By Kostya Etus, CFA, Portfolio Manager at CLS Investments

Financial advisors and investment managers are trying to crack the code on what millennial investors are looking for and how to help them save for retirement. Here are a few insights from a millennial point of view on dealing with this evolutionary generation.

Keeping Up With Technological Evolution

Millennials are always busy. They’re often tired and often working. They’re typically starting their families, and they don’t have much time to visit with financial advisors. Millennials also want everything at their fingertips, which is, of course, very possible with the evolution of the mobile phone. We all have a supercomputer in our pocket.

But, financial advisors don’t always make it easy to manage investment accounts from a mobile device. While they may prefer their clients to call if they’re concerned or have questions, many millennials simply don’t have the time. They would rather send a text message or get text message notifications. This preference is leading to growth in automated account opening tools, which enable users to sign on to a website and create accounts in a matter of minutes, while making everything easily available through an online interaction.

Advisors need to think about interactions with their clients and how they can evolve their technology offerings to keep up with this trend and adapt to the future. At CLS and our sister company, Orion, we continue to evolve our back office support with video statements, text notifications for account information, and the launch of an automated account opening platform called Autopilot. We are consistently trying to find ways to help advisors with technological evolution.

Keeping Up With Investment Evolution

As far as product evolution, all signs point to ETFs. Flows have continued to move to ETFs over the past decade, growing as much as 20-30% per year. There has been intense competition in the investment fund space, and the focus has shifted toward low-cost. Millennials are very cost-centric, and they are also very skeptical. After experiencing two major bear markets — the tech bubble in 2000 and the global financial crisis in 2008 — younger investors have little reason to trust the markets. As a result, they demand products that are easy to understand and offer transparency.

Additionally, I like to call millennials the know-it-all generation because we perceive ourselves as experts on everything. No matter the question, we simply “Google it” and find the answer instantly. The ability to look things up quickly creates a great benefit to ETFs, which are highly transparent and simple. They’re very easy to understand; they’re index-based and transparent. Anyone can look up the underlying holdings every day and know exactly what companies are being held. Millennials can really grasp and appreciate that. If you told me I could have a simple, diversified investment at a low cost, it’s a no brainer.

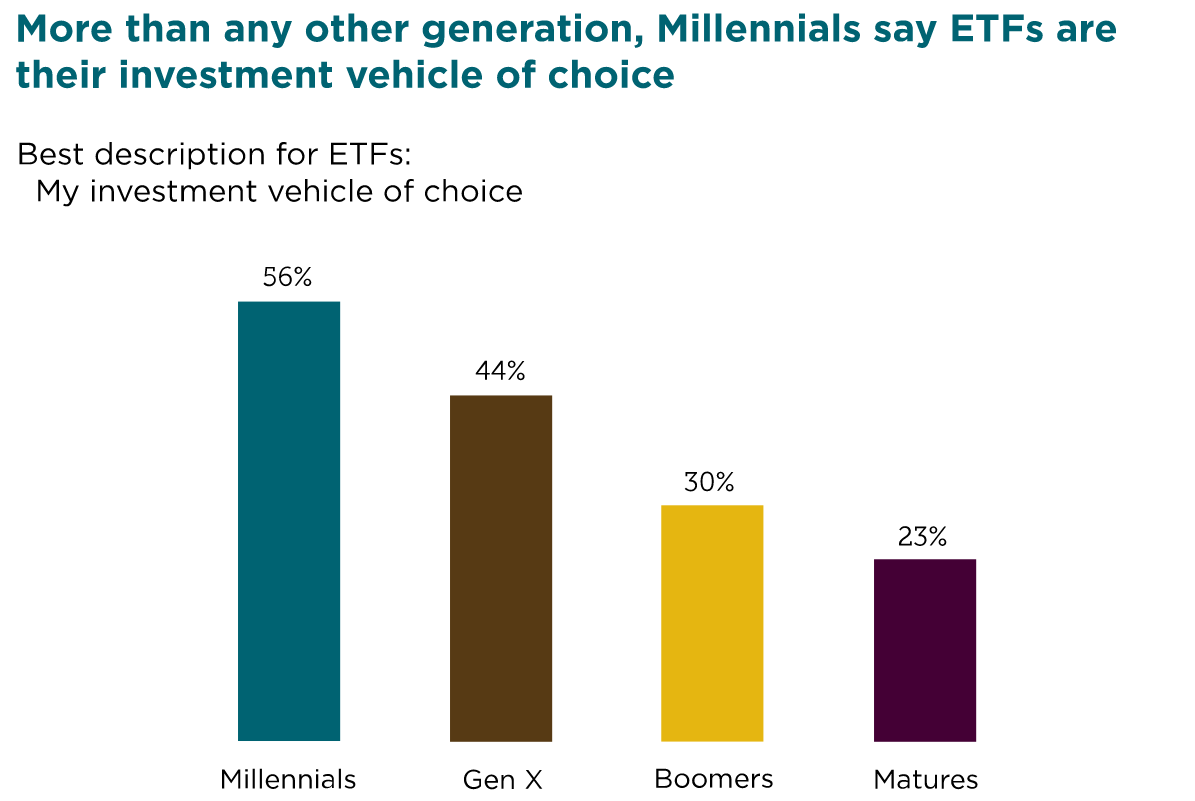

![]() The chart below is from an investor study by Charles Schwab highlighting millennials’ preference for ETFs.

The chart below is from an investor study by Charles Schwab highlighting millennials’ preference for ETFs.

Keeping Up With Life Stage Evolution

The millennial generation is getting married, having children and building houses a little later than previous generations. For most millennials, these significant life events have happened in the last five years or so. Thus, the natural evolution of the stages of life suggests we will see more and more millennials begin to save for retirement.