But are those same things true today?

Let’s take a look a stocks, bonds and cryptocurrencies to see.

Stocks are pretty clearly not a bubble, even if you look at them prior to the recent decline. The Shiller PE ratio is not only not 50% above what we have ever seen before, it is actually well below what we saw in the late 90s. And this bull market has been notable for the lack of euphoria that has surrounded it. So the criteria for a bubble haven’t been met.

That doesn’t mean the market is cheap – it certainly isn’t. That also doesn’t mean there won’t be a significant decline – there very well could be. It just means that we are not in a situation where losses are inevitable, and that is what a bubble entails.

Bonds also don’t meet the criteria of a bubble. The current extended period of low rates has been unlike anything that has occurred historically, but it isn’t so far outside of it that positive returns from here are very unlikely. In fact, the best way to predict future bond returns is to use the current yield, which implies that likely returns from here are low, but positive.

That isn’t what you see in a bubble. There also is certainly no euphoria surrounding bonds. You may run in different circles than I do, but I haven’t heard anybody expressing extreme excitement about what is going on with their bond portfolios.

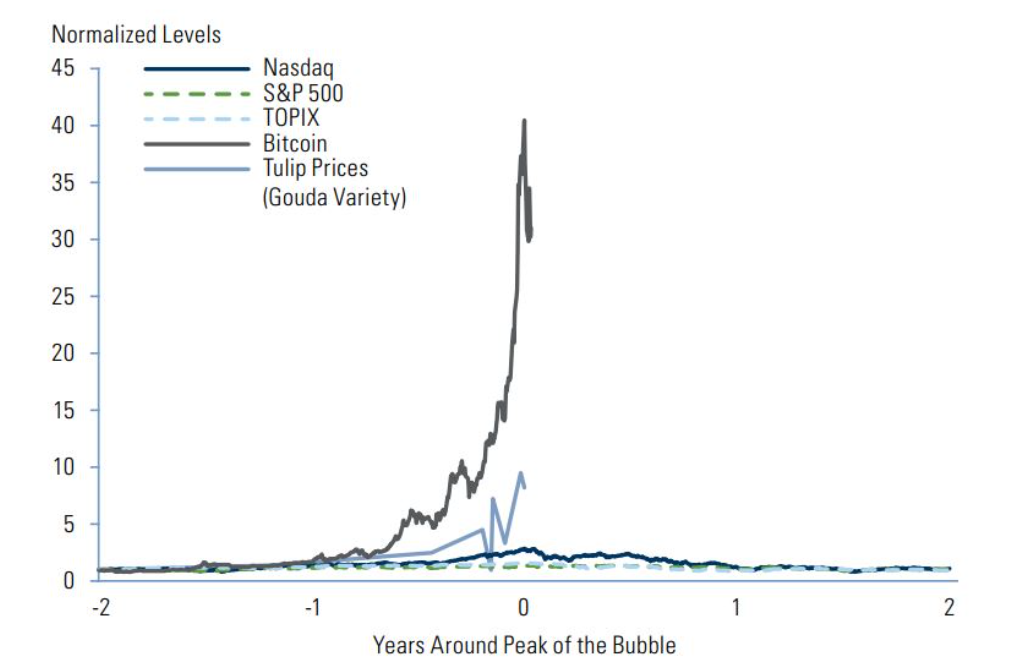

Cryptocurrencies are a much tougher case. They haven’t existed for a long time, so there is no history to compare them to. But you can look at other bubbles in history to get some perspective. This chart that Goldman Sachs put out recently, does exactly that.

As you can see, the returns of cryptocurrencies dwarf the returns of any other bubble in history. That is even true after the recent decline. There is also a significant amount of euphoria within the cryptocurrency community and a belief that this time is different and the rules of asset valuation that have applied historically don’t apply here. The likelihood is that cryptocurrencies are currently in the midst of a bubble.

But that doesn’t mean they are going to collapse any day. It also doesn’t mean that certain cryptocurrencies might not perform very well going forward. It just means that as a whole, they are likely in bubble territory. As an example, consider the late 90s stock market bubble. It was driven by large growth companies, but small-cap value names did not participate for the most part. And when the bubble popped, those large-cap growth names led the way, but small-cap value didn’t decline at all.

So even though there was a bubble in stocks, it didn’t mean all stocks were going to decline. The same could be true for cryptocurrencies now. The popping of the cryptocurrency bubble could mean that most of the assets in the space are going to decline or go away entirely, but a select group will not only survive, but thrive.

What does all of this mean for investors going forward? Likely not much. Even if you could define bubbles in advance before they pop, predicting when they will pop is next to impossible. As always, the key is having a long-term plan that makes sense and that you can stick with during the ups and downs.

But it is important to understand that fear is a driver of a lot of bad decision making in investing and the overuse of the term bubble tends to stoke that fear. So next time you hear that a particular asset class is in bubble territory, take it with a grain of salt. Bubbles are certainly something you want to avoid, but they are also very rare and very hard to predict in advance, so changing your investment plan in response to predictions of bubbles is likely a losing game.

The following article was republished with permission from Validea.