By David Fajardo

Editor’s note: Any and all references to timeframes longer than one trading day are for purposes of market context only, and not recommendations of any holding timeframe. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don’t have the resources, time or inclination to constantly monitor and manage your positions, leveraged ETFs are not for you.

The market has seen the yield on the benchmark 10-year Treasury climb from 2.36% on April 1 to 2.71% as of April 8. Traders in the fixed income world have been focused on concerns about inflation, as well as the Federal Reserve’s plans for monetary tightening. With respect to its overnight policy rate, the Fed raised rates by 25 basis points* at its March FOMC meeting. Meanwhile, the central bank has started to sketch out plans for reducing the size of its balance sheet. Comments by Fed Governor Lael Brainard on Tuesday sent 10-year yields sharply higher after she warned that the pace of balance sheet reduction could be rapid.

So, what does all this mean for shares of banks and other financial companies?

Typically, bank shares benefit from higher long-term rates. Higher rates widen the spread between what banks pay on deposits and what they can earn by lending money (their so-called net interest margin).

There are a number of potential catalysts for even higher 10-year yields in coming weeks. Here are two to watch out for:

- On April 14, import price index data will be released by the Bureau of Labor Statistics. A hotter than expected reading could send bond yields surging again.

- On May 4th, a two-day FOMC meeting concludes. There is increasingly speculation in the market (reflected in market pricing) that the Fed may hike 50 basis points. A 50-point hike, coupled a hawkish FOMC statement could be enough for the 10-year yield to climb.

After massively underperforming the S&P 500* for most of 2020, bank shares did very well into Q1 2021 and then have more or less traded in line with the broader market ever since. That said, on a relative basis they are still below the levels seen pre-COVID, and the last month or so has been rough. Might this relative weakness reverse?

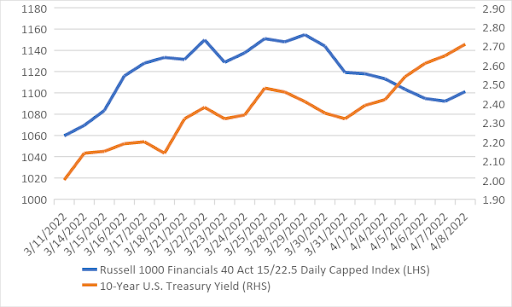

As the following chart shows, the Russell 1000 Financials 40 Act 15/22.5 Daily Capped Index* and the 10-year yield trended in the same direction from March 11 to March 28. Rising yields went hand in hand with rising bank stocks.

Source: Yahoo Finance. Past performance is not indicative of future results. You cannot invest directly in an index

In the last week or so, however, general risk aversion has seen this relationship fray. Spooked by higher rates, equities have sold off, and that’s taken bank shares down, too. Traders who believe that bank shares will reassert their link to yields can play it by owning FAS, the Direxion Daily Financial Bull 3X Shares ETF. Bank shares may also benefit if the current risk-off environment abates and sends the broader market higher.

The Other Side of the Trade

Higher rates aren’t a certainty. Traders looking to express a bearish view on yields can use FAZ (the Direxion Daily Financial Bear 3X Shares ETF) to wager that interest rates are going down and will take bank stocks down with them. And even if rates stay elevated, bank stocks might continue to be vulnerable if the overall market remains bearish.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.

*Definitions:

– A basis point equals 1/100th of 1%.

– The S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States.

– The Russell 1000 Financials 40 Act 15/22.5 Daily Capped Index measures the performance of US large cap companies that are assigned to the Financials Industry by the ICB sector classification framework.

Leveraged and inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The Russell 1000® Index is a trademark of Frank Russell Company (“Russell”) and has been licensed for use by the Trust. The Direxion Daily Financial Bull and Bear 3X Shares are not sponsored, endorsed, sold or promoted by Russell. Russell makes no representation regarding the advisability of investing in the Direxion Daily Financial Bull and Bear 3X Shares.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs) Risk, and risks specific to the securities of the Financial Sector. Performance of companies in the financials sector may be materially impacted by many factors, including but not limited to, government regulations, economic conditions, credit rating downgrades, changes in interest rates and decreased liquidity in credit markets. Additional risks include, for the Direxion Daily Financial Bull 3X Shares, Daily Index Correlation Risk, and for the Direxion Daily Financial Bear 3X Shares, Daily Inverse Index Correlation Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

Distributor: Foreside Fund Services, LLC.