There has been tremendous development of the marijuana industry over the past few years, and 2018 in particular was groundbreaking for cannabis-related businesses.

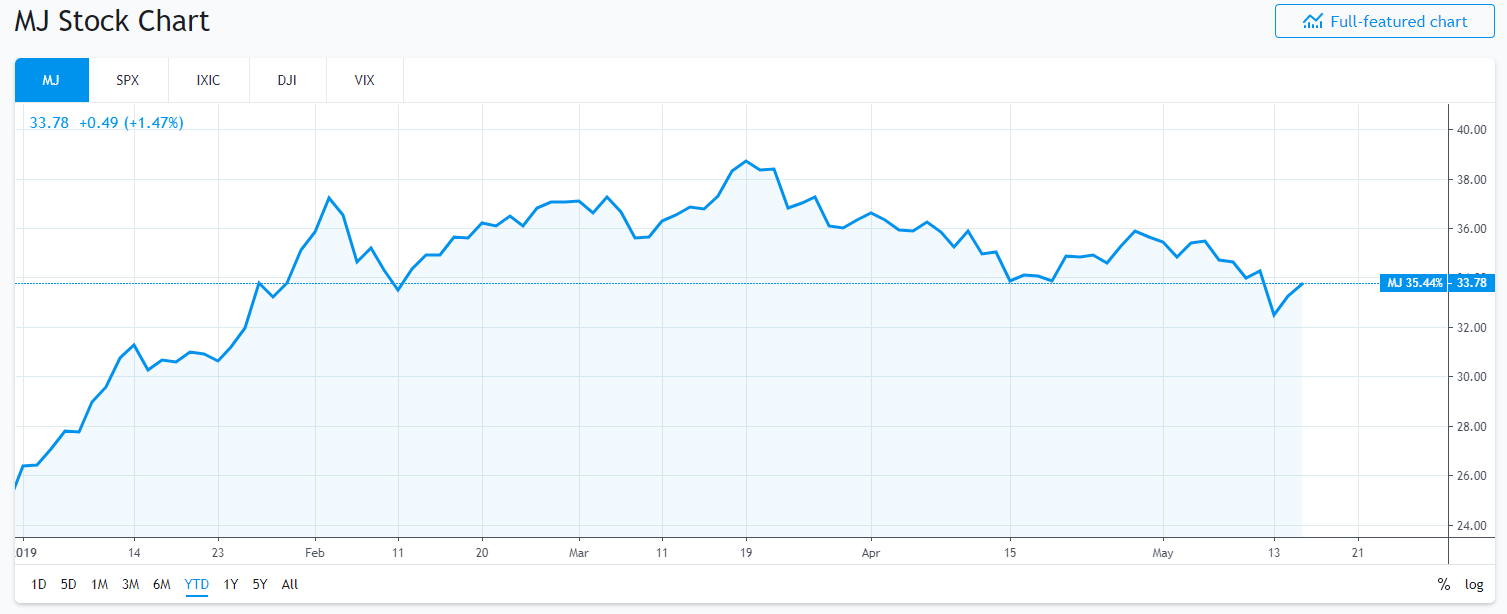

On Tuesday, the ETFMG Alternative Harvest ETF (MJ) is up 1.47% to $33.78, as of 12:40 pm EST, according to Yahoo Finance data.

MJ ETF’s year-to-date performance via TradingView.com

Currently there are 11 U.S. states where marijuana is legal: Alaska, California, Colorado, Maine, Massachusetts, Michigan, Nevada, Oregon, Vermont, Washington, and Washington D.C.

After watching for years as individual U.S. states legalized marijuana one by one for various purposes, the entire nation of Canada took a giant leap forward by making recreational cannabis legal across the country in mid-October. Gradually, more jurisdictions across the globe have decided to eliminate laws against marijuana, and the movement seems to be gaining even more traction in 2019.

The good news for investors, is that with the rise of legal marijuana comes opportunity to invest in it’s business development. Pot stocks like Canopy Growth (CGC) and Aurora Cannabis (ACB) have grown increasingly popular among investors, but they’ve also seen a lot of volatility. Many companies in the cannabis industry saw their shares rocket higher during the incipient period of the the Canadian recreational market, only to give up their gains and see prices fall back to Earth in the months that followed. The experience taught many investors that rapid growth comes with risk, and that diversification can be a valuable asset when investing in a speculative space, such as the marijuana sector.

Fortunately, there are Marijuana ETFs to help with this dilemma. They allow investors to diversify, mitigating some of the risk of an individual stock, and participate in more than one part of the business model.

One relatively new exchange-traded fund focused on marijuana stocks planned to undercut competitors when it debuted just days before the unofficial pot holiday. According to Bloomberg, YOLO, which stands for the credo, “You Only Live Once”, is the ticker for the AdvisorShares Pure Cannabis ETF, which charges 74 basis points, or $7.40 for every $1,000 invested. That’s 1 basis point less than the ETFMG Alternative Harvest ETF, creatively named known as MJ., and the AdvisorShares Vice ETF (ACT), two other popular marijuana ETFs.

For more news and articles on marijuana ETFs, visit our Marijuana ETFs category.