By Irma Bribiesca and Joe Becker

The financial wellbeing of tens of millions of individuals around the globe is tied to the ability of insurance companies to make good on their obligations. As such, insurance companies are arguably the world’s biggest and most important managers of financial risk.

To entities that use their assets to finance the guarantees they offer (like insurance companies), market volatility is enemy number one. This is because higher volatility in the value of their assets increases the likelihood of incurring negative effects stemming from the sequence of returns risk.

No one understands and appreciates sequence of returns risk better than insurance companies do. The very survival of their business depends on it. At its essence, sequence of returns risk is the risk of portfolio withdrawals combining with an unfavorable chronology of returns to create a result that devastates the portfolio’s value.

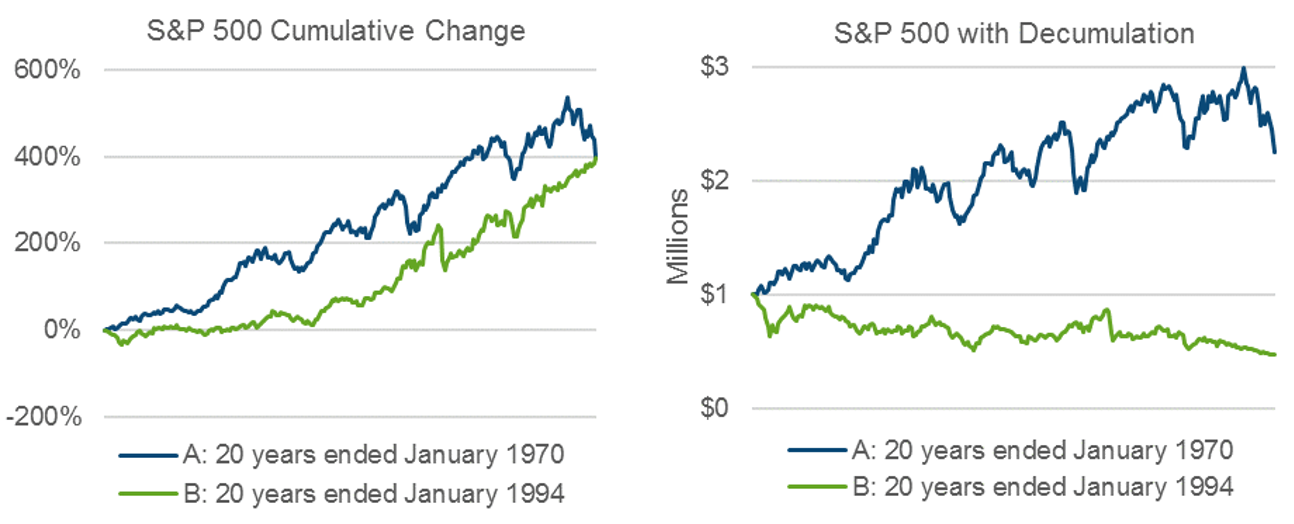

To illustrate the concept, the charts below compare two portfolios tracking 20-year returns of the S&P 500, in both an accumulation phase and a decumulation phase.[1]

Portfolio A tracks the return from 1950 – 1970 while portfolio B tracks the return from 1974 – 1994. In the first chart where there are no portfolio withdrawals, the portfolios take different paths through different economic conditions, but end up at the same value.

In the second chart, where withdrawals are being taken, the portfolios are again exposed to the same returns as in the accumulation chart. This time, however, the final values are miles apart:

![]()