Not only did the Fed recently imply it could soon cease its asset-buying program, minutes from the June meeting of the Federal Open Market Committee (FOMC) indicate more Fed members are becoming comfortable with the idea of moving up the rate hike timeline.

Speculation about the Fed setting out to raise borrowing costs sooner than expect is the latest fixed income curveball advisors are dealing with this year. Advisors can calm skittish clients with the WisdomTree Fixed Income Model Portfolio.

Home to a variety of fixed income exchange traded funds offering exposure to an array of credit qualities, geographies, and rate risk profiles, the model portfolio is appropriate at a time when many market observers are simply playing guessing games regarding the Fed’s rate hike intentions.

“At present, there are 18 Fed members providing estimates for the future Fed Funds Rate. As of the June FOMC meeting, there are now seven policymakers projecting the first increase to occur in 2022, up from just four at the March gathering,” said Kevin Flanagan, head of fixed income at WisdomTree. “Interestingly, this trend, of an increasing number of Fed members pushing up the timing for liftoff, is exactly what occurred for the ‘2023–2024’ outcome.”

ETF Preparation

Forecasting what the Fed, or any central bank for that matter, has in store isn’t as easy of a task as some make it out to be. One way to prepare for rate shocks is with floating rate notes (FRNs).

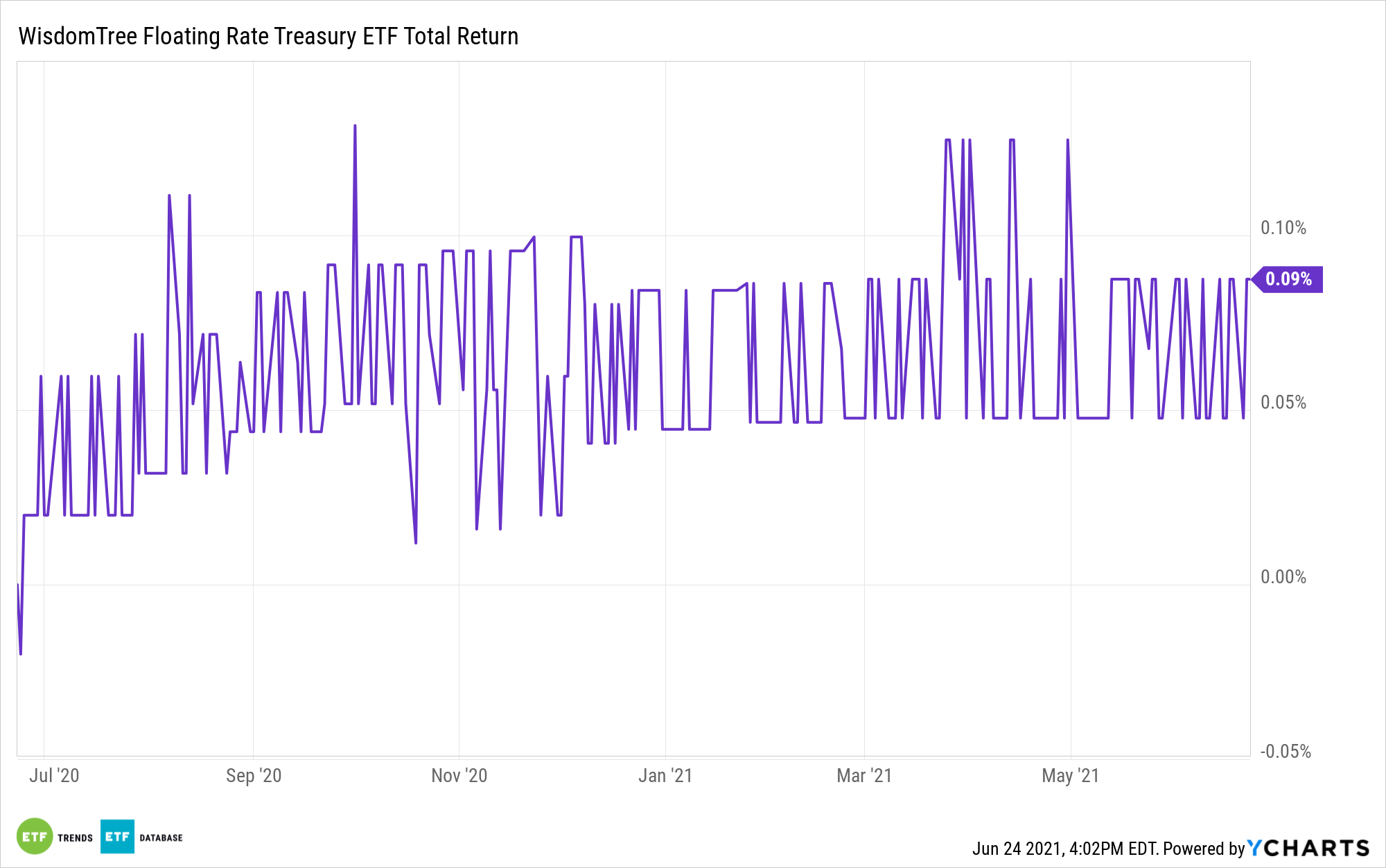

That bond segment is featured in the model portfolio via the WisdomTree Bloomberg Floating Rate Treasury Fund (NYSEArca: USFR). FRNs typically sports lower yields than fixed-rate bonds, but rising interest rates are historically beneficial to floaters.

USFR is slightly higher this year, but that is still better than the 2.66% shed by the Bloomberg Barclays Aggregate Bond Index. That’s a sign that when Treasury yields surged earlier this year, USFR was a valid destination over fixed-rate bonds.

“Specifically, vehicles that are often used as rate hedges like TIPS and short-term Treasuries actually saw their yields rise in response to the June Fed meeting. This development offered investors a real-time example of what could continue to occur in the (rate increase) scenario,” adds Flanagan. “As a result, I would suggest investors consider other rate hedge solutions such as WisdomTree’s Zero Duration and Treasury Floating Rate strategies to help navigate the waters that may lie ahead.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.