By Matt Wagner, CFA, Senior Research Analyst, WisdomTree

This has been a whirlwind year in countless ways.

The usually staid topic of dividend announcements has even had its fireworks, with significant dividend cuts made from a diverse set of household names like Wells Fargo, Boeing and Disney.

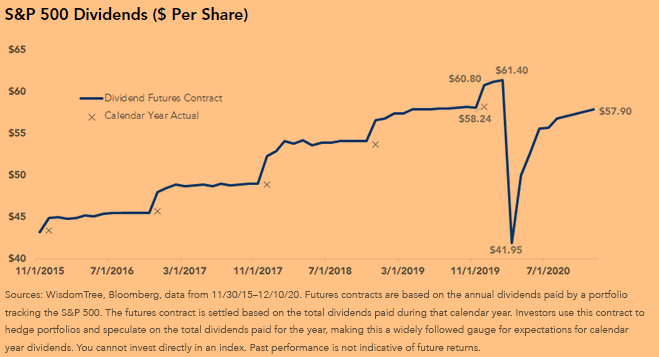

S&P 500 dividends per share in 2019 set a record of $58.24. With the backdrop of a steady economy, expectations entering this year were for dividends to improve about 4% from that record, to $60.80.

By the end of February, expectations had inched up to $61.40 before nosediving as the economy plummeted into a coronavirus-induced contraction. Through March, expectations shifted to a 28% contraction in 2020 dividends relative to 2019—an outcome that would have set a record for negative growth in S&P 500 dividends in a calendar year.

Nearing the end of this year, with just about all dividend payments having been announced, S&P 500 dividends are expected to be off by just 1% relative to the 2019 high watermark—a welcome positive outcome for income-oriented investors.

But this 1% decline obscures the dire outcomes that transpired across segments of all U.S. dividend payers—not just the S&P 500 blue chip names.

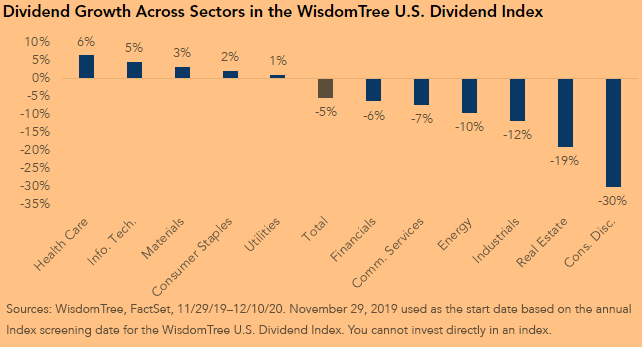

Segmenting dividend growth across sectors within the WisdomTree U.S. Dividend Index (which includes large-, mid- and small-cap dividend payers) helps illustrate the greatest dividend pain and where there was relative safety.

The “stay-at-home” sectors—Health Care, Info. Tech., Consumer Staples and Utilities—fared better than the sectors now dubbed “reopening” plays—Consumer Discretionary, Real Estate, Industrials and Energy.

One sector that fared relatively well, perhaps contrary to some people’s expectations, was Financials. As a sector, dividends were only down 6%—about in line with the broader Index.

Of the largest U.S. banks—a list that includes some of the largest dividend payers globally—only Wells Fargo and Capital One Financial were forced to cut dividends. This is a far cry from what transpired in the last recession when that sector was the epicenter of severe dividend cuts.

This time around, regulators forced banks to suspend share buybacks, but dividends were by and large left untouched—unlike European peers that were forced to suspend payouts.

Many would argue that U.S. banks have taken their medicine in the years since the financial crisis and carry much greater capital today than they did then. As a payoff to this restructuring of balance sheets, banks were able to keep payouts steady.

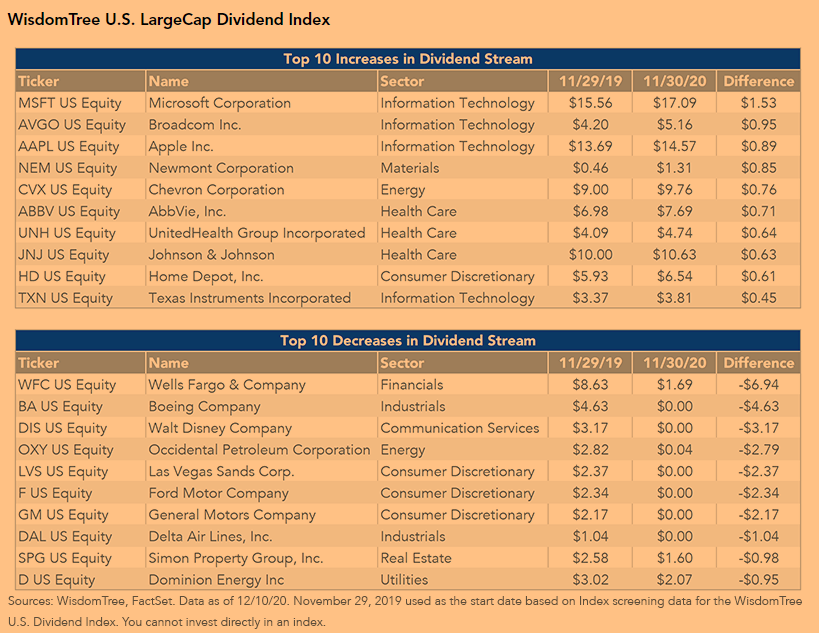

The below tables provide some context to the individual companies with the greatest increase in their Dividend Stream® this year, as well as the greatest decrease.

While you may not be surprised by most of the names on the top 10 list, Chevron’s appearance may be a bit of a surprise given the plunge in oil prices this year.

Chevron is an example of a company that increased its dividend prior to the onset of the recession in January. If oil prices do not materially recover in 2021, a potential cut from Chevron’s dividend—a move that would mirror moves from its global oil competitors—could weigh on dividend growth next year.

Looking forward, S&P 500 dividend futures indicate a further drop of 2% in 2021 dividends relative to this year, which is an improvement from a 6% drop indicated just 2 weeks ago. This expected drop is likely caused by the roughly 60 companies that suspended or cut their dividends in 2020 that will have reduced first quarter dividend payouts in 2021 compared to those paid out in January and February this year.

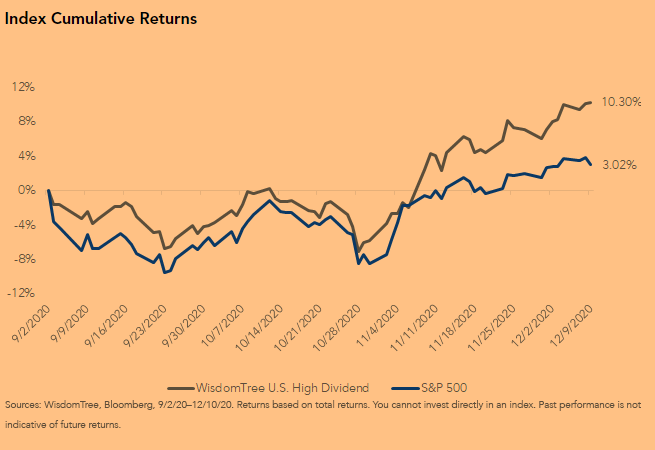

As the market prices in greater confidence in the reopening of the economy next year, we have seen the share prices of the high-dividend payers that have lagged the most this year begin to outperform.

In recent months, the WisdomTree U.S. High Dividend Index—an Index heavily populated by companies in the “reopening” sectors—has outperformed the S&P 500 by more than 700 basis points. Both for investors with income needs and those looking to tap into the reopening theme, the high-dividend payers that have lagged for much of 2020 and the previous years’ growth rally may be a place to consider.

Originally published by WisdomTree, 12/11/20

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.