India’s financial markets are a case study in 2021 resilience. While the country struggles to contain the coronavirus, the MSCI India Index is higher by 10.47% year-to-date.

That’s nearly 400 basis points better the MSCI Emerging Markets Index. Some market observers believe Indian stocks can continue trending higher, potentially benefiting exchange traded funds like the WisdomTree India Earnings ETF (NYSE: EPI) along the way.

Prime Minister Narendra Modi’s “government has also endured waves of protests over policies affecting the country’s large agricultural sector,” writes WisdomTree analyst Brian Manby. “His regime adopted authoritative tactics in response to quell the unrest, including the suspension of Twitter accounts linked to protest support and government criticism and the arrests of high-profile activists. Normally, this type of social instability coupled with a severe public health crisis would create a challenging environment for equity markets to flourish. But the past year has proven itself anything but normal, and Indian equities are somehow staging a rally of their own.”

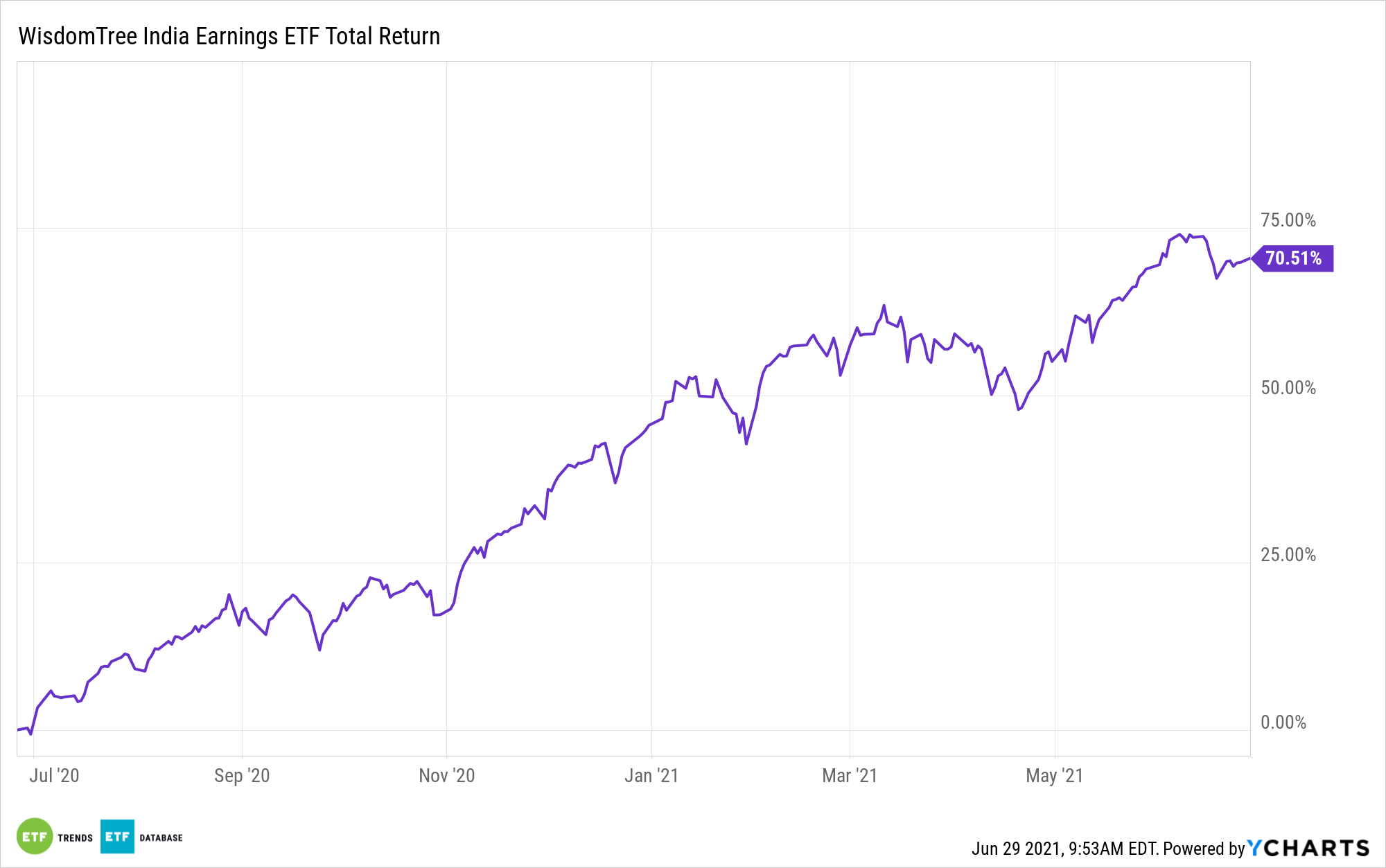

EPI Has Been Excellent

While Indian equities are showing sturdiness amid trying circumstances, EPI reminds investors that fund structure matters. The WisdomTree fund is up more than 16% year-to-date, trouncing the aforementioned MSCI India Index.

The $853.9 million EPI follows the WisdomTree India Earnings Index. That benchmark weights components by earnings, meaning the more profitable companies are assigned larger percentages. EPI’s methodology is also helping capitalize on strength in cyclical sectors.

“Sector leadership has been driven by Materials and Industrials, two areas we’ve touted as having outperformance potential this year as part of our forecast of a cyclical economic revival. India is also being aided to a lesser extent by Real Estate and Energy, two sector mainstays of value investing, which we’ve also been bullish on,” adds Manby.

Materials and industrials combine for about 21.5% of EPI’s weight, while energy and real estate stocks chip in another 10.7%, according to issuer data.

EPI thus has a cyclical value feel. In fact, the ETF has long sported discounts relative to broader Indian and emerging markets benchmarks (it’s inexpensive today, too) thanks in part to its earnings-weighted methodology.

“As a matter of fact, EPI has maintained a discount on a forward P/E basis since inception. Its current discount is about 30% relative to the MSCI India Index on a forward P/E basis,” concludes Manby.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.