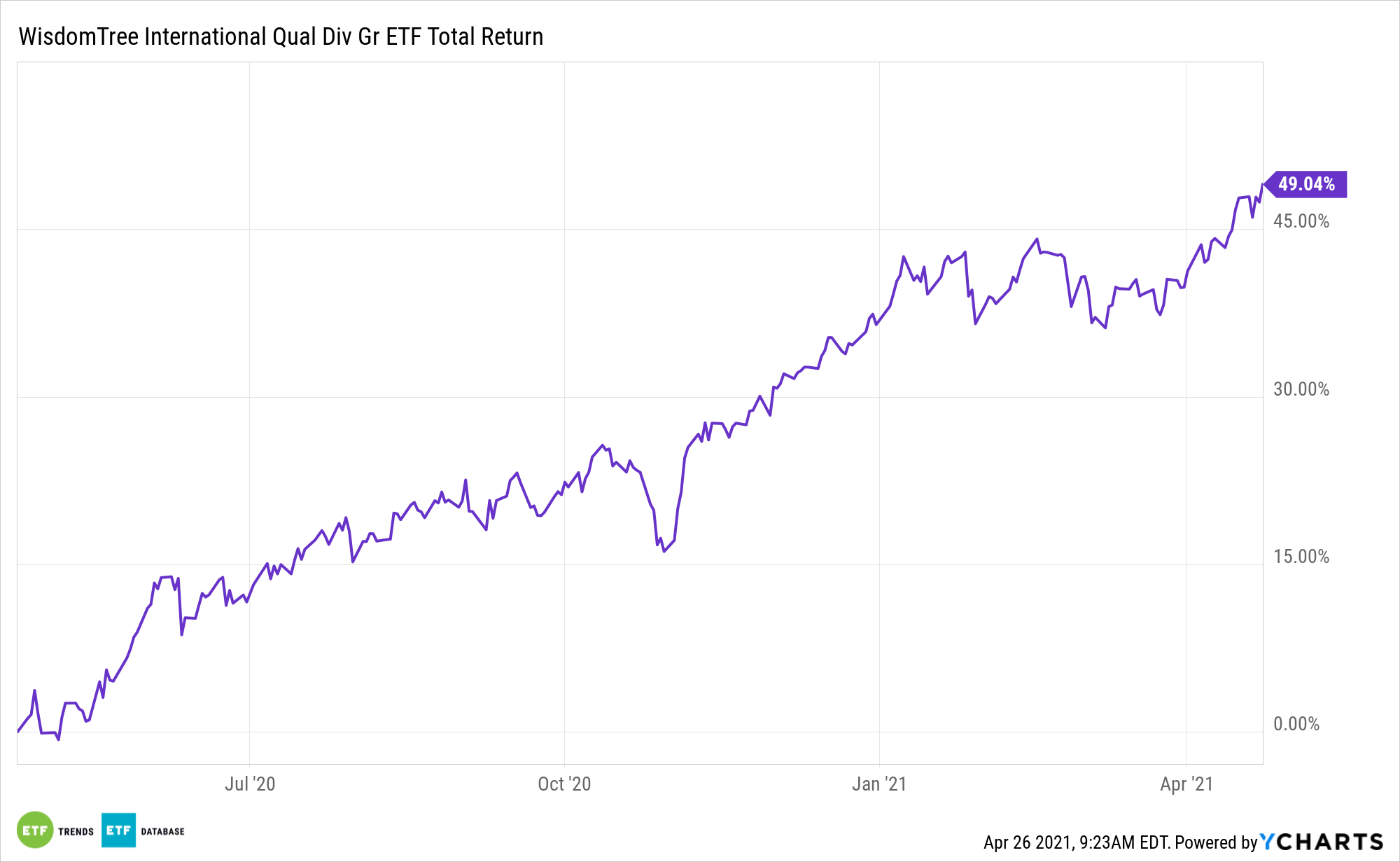

Another idea with a quality purview is the WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG). IQDG follows the WisdomTree International Quality Dividend Growth Index, which combines growth and quality factors.

“The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets. Companies are weighted in the Index based on annual cash dividends paid,” according to WisdomTree.

Those attributes are increasingly relevant given the current landscape for ex-US developed markets stocks.

“Earnings have surprised to the upside and look to be trending higher in 2021 as well. The global rotation from growth to value stocks stands to aid the developed world given the cyclical composition of its equity markets and reliance on global growth,” adds WisdomTree.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.