With Beijing clamping down on Chinese internet firms, tech organizations, and for-profit tutoring companies, these are perilous times for investors with exposure to the world’s second-largest economy.

The MSCI China Index is off 8.50% over the past month and resides 26.62% below its 52-week high – a sign of a bear market. Those statistics imply investors currently lacking China exposure may be all the better for it, but those data points may also invite some investors to bottom-fish.

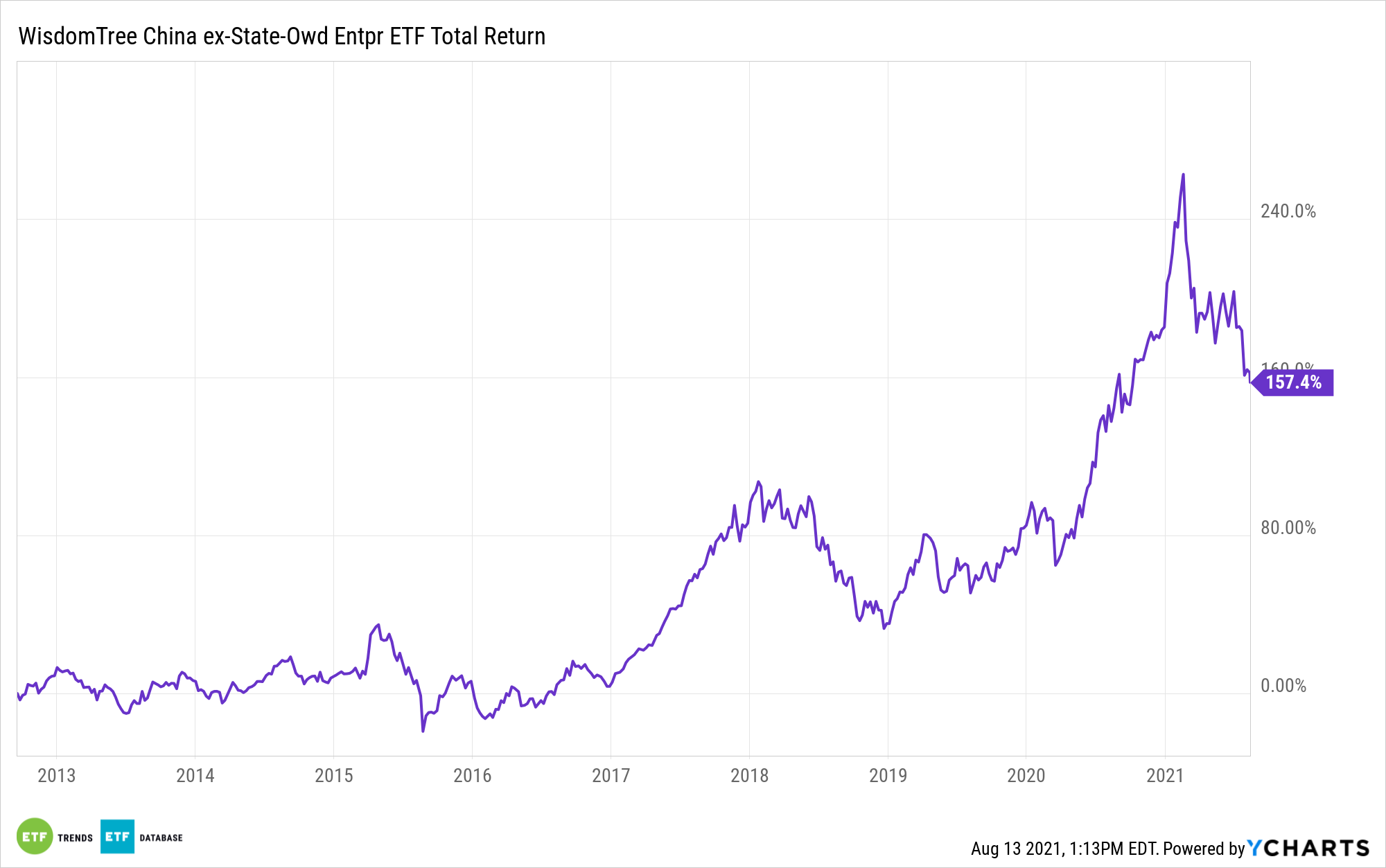

In that case, the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) may be the way to go. At least that’s the sentiment of Bank of America. In a recent research note by Pooja Saksena and Jared Woodward, the analysts wax bearish on China in a broad sense, display some enthusiasm for CXSE.

“As detailed in this month’s RIC Report, after weighing the risks & rewards, we believe the reasons for US investors to underweight Chinese assets outweigh the reasons to own them. We find that the regulatory risks are increasing, P/E multiples are likely to contract, and major headwinds from demographics, debt, and ESG are rising,” say the analysts.

CXSE: The Way to Go in China?

While CXSE is home to some consumer-facing internet companies, which are among the firms at the epicenter of Beijing’s regulatory crackdown, the ETF may be better-suited to play a possible rebound in Chinese stocks.

Due to the Chinese Communist Party’s (CCP) focus on consumer protection and data privacy, some market participants abandoned once-hot Chinese internet names in favor of previously inexpensive state-owned enterprises in slower growth sectors. However, some of those stocks are no longer cheap. Plus, state-run firms, which CXSE ignores, are often prone to higher environmental, social, and governance (ESG) risk.

“Whether ESG investors (now 30% of flows) will go to China is questionable given opaque auditing, controversial labor practices, top rank in CO2 emissions, and Communist Party governance turning each firm into a potential state-owned enterprise,” add the Bank of America analysts.

The CXSE ETF garners a “most attractive” rating from Bank of America and a composite rating of 87 on a scale of 1-100. That’s well ahead of the second-place fund, which has a composite score of 63.

The Bank is broadly bullish on emerging markets equities ex-China and favors India among individual developing economies.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.