What a difference a day makes. Or even a few hours. That’s how sharply the markets turned after Federal Reserve Chair Jerome Powell stated in an address about the committee’s approach to monetary policy that they were “closely monitoring the implications” of President Trump’s array of tariffs on the domestic economy and would “act as appropriate to sustain the expansion.”

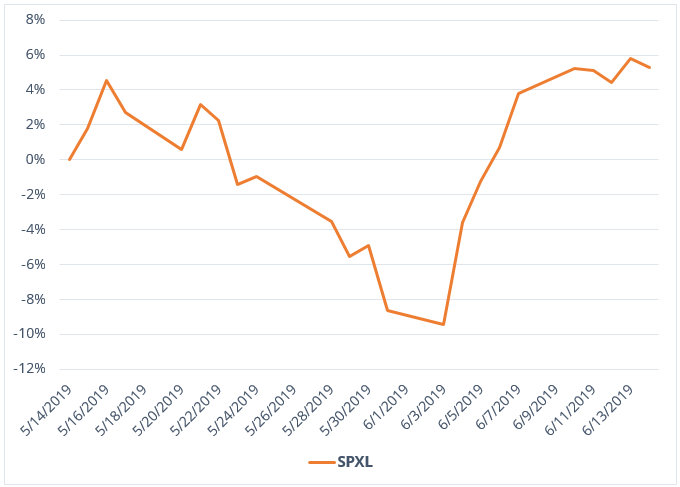

Those small concessions alone managed to perk up the broad market from a month-long losing streak to gain 5% in less than a week. You can see the massive shift from bear to bull by taking a look at the Direxion Daily S&P 500 Bull 3X Shares ETF.

Source: Bloomberg. Date: 5/14/19 – 6/14/19. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

The obvious hope among traders is that “act as appropriate” translates to “we’re going to cut rates, make borrowing easier, and open the floodgates of liquidity.”

That’s certainly how the market and many commentators have taken it. In the four days following Powell’s speech, the average daily change in the S&P 500 was 1.16%. For context, that’s the index’s best four-day performance all year, only rivaled in recent history by the bounce in late 2018. What’s more, the CME’s Fed Watch tool, almost overnight, began anticipating a 90% chance of a rate hike by the September FOMC meeting. For this week, most are expecting a change in policy stance but not a rate cut just yet.

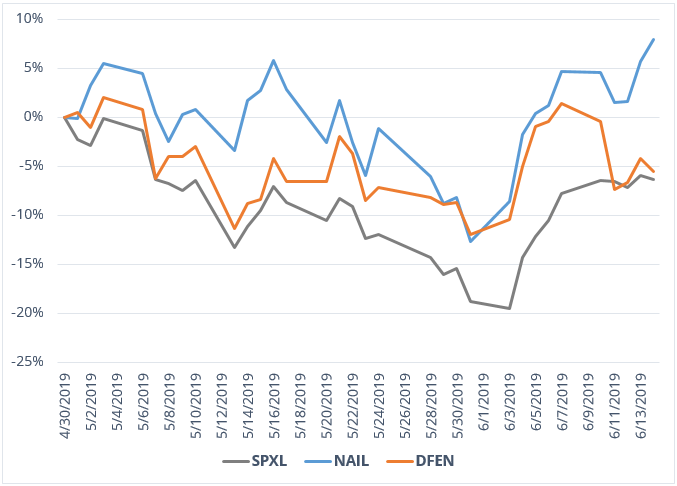

One obvious means of approaching this opportunity is to stick with broad equity trades like SPXL, or other popular industries that thrive in a low-rate environment, such as homebuilders and defense contractors, two sectors that have already shown strong performance even before Powell’s speech. You can see how sector ETFs like the Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF and the Direxion Daily Industrials Bull 3X Shares ETF have performed next to the surging SPXL.

Source: Bloomberg. Date: 5/14/19 – 6/14/19. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

However, the problem with anticipating a cut in interest rates right now is that much of the market has already factored it in. Major indexes have already more than halved their May losses, and most poised to retake their all-time high before the end of the second quarter.

That is, if there is an incoming rate cut. Keep in mind that many of the expectations for a rate cut give a fairly wide time frame, anywhere from the 20% chance the CME is projecting for a cut in the upcoming June meeting to the 95% chance it estimates by the October meeting.

While there’s no telling how circumstances might change between now and the end of the year, the immediate economic picture from the Fed’s point of view is that the economy is chugging along just fine. While its possible the market may exercise some patience with the Fed, the volatility that’s we’ve seen over the past twelve months should indicate that this isn’t a patient market.

If the Fed takes the next few meetings to simply leave rates unchanged, investors shouldn’t be shocked to see some areas of the market scramble more than others. Semiconductors and consumer discretionary were two areas that reacted dramatically during May’s turmoil, as did many media companies. You can get a glimpse of all of this by checking the performance of the Direxion Daily Semiconductor Bear 3X Shares ETF, Daily Consumer Discretionary Bear 3X Shares ETF and Daily Communication Services Index Bear 3X Shares ETF.

![]()

Source: Bloomberg. Date: 5/14/19 – 6/14/19. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Many of the forces that were weighing on these areas of the market in May still persist today, the ongoing U.S.-China trade war, scrutiny over internet and media companies’ use of private data, as well as flagging retail sales and consumer spending. However, the market has forgiven these flaws for the promise of rate cuts that may be somewhere on the horizon.

Although the long-standing threat of a global slowdown makes it impossible to entirely discount the possibility of lower interest rates this year, traders should remember that it only takes a day for things to change.

So if you’re worried, you’re still welcome…

Related Leveraged ETFs

- Direxion Daily S&P 500 Bull 3X Shares ETF (SPXL)

- Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NAIL)

- Direxion Daily Industrials Bull 3X Shares ETF (DUSL)

- Direxion Daily Semiconductor Bear 3X Shares ETF (SOXS)

- Daily Consumer Discretionary Bear 3X Shares ETF (PASS)

- Daily Communication Services Index Bear 3X Shares ETF (MUTE)

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-904-8818 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.

This leveraged ETF seeks investment results that are 300% of the return of its benchmark index for a single day. The ETF should not be expected to provide returns which are three times the return of its benchmark’s cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

SPXL Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the securities that comprise the S&P 500® Index. Additional risks include Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

NAIL Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Consumer Good Sector, Consumer Services Industry and the Homebuilding Industry. The homebuilding industry includes home builders (including manufacturers of mobile and prefabricated homes), as well as producers, sellers and suppliers of building materials, furnishings and fixtures. Companies within the industry may be significantly affected by the national, regional and local real estate markets, changes in government spending, zoning laws, interest rates and commodity prices. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

DUSL Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Industrials Sector. Stock prices of issuers in the industrials sector are affected by supply and demand both for their specific product or service and for industrials sector products in general. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

SOXS Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk,and risks specific to the Semiconductor Industry. Companies that are in the semiconductor industry may be similarly affected by particular economic or market events, which may, in certain circumstances, cause the value of securities of all companies in the semiconductor sector of the market to decrease. Additional risk include Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

PASS Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Consumer Discretionary Sector. The success of companies in the consumer discretionary sector is tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence, and may be subject to severe competition, which may have an adverse impact on a company’s profitability. Additional risks include Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

MUTE Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Communication Services Sector. The success of companies in the communication services sector is tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence, and may be subject to severe competition, which may have an adverse impact on a company’s profitability. Additional risks include Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.