There are 30 blue-chip companies in the index. Meanwhile, there are something like 4,000 listed stocks (that trade actively) in the U.S. and multiples of that number overseas! In the age of railroads and conglomerates, 30 stocks could maybe capture the full picture, but it just doesn’t cut it today. Major staples of American industry, such as Google’s parent company Alphabet, aren’t even included! Alphabet has revenues higher than 23 Dow components and a market capitalization higher than every component except Apple. But, even more than the size of these companies, included or not, is the growth potential of small- and mid-cap firms. America is a growth story, the heart of capitalism and innovation. These blue chips are no doubt innovative too, but they may not capture the true essence of America.

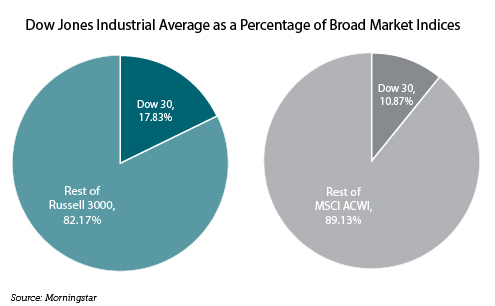

There are 30 blue-chip companies in the U.S. It’s safe to say the world has become immensely more connected since 1896. At CLS, we are global investors and believe the investment opportunity is tremendously broader than the 30 blue chips referenced daily. While these are certainly large companies, and still command 11% or so of global market-cap, the sheer number of investment opportunities out there in other countries dwarfs the exposure from the Dow firms.

It’s unlikely the Dow will be removed from ticker tapes any time soon – although I did hear a commentator mention some of the index’s flaws recently. Coaching our investors and advisors to focus on a broader index, even just the S&P 500 (which also has its drawbacks) can go a long way. The MSCI All Country World Index may be a ways off for my family to reference as the market (although I’m training best I can), but the investing world is going that direction whether it’s convenient or not.

Grant Engelbart is a Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

2815-CLS-8/4/2017