Broadly speaking, it’s not hard to find optimism among market observers for riskier assets entering 2021. Optimism aside, advisors need tailored plans to deliver for clients this year.

Enter the aggressive sleeve of the WisdomTree Strategic Model Portfolio.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity and fixed income ETFs. The model portfolio strives to deliver performance in excess of an 80/20 combination of a broad-based global equity benchmark and a U.S. aggregate bond index,” according to WisdomTree.

Allocated 80% to equities and 20% to fixed income assets, the model portfolio is indeed positioned for an aggressive 2021.

Can WisdomTree’s Strategic Portfolio Drive the Right Mix for 2021?

On the bond side, the Strategic Model Portfolio is an ideal avenue for contending with low Treasury yields because it provides exposure to corporate debt – both high-yield and investment-grade – and emerging markets bonds, among other fixed income assets.

One of the key components in the model portfolio is the is the WisdomTree U.S. High Yield Corporate Bond Fund (CBOE: WFHY).

WFHY’s fundamentally-weighted methodology could serve income investors well if defaults increase. The fund tracks the WisdomTree U.S. High Yield Corporate Bond Index, which uses a multi-step fundamental screen to steer investors away from the junkiest of the junk bonds. That’s important at a time when many high-yield issuers are under scrutiny due to financing needs.

The equity side of the model portfolios features 11 exchange traded funds spanning domestic and international (emerging markets included), large, mid, and small cap equities.

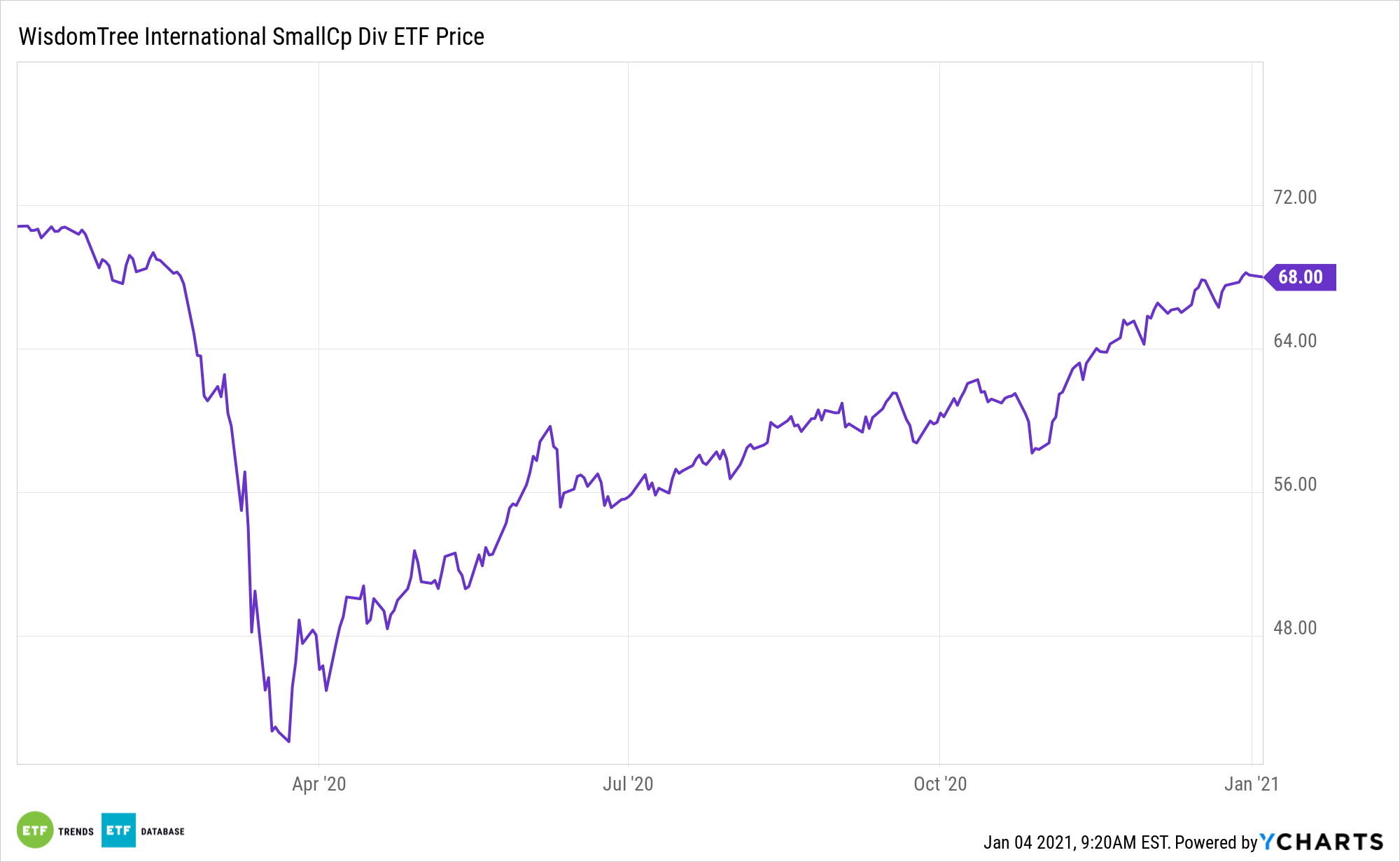

One of the prominent equity holdings is the WisdomTree International SmallCap Dividend Fund (DLS).

DLS seeks to track the price and yield performance of the WisdomTree International SmallCap Dividend Index, which is comprised of the small-capitalization segment of the dividend-paying market in the industrialized world outside the U.S. and Canada.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.