We’re awash in mid-year predictions articles right now. Almost all of them will mention inflation, interest rates, global energy and related conflicts, and the mid-term elections. Those will all be important, but honestly, we all already have our chosen sources, filters, and biases on those topics, and I’m not out to change anyone’s mind on those big picture outlooks.

I spend a lot of time thinking about the big picture and listening/reading/talking with lots of folks deep down the rabbit holes of their own “big pictures.” Inflation and interest rates matter, but so too does the direction and evolution of fixed income, or what’s happening in crypto — not the meltdown, lots of ink is already being spilled on that — but this increasing intersection happening between DeFi and TradFi, or the increasing noise on collective ownership and ESG.

I’ve picked out a handful of what I think are some of these “big pictures” that are interesting in this second half, things that matter but that sometimes get lost while we’re drowning in headlines, and why I think they matter — why they’re some of my big pictures. Some I’ve already shed a bit of light on, and others I’m looking to dive into extensively in the coming months. If you’re looking for spoilers, you’re in the right place.

The Ethics of Indexing

Depending on how you want to measure it, which markets you want to focus on, and how much you believe voluntary reporting, somewhere around 20%–40% of the value of U.S. equities is now in passive vehicles. On a net new flow basis, however, passive is gathering new assets somewhere between 3x–4x faster — infinitely faster for the last few years, as active has been a net loser (which I dug into in my previous piece on the topic).

The Second Half Prediction: Expect much more scrutiny on every aspect of passive investing. Unfortunately, I suspect the discussions happening at the highest levels and trickling down will mostly revolve around proxy voting instead of what are arguably much more important issues around the fundamental structure of capitalism. Any time you get Bernie Sanders and Elon Musk to agree on something, I suspect bipartisan support won’t be that hard to find; I’d be shocked if we don’t see at least some trial balloons floating in the next year on severely limiting or altering how asset managers vote proxies.

What We’re Exploring: We’ll continue to dig in on ways that passive might change governance, but there’s also a continuous flood of fascinating and surprising new research examining the deeply nerdy consequences of our now index-reliant financial infrastructure. Whether it’s understanding dealer hedging in the derivatives markets, how target date fund rebalances impact prices, or the vagaries of how the tax code got us here, we’re heads down and pencils sharp. Of recent note is this paper, highlighting that passive investors may actually be better owners than activists when it comes to the fate of labor.

The Future of Fixed Income

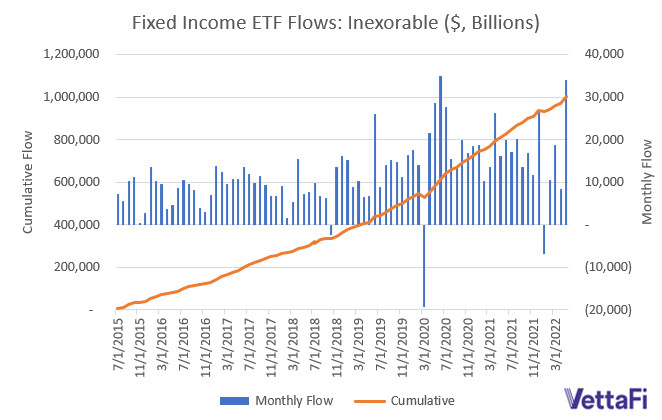

I’ve never been happier not to be a bond trader. Every financial advisor I know is trying to find the solve for rising rates, rising inflation, strange yield curves, and an upcoming election. None of those concerns, however, have stopped the absolute freight train of fixed income ETF flows:

And yet, most of these flows go into incredibly boring products: global or domestic aggregate products, maturity-tranched Treasury funds, a bit into munis, and high yields. Still, we’ve had over 100 new fixed income products launch in the last 18 months, from a raft of new providers, targeting interesting new angles from sectorized corporate bonds to interest rate hedged exposures.

The Second Half Prediction: The core prediction for the rest of the year is one of increased flows towards year-end as bonds start looking like yield vehicles again. Expect more flows, more interesting product launches, and a lot of talk from active bond managers who managed to rack up decent pandemic-duration track records.

What We’re Exploring: Under the hood, fixed income trading is changing dramatically. Folks like Tradeweb and MarketAxess are rethinking how bonds trade, from building equity-like limit order books to new matching engines for portfolio trading. In some cases, they’re also putting up record volumes, growing by more than 10% a month. At the same time, we want to dig into how the massive use of passive bond portfolios in retirement accounts will impact market dynamics in the near term — gotta get batteries for the HP-12c.

Crypto and the DeFi Sandbox

Sure, the price of bitcoin is hovering around $20,000, which is a lot less than it used to be. What seems to be missed in all the doom-saying is that the world of the now is very different from the last crypto-winter in 2018. I’m generally a pretty positive guy who doesn’t go in for grave-dancing, but it’s actually important and system-positive that Celsius filed for bankruptcy and that the very real risks of private blockchains and complex ecosystems like Axie get tested (and in some cases, blown up). While I always try to keep a space open in my theory of mind for the folks who are losing real money and experiencing real pain, regular and frequent reminders about how money and capital work are also important.

