Many investors adhere to a long-term, buy-and-hold investment to grow wealth over time, but there are drawdowns to being too passive with their portfolios. Exchange traded fund investors, though, may consider an alternative strategy to improve their risk-adjusted returns over the long haul.

On the recent webcast (available On Demand for CE Credit), Improve the Traditional Buy-and-Hold Strategy, Stephen Blumenthal, Chief Investment Officer and Chief Executive Officer of CMG Capital Management Group, argued that there may be room to improve long-term equity investing by limiting downside risk. Historically, there have been secular bull markets 54% of time since the early 1900s, which has left investment portfolios to periods of downturns that could eat away at total returns.

“A rules-based tactical equity allocation strategy may help manage risk and could potentially limit losses from downturns,” Blumenthal said.

If an investor followed a traditional buy-and-hold strategy, one would require larger gains to break even after a loss. For example, a 50% drop in a position would require a 100% gain to fully recover from the loss. Riding out a drop can mean many months of declining value and purchasing power.

“Managing the risk of deep and extended periods of loss is critical for long-term success and peace of mind,” Blumenthal said. “Avoiding loss could help increase market participation by potentially reducing the amount needed to recoup.”

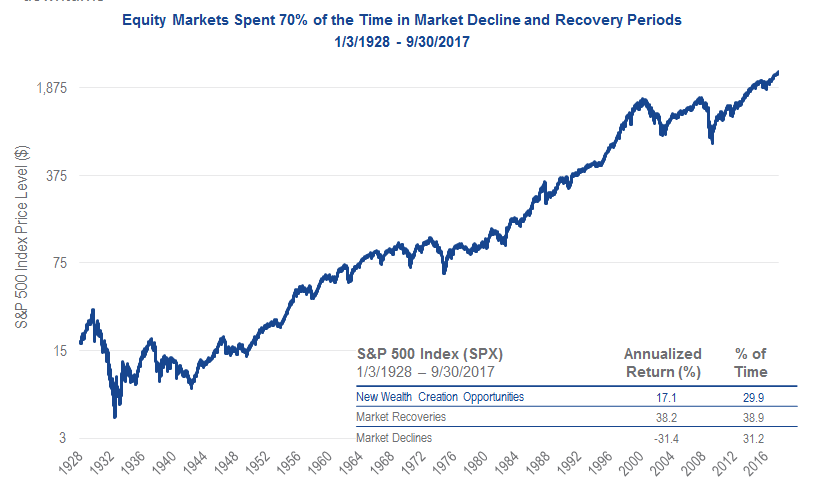

![]() Since 1936, there has been seven major bear markets with an average loss of -37%, and it required an average 30 months for the markets to fully recover from the loss. In the past 17 years, there have been two major market sell-offs of over 40%. In the most recent financial downturn of 2007 to 20212, the S&P 500 decline and recovery period last 4.5 years. These periods of declines and recovery means an investor’s long-term portfolio is just sitting idle for years.

Since 1936, there has been seven major bear markets with an average loss of -37%, and it required an average 30 months for the markets to fully recover from the loss. In the past 17 years, there have been two major market sell-offs of over 40%. In the most recent financial downturn of 2007 to 20212, the S&P 500 decline and recovery period last 4.5 years. These periods of declines and recovery means an investor’s long-term portfolio is just sitting idle for years.

In an attempt to manage market risks, investors may follow various tactical allocation strategies to limit short-term turns. Robert Schuster, Senior Director of Ned Davis Research, pointed out that those actively seeking to improve risk-adjusted returns by opportunistically reallocating a portfolio may consider options like long/short hedges, downside hedging strategies, low=volatility plays or tactical long/flat strategies.

![]() As investors consider short-term hedging strategies, it is important to have a plan in place. Indicators like momentum or moving averages may provide signals that guide buy/sell decisions as a disciplined rules-based approach incorporating technical indicators helps remove emotion from the investment process, Schuster said.

As investors consider short-term hedging strategies, it is important to have a plan in place. Indicators like momentum or moving averages may provide signals that guide buy/sell decisions as a disciplined rules-based approach incorporating technical indicators helps remove emotion from the investment process, Schuster said.