The recent release of May’s consumer price index has come as a surprise to many, with words like “shocking” trending in headlines. While it’s an indicator that inflation is yet to peak, trying to ascertain exactly where that peak lies remains a difficult task. Managed futures can help take the added stress out of trying to second guess inflation, the Fed, or both.

Managed futures offer a host of benefits for portfolios: They are highly diversified as they generally carry low to no correlation to equities and bonds, they seek to perform no matter which way markets are moving, and most importantly, they generally do exceedingly well during volatility.

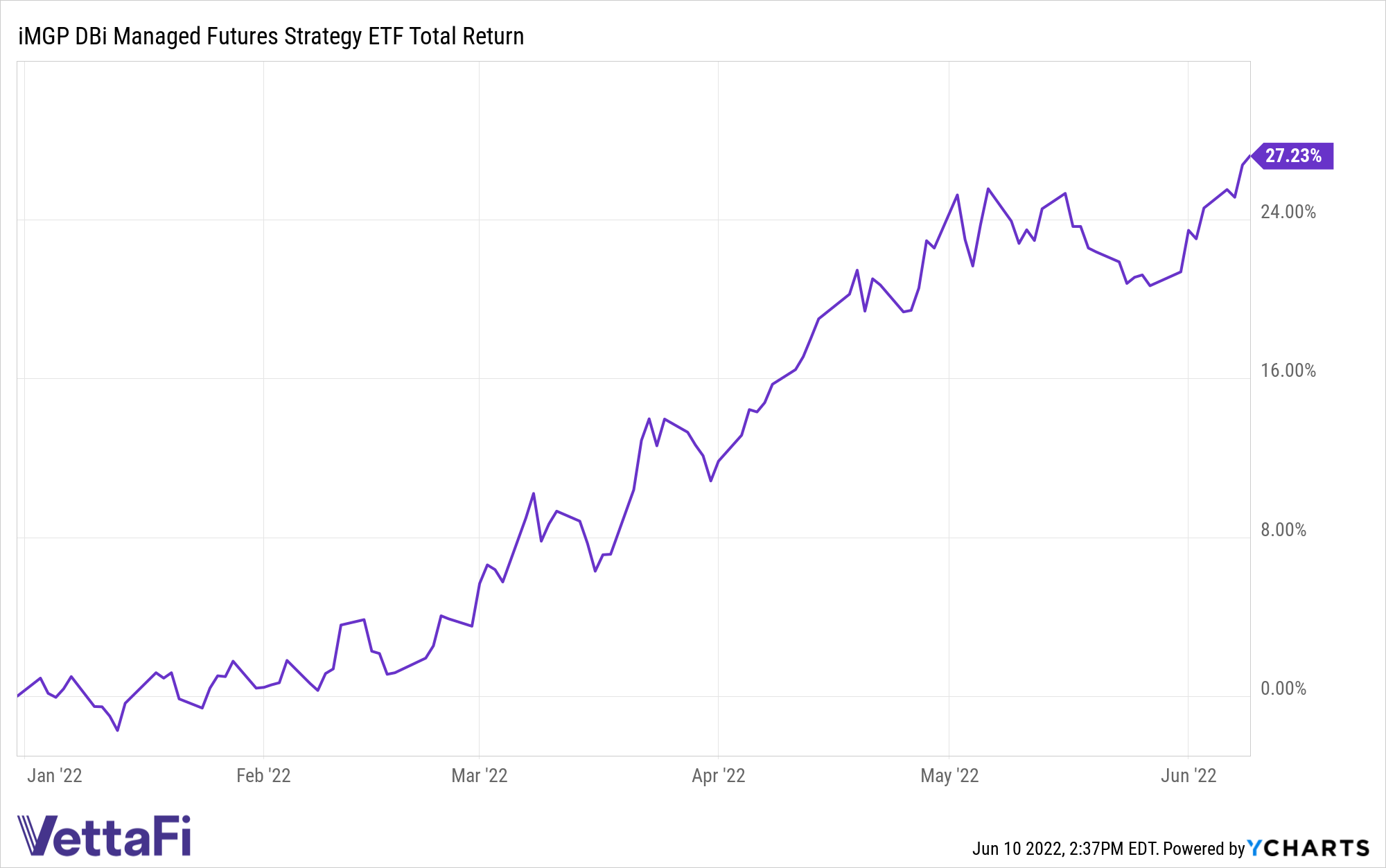

The iMGP DBi Managed Futures Strategy ETF (DBMF) is designed to attempt to capture performance no matter how equity markets are moving. The fund seeks long-term capital appreciation by investing in some of the most liquid U.S.-based futures contracts in a strategy utilized by hedge funds.

DBMF allows for the diversification of portfolios across asset classes that are uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within futures contracts and forward contracts. These contracts span across domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

DBMF is unique in that it seeks to track and mimic the averaged performance of some of the largest managed futures hedge funds. The position that the fund takes within domestic managed futures and forward contracts is determined by the Dynamic Beta Engine.

This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

By offering managed futures hedge fund performance within an ETF, the savings incurred in the fee reductions equate to automatic alpha for investors.

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8-10% annually.

Utilizing the Dynamic Beta Engine allows the fund to track trends, capturing the pockets of performance in volatility and generating what has been dubbed “crisis alpha.” By trend tracking, the fund avoids individual manager bias that can sometimes be seen in singular hedge fund performance, while capturing returns by pulling levers within the futures market to pivot long or short on a variety of asset classes.

DBMF has a management fee of 0.85% and an additional ten bps for other expenses listed in the prospectus.

For more news, information, and strategy, visit the Managed Futures Channel.