Gold is a far cry from the upside it saw at the height of the pandemic in 2020, which has helped inverse ETFs like the Direxion Daily Gold Miners Index Bear 2X Shares (DUST) rally 10% the last few months.

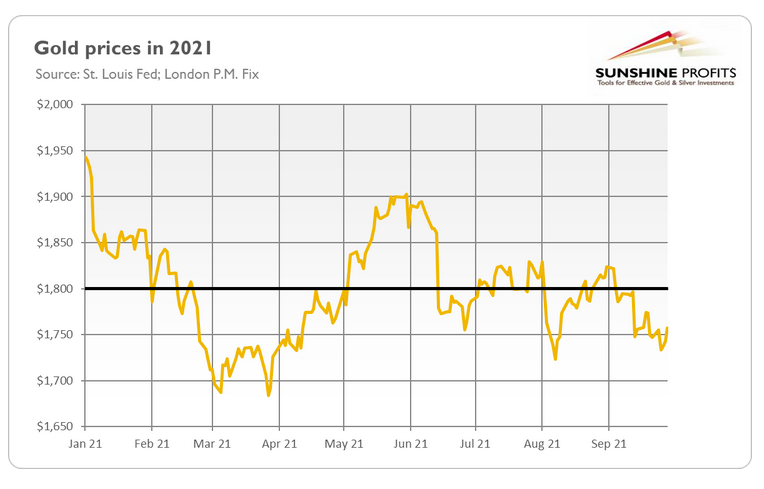

September was a volatile month for equities, which should have translated into a strong month for gold. However, that clearly wasn’t the case, as the precious metal continues to languish and stay under the $1,800 price level.

“September is believed to be, from the historical point of view, one of the best months for gold,” wrote Arkadiusz Sieroń of Sunshine Profits, nothing that the price of gold fell 4%. “Well, September 2021 definitely wasn’t very good for the yellow metal.”

Rising bond yields caused investors to fret during much of September, which should have spurred a move to gold amid the volatility. Instead, bearish traders in DUST were able to scalp some gains.

Rising bond yields caused investors to fret during much of September, which should have spurred a move to gold amid the volatility. Instead, bearish traders in DUST were able to scalp some gains.

DUST seeks daily investment results (before fees and expenses) of 200% of the inverse of the daily performance of the NYSE Arca Gold Miners Index. The ETF invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets.

“Actually, the whole third quarter was rather disappointing for the yellow metal, which lost 1.15% over the last three months,” said Sieroń. “However, it was still much better than the disastrous first quarter of the year in which gold plunged more than 10%. So far, the yellow metal is 7.67% down year-to-date.”

More Bearishness Through 2021

The ICE U.S. Dollar Index is up 4% so far this year, contributing to gold’s stumble in 2021. The Federal Reserve is looking to scale back its stimulus measures, which could put downward pressure on gold, but stagflation could work in its favor in 2022.

“Well, the recent jump in gold prices is quite welcoming,” said Sieroń. “However, it doesn’t change gold’s bearish outlook for the fourth quarter of 2021. Gold has been unable to surpass $1,800, and it looks like it wants to keep falling. In particular, any new hawkish comments from the Fed could push gold prices down even further.”

“Having said that, I’m more optimistic about gold in 2022,” added Sieroń. “One reason is that, over time, the narrative about transitory inflation will look less and less convincing. Meanwhile, the odds of some inflationary crisis, or stagflation, should be higher and higher.” For more news, information, and strategy, visit the Leveraged & Inverse Channel.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.