Despite having entered another phase of tariffs and