Oil is on the move, rising 50 percent since its Christmas Eve low last year. Traders can take advantage of these price surges in oil with REX Shares announcing another expansion of their MicroSectors brand with the launch of a suite of leveraged and inverse exchange-traded notes (ETNs).

The ETNs are linked to the Solactive MicroSectors U.S. Big Oil Index (the Index) and will be issued by Bank of Montreal. These products further amplify the MicroSectors brand which originated in January 2018 with FANG+

linked ETNs and expanded to include the U.S. Big Banks linked ETNs that were launched just last week.

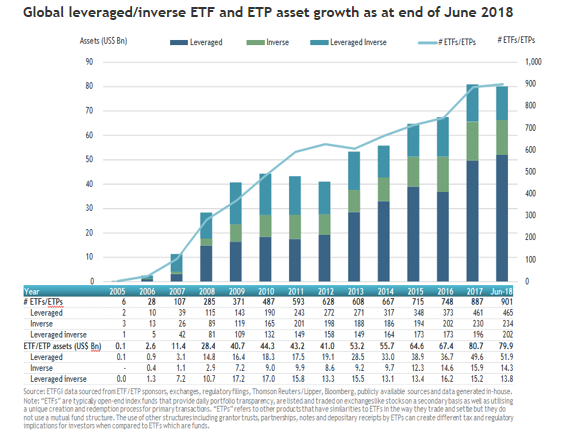

“According to ETFGI, the Leveraged and Inverse market has grown significantly over the last decade,” said Scott Acheychek, President of REX Shares. “I believe L&I growth is benefiting from several trends taking place that aren’t likely to slow down; FAs moving to RIAs or independent shops, Hedge Fund and RIA AUMs continuing to set record high levels, and the growth of the self-directed trading in the information age.”

New big oil ETNs trading on the NYSE Arca now:

- MicroSectors U.S. Big Oil Index 3x Leveraged ETN (NRGU)

- MicroSectors U.S. Big Oil Index -3x Inverse Leveraged ETN (NRGD)

- MicroSectors U.S. Big Oil Index 2x Leveraged ETN (NRGO)

- MicroSectors U.S. Big Oil Index -2x Inverse Leveraged ETN (NRGZ)

- MicroSectors U.S. Big Oil Index Inverse ETN (YGRN)

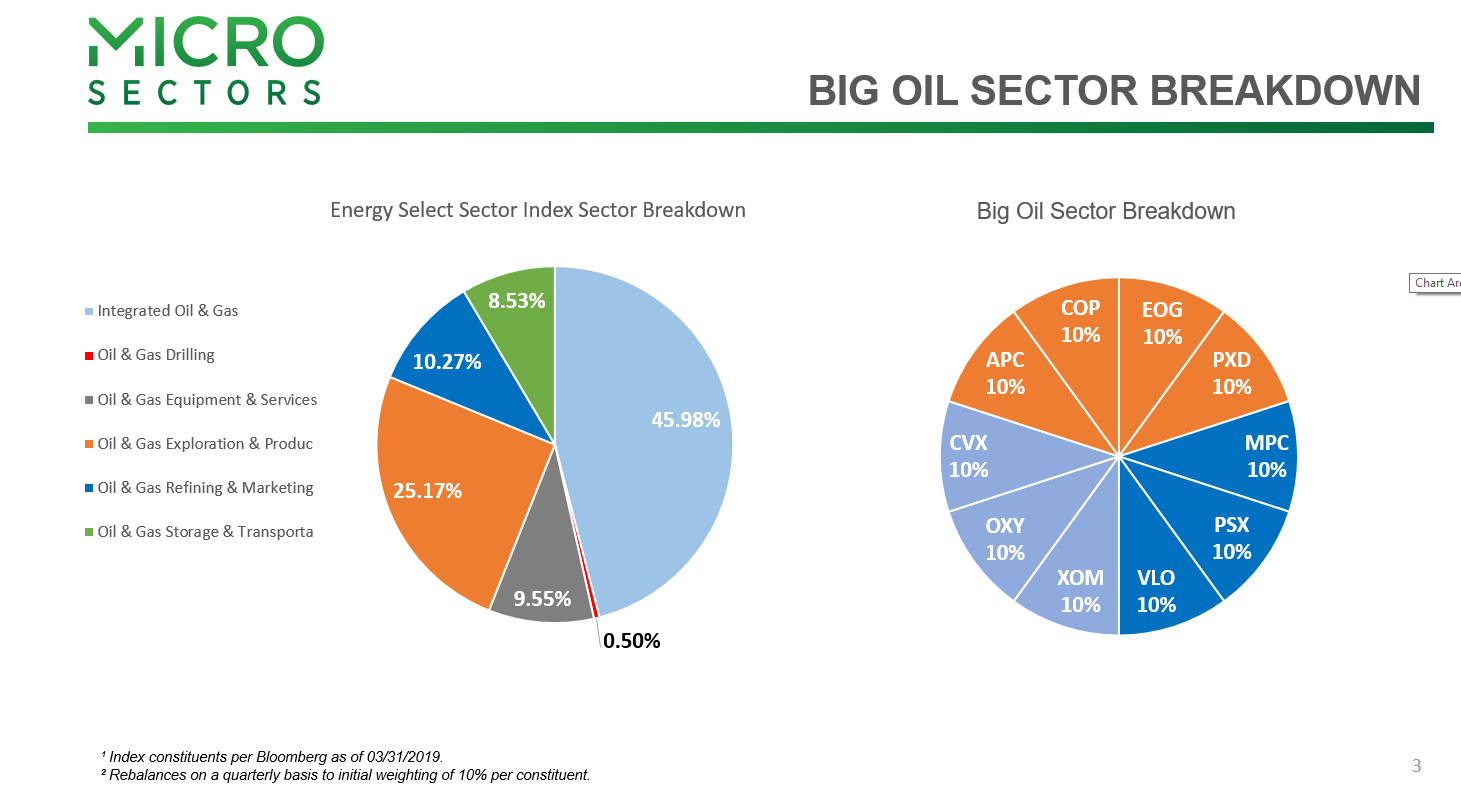

The Solactive MicroSectors U.S. Big Oil Index is an equal-dollar weighted index designed to track the

prices of the 10 U.S. stocks in the oil/energy sector with the largest free-float market capitalization. The

Index was launched on March 12, 2019.

As of the launch of these ETNs, the index constituents are Anadarko Petroleum (APC), ConocoPhillips (COP, Chevron (CVX), EOG Resources (EOG), Marathon Petroleum (MPC), Occidental Petroleum (OXY), Phillips 66 (PSX), Pioneer Natural Resources (PXD), Valero Energy (VLO), and ExxonMobil (XOM).

REX, a provider of alternative investment products, continues to see large demand for hedging and

trading vehicles based on certain segments of the market such as Big Oil stocks.

“Oil or energy stocks are highly traded and often used to express views on earnings, oil & natural gas prices, the futures curve, the macro environment and more,” said Acheychek. “We hope this equal-weighted index will serve as the benchmark for the biggest oil companies in the U.S and consequently deliver a trend barometer for the entire U.S. oil/energy sector.”

The ETNs are senior, unsecured obligations of Bank of Montreal.

Trading the Big Banks

The latest launch comes after the introduction of the MicroSectors U.S. Big Banks Index 3x Leveraged ETN (BNKU), MicroSectors U.S. Big Banks Index -3x Inverse Leveraged ETN (BNKD), MicroSectors U.S. Big Banks Index 2x Leveraged ETN (BNKO), MicroSectors U.S. Big Banks Index -2x Inverse Leveraged ETN (BNKZ), and MicroSectors U.S. Big Banks Index Inverse ETN (KNAB) last week.

These ETNs give traders concentrated exposure to a specific corner of the financial sector–in this case, large U.S. banks. In addition, traders can go long or short as well as choose their level of exposure–as much as 300 percent.

“Our goal with the MicroSectors U.S. Big Banks Index linked ETNs is to create the first suite of long & short products linked only to the biggest U.S. banks for sophisticated investors who desire such a precise exposure,” said Acheychek.

For more market trends, visit ETF Trends.