In the past three months, MOAT’s allocation was able to blunt the effects of the volatility roiling the markets, allowing for less losses compared to the S&P 500.

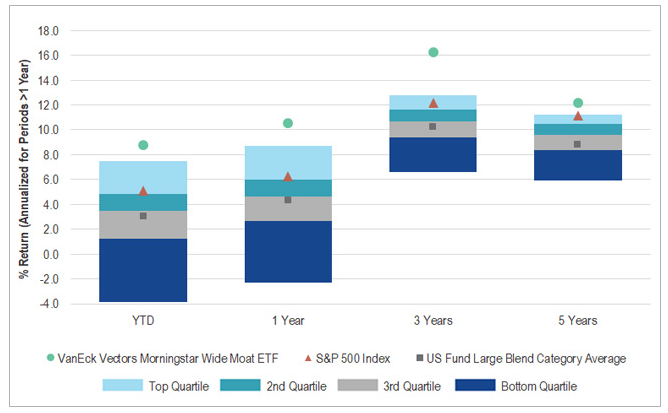

“Ultimately, investors tend to judge an investment philosophy or strategy based on outcomes, and Morningstar’s forward-looking moat investment philosophy stands out in the crowd,” wrote Rakszawski. “Despite recent turmoil in the markets, the VanEck Vectors Morningstar Wide Moat ETF (MOAT®) is among the top performing ETFs and mutual funds in the Morningstar US Fund Large Blend Category across multiple periods through November 30, 2018. In fact, MOAT is ranked number one for the three-year period based on total return.”

The Morningstar Economic Moat Rating methodology assigns an economic moat rating to companies, but in addition, it focuses on companies exhibiting attractive valuations relative to its price. Furthermore, the indexing methodology uses five sources of economic moats:

- Intangible assets with brand recognition for premium pricing options

- Switching costs that make it too expensive to stop using a company’s products

- Network effect that occurs when the value of a company’s service increases as more use the service

- A cost advantage helps companies undercut competitors on pricing while earning similar margins

- Efficient scale associated with a competitive advantage in a niche market

For more information on the MOAT ETF, click here.

For more market trends, visit ETFTrends.com.