By J.P. Morgan Asset Management

The economic ripple effects of COVID-19 are hitting some companies harder than others. As the trend continues, passively buying broad benchmarks may expose investors to unstable companies and unwanted risks. Instead, investors may want to consider a strategy that targets the highest quality businesses with high profit margins and low debt levels. The JPMorgan U.S. Quality Factor ETF seeks to own the highest quality stocks in each sector, which can help investors to weather market downturns and also participate in upswings.

Why it’s high time for high quality

Lockdown efforts aimed at mitigating the virus will likely trigger a severe economic slowdown and, in turn, an earnings recession for U.S. corporations. Profits were slowing even before the pandemic, and forecasts have worsened since. The latest earnings estimates range from steep declines in more sensitive sectors like energy and industrials, to modest growth in more insulated industries such as technology and utilities.

Earn 1 CE Credit on Sept. 30! Webcast: Focus on Quality to Navigate Changing Markets

Meanwhile, corporate leverage has climbed to its highest level in years, raising solvency concerns among the more financially vulnerable holdings in traditional indexes. Against this backdrop, JQUA’s focus on higher-quality, stable companies offers a solution for staying invested through the uncertainties. JQUA seeks to:

• Manage risk and limit losses during volatile periods. Quality was one of the few equity styles to post positive excess returns as stocks sold off sharply in the first quarter. Relative performance was especially strong in March, as investors gravitated toward the types of large, high-quality businesses we favor.

• Capture growth potential as markets recover. Quality stocks have historically outperformed the broad market across cycles, with less risk. Adding exposures now allows investors to access growth opportunities as they arise and enhance long-term return potential as we move through and beyond the pandemic.

Chart 1: Higher returns with lower risk: U.S. Quality factor ETF vs. Russell 1000 Index

Three-step process for constructing a high-quality equity ETF

As part of our suite of factor-based equity strategies, JQUA brings J.P. Morgan’s quantitative research, portfolio management, technology and trading capabilities to an ETF priced at just 0.12%. Rather than buy every name in the Russell 1000, the index targets the 200 to 300 highest-quality U.S. large cap companies across all sectors to offer similar sector exposure without the significant stock concentrations of traditional indexing.

Step 1: Align sectors with the market. JQUA’s process begins by matching the sector allocations of the Russell 1000, and realigning them back during each quarterly rebalance. We align sectors to the index to avoid sector bets and ensure that the exposure to high-quality companies is what drives the fund’s performance relative to the Russell 1000.

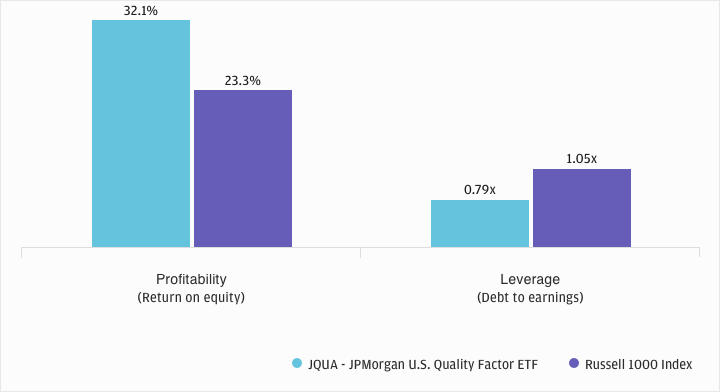

Step 2: Rank stocks within each sector. When determining the overall quality of each company, our rules-based approach ranks sector peers based on three key quality pillars:

• Profitability – strong earnings and cash flow

• Financial risk – low leverage, high interest coverage, low share price volatility

• Earnings quality – consistent accounting practices

Step 3: Select and weight stocks. We own the highest-ranked companies in each sector and seek to avoid overconcentration, thereby reducing stock-specific risks while maintaining diversification and liquidity.

Chart 2: JQUA seeks quality companies with higher profits and less debt

JQUA plays multiple roles in strong portfolios

With its targeted exposure to quality companies, JQUA aims to serve as a core holding alongside standalone value and growth strategies. It also aims to act as a core complement to round out existing portfolio positions or bolster overall quality exposure in one simple trade. Or, consider it as a tactical allocation as outlooks change in today’s fast-moving markets.

Looking ahead, we expect to see increased discrepancies among company fundamentals as winners and losers emerge from the COVID-19 crisis. As always, we will look to improve on traditional beta by separating the most attractive stocks from the rest of the broad index.

Learn more about JPMorgan U.S. Quality Factor ETF ►

JQUA RISK SUMMARY: Investments in mid cap companies may be riskier, less liquid, more volatile and more vulnerable to economic, market and industry changes than investments in larger, more established companies. Share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term.