Against the backdrop of political change in the U.S., many market observers are encouraged by emerging market equities prospects.

One way of tapping into that theme is with WisdomTree’s Emerging Markets Multi-Factor Model Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs,” according to WisdomTree. “The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETFs.”

One of the primary benefits of the portfolio is that it actively eschews exposure to lumbering state-owned enterprises (SOEs), assets which have historically weighed on the performances of traditional emerging markets benchmarks.

“State-owned enterprises typically have an inherent conflict of interest as they often look to (or are forced to) promote the government’s objectives at the expense of creating value for other shareholders. This is often referred to as a “national service” requirement of SOEs,” writes Alejandro Saltiel, WisdomTree associate director of modern alpha, in a recent report.

X Marks the Spot for WisdomTree Model Portfolios

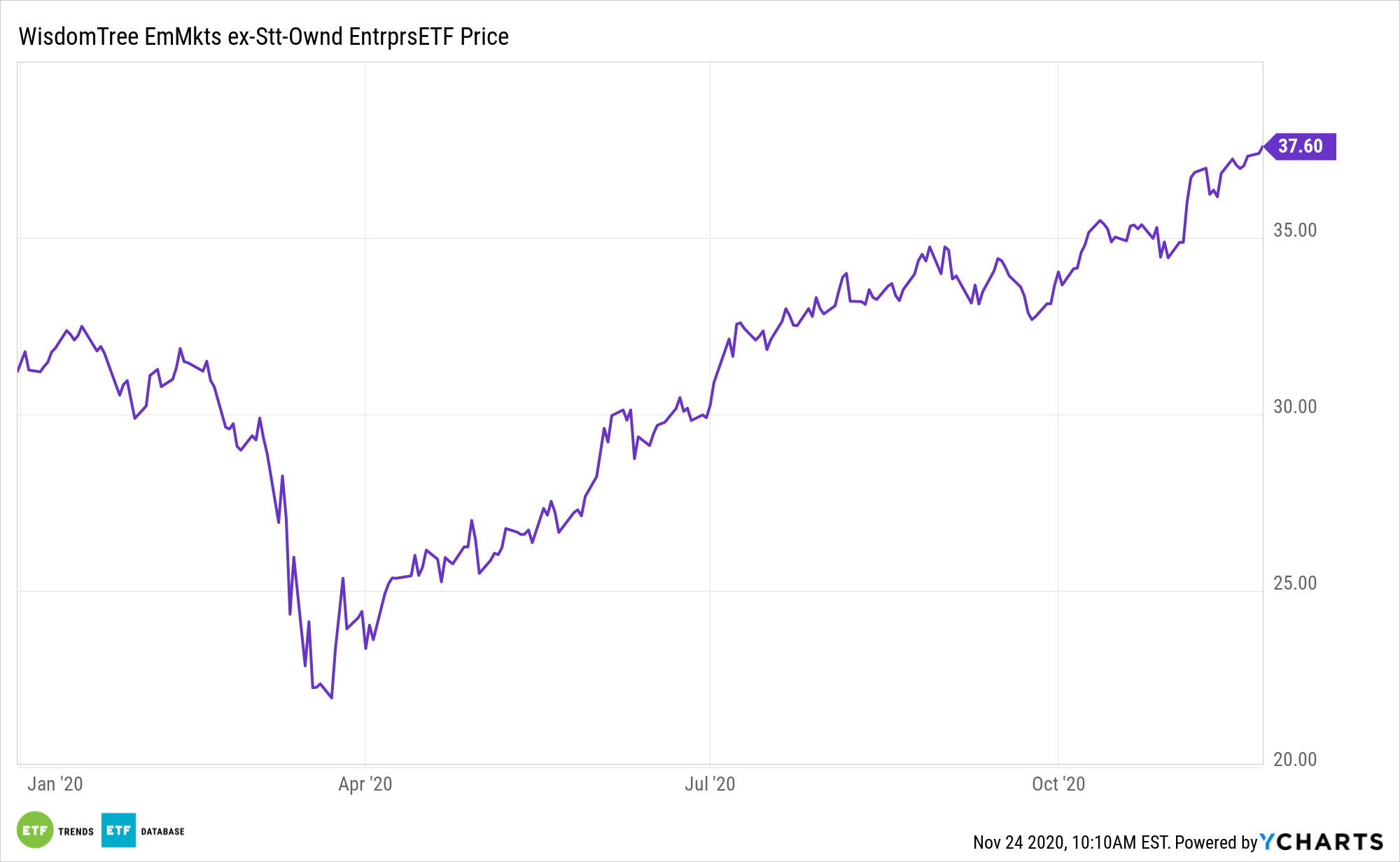

The WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE), one of the original ETFs to explicitly exclude SOEs, is the cornerstone of the aforementioned model portfolio.

XSOE seeks to track the price and yield performance of the WisdomTree Emerging Markets ex-State-Owned Enterprises Index. Under normal circumstances, at least 80% of the fund’s total assets will be invested in component securities of the index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. The index is a modified float-adjusted market cap weighted index that consists of common stocks in emerging markets, excluding common stocks of “state-owned enterprises.”

“After reconstitution, EMXSOE’s country exposure was reset to match its starting universe, while its sector tilts continue to over-weight Consumer Discretionary and Information Technology and under-weight Financials and Energy,” notes Saltiel.

Bottom line: XSOE’s underlying is better positioned to capture emerging markets growth opportunities than rival, old-guard benchmarks.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.