Asset allocators and their clients are hearing more and more about disruptive growth, but harnessing the advantages of this investment style requires more than just broad approaches.

Can disruptive growth be modeled? Advisors looking to deploy the advantages of disruptive growth investments within client portfolios can turn to WisdomTree’s new Disruptive Growth Model Portfolio.

“The WisdomTree Disruptive Growth ETF Model Portfolio targets structural growth themes that are believed to drive innovation across different industries and segments of society in the future,” according to the issuer. “The themes and affiliated ETFs selected for inclusion will typically have above-market growth projections. The model portfolio seeks maximum long-term capital appreciation and may include both WisdomTree and non-WisdomTree ETFs.”

The newest addition to WisdomTree’s expansive roster of model portfolios, the disruptive growth offering features exposure to six exchange traded funds at weights ranging from 15% to 20%.

Disruptive themes represented in the model portfolio including cloud computing, cybersecurity, fintech, genomics, and even video games.

Growth Mode, Activated

While there are rumblings regarding a value resurgence amongst investors, growth and momentum fare are still in the driver’s seat.

“Recognizing that many advisors and their end clients believe in this “all growth, all the time” narrative, we recently launched the WisdomTree Disruptive Growth Model,” said WisdomTree Model Portfolios Chief Investment Officer Scott Welch in a recent note. “This model seeks to capture the attraction of many advisors to rapidly evolving new technologies (e.g., cloud computing), new ways of living, working and playing (e.g., biotech, cybersecurity and online gaming) and disruptive solutions in existing industries.”

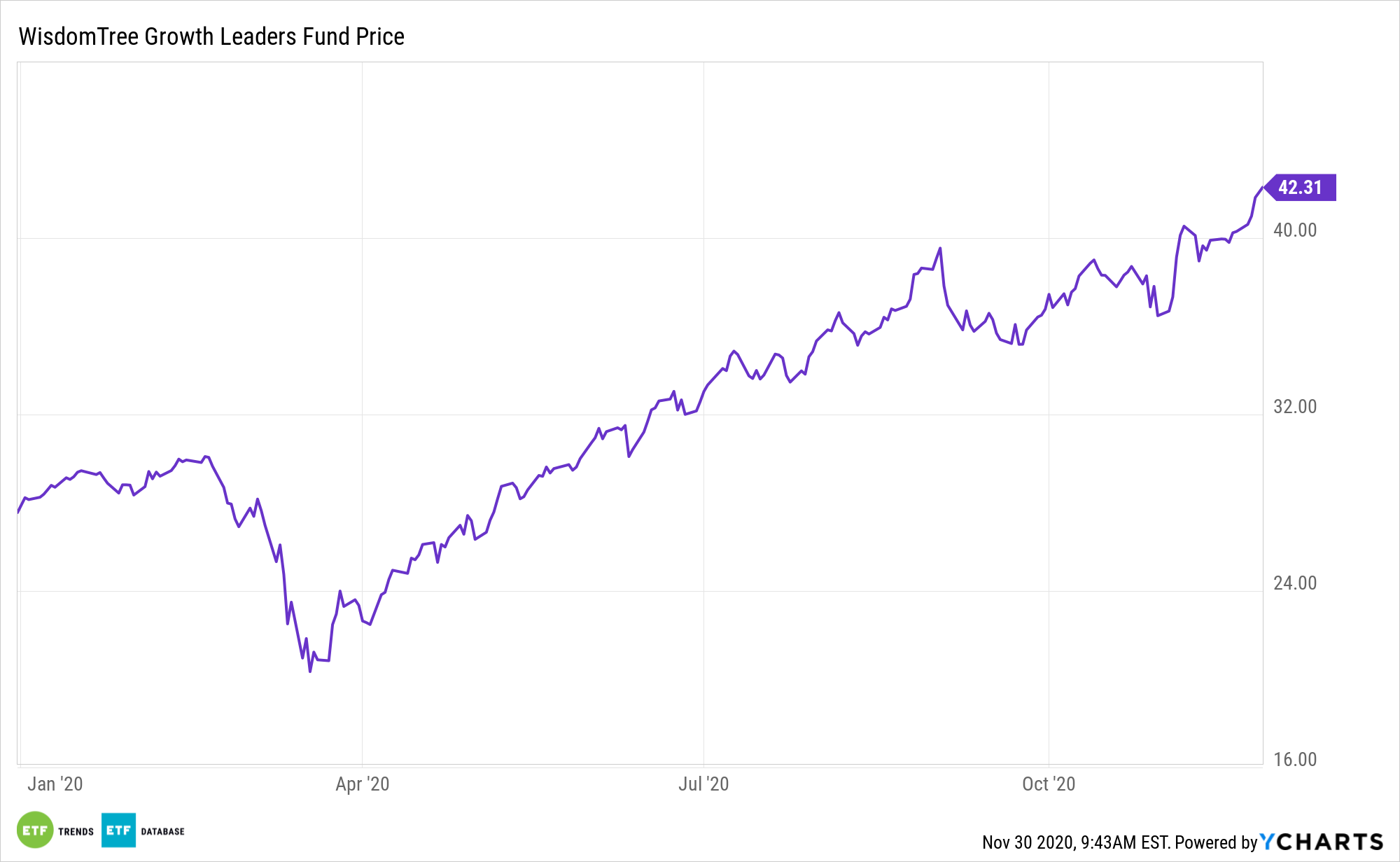

A diversified approach to disruptive growth in the model portfolio is the WisdomTree Growth Leaders Fund (NYSEARCA: PLAT). PLAT seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Modern Tech Platforms Index and has an expense ratio of 0.45%.

PLAT offers investors access to companies that are generating revenue from platform business models – these are companies with non-linear business models focused on creating value by facilitating interactions between two or more groups through technology.

“But if you believe that the election results and corresponding economic, political and market conditions suggest we may return to a similar environment to that of the past few years (even including the pandemic-induced recession of the first half of 2020), then adding some disruptive ‘whole lotta shakin’ into your portfolios may be just what’s ‘goin’ on,’” notes Welch.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.