The Second Half Prediction: My near-term prediction is that crypto assets will remain relatively rangebound until more regulatory shoes drop. My crystal ball would suggest that Grayscale’s lawsuit against the SEC concerning its denial of the NYSE/Grayscale GBTC conversion will take longer to get through the system than the first bitcoin ETF. The path towards approval that seems most likely remains a crypto exchange of significant U.S. scale — FTX.us, Coinbase, Gemini — working proactively with the SEC to get over the surveillance requirements that the SEC keeps highlighting in its19b4 rule rejections from exchanges.

I also think that regulating stablecoins could be done relatively quickly. There’s a growing international consensus on regulating stablecoins like money market funds, essentially, as well as rare bipartisan support to get something done.

What We’re Exploring: While the market shakes out some detritus, what’s going on “on the bridges” between DeFi and TradFi? What new projects are learning from the last few years’ mistakes and advancing the utility and security of DeFi protocols? How are DeFi innovations getting implemented in TradFi ways (such as Broadridge’s Digital Repo Ledger or MakerDAO’s Loan Vault)? While the eye of Sauron has moved back to global macro from crypto-degeneracy is the perfect time to dig deep and learn stuff.

ESG 2.0

We may have shown our hand a bit earlier this month when we asked if ESG was screaming into the void and questioned the intangibles, but it feels like ESG is at a crossroads. Asset growth remains positive, but flows are on track to be maybe half of what their pace was before 2022 roared into view, spitting fire and angst. And yet, Bloomberg Intelligence is predicting that ETF ESG assets will cross $1 trillion within just three years, with total ESG assets hitting a whopping $50 trillion (or a third of global assets) — by 2025. On the other hand, there’s a clear media (and asset manager) backlash, as launching anti-ESG funds seems to be a bit of a fad right now.

The Second Half Prediction: This year, expect many more discussions around proxy voting and energy but little actual news. Flows for the second half will likely remain positive but won’t be setting any records. If you pay attention, however, expect to see more shareholder votes swing towards ESG issues (particularly climate and labor), and corporate partnerships emerge as a significant force in many arenas. Who knew Microsoft was working with a coalition on sustainable aviation fuel?

What We’re Exploring: To us, classification and definition remain huge issues, so we’re going to take a tilt at those particular windmills. Who knows, maybe we can finally get a few people to even agree on what ESG is? More importantly, however, we want to tease apart the impact of projected ESG flows on markets and those that ESG hopes to impact, like climate and representation. We’ll also keep trying to answer the performance story, showing the actual transmission vectors for how different ESG factors can help and hinder performance in different timelines.

Modern Portfolios and Complexity

First, there were balanced funds, target date funds, model portfolios, robo advisors, and direct indexing. The interactions between technology and portfolio assets get ever more interesting, and as direct indexing platforms spread to the “mass affluent” market (I need to gargle now to get the taste out of my mouth), individual accounts are becoming ever more institutional in their flexibility, access to markets, use of derivatives, and complexity. That’s good or bad, depending on your perspective. At the same time, while a lot of the progress made in the past 20 years came from simple, low-cost beta building blocks, there’s no slowing down the march of complex, even speculative products entering the market; just look at the recent launches of funds chasing the overnight returns anomaly, or those leveraging single stock returns.

The Second Half Prediction: Short-term, we see the market “settling in” a bit as new approaches go through a classic mainstreaming phase. This is good for most customers, but it also can add complexity and increase switch costs for the unwary. At the same time, the Complex Products proposal from FINRA this spring should have been a wake-up call for the actual asset manager community. Over the next six months, expect to hear more about drawing a line between “simple” and “speculative” from, if not FINRA, some other regulator or legislator. While I don’t expect rulemaking before year-end, I would expect some hints.

What We’re Exploring: At the core, every portfolio is based on intellectual property, whether it’s the hunch of an undisciplined day trader or the rigorous math of a hardcore total market index. We’ll take a first principles approach, looking at how investment intellectual property will be transmogrified into portfolio returns through new technology. This includes everything from Set-protocol based blockchain portfolios to tokenized equity to state-of-the-art display and reporting layers that can simplify traditional approaches, always with an eye towards how the advisor market is leading the charge (because it’s always leading the charge).

Big Picturing the Big Pictures

Of course, none of those five silos of thinking live in a vacuum — they’re all connected to the macro/market environment, geopolitics, fiscal policy, and all the rest, and indeed, part of the gig here is uniting all those dots as well. And behind all of that — behind all of what I see in markets and modern life — is a ground-state theme which I’ve dubbed “the right-braining of finance.” If going down each rabbit hole is a Dionysian parade for the analytical and segregation-addicted left brain of modern culture, understanding how all those parts and pieces connect into the true holism of not just modern culture, but politics, sociology, technology, science, market systems and economics is at least as important. Hopefully, we can keep that “right brain” view of the landscape and help connect some dots to the bigger picture, whether you’re an ESG skeptic, a crypto novice, a seasoned bond trader, an economist, a financial advisor, or, you know, just a person.

Here’s to a better second half. Cheers.

For more news, information, and strategy, visit VettaFi.com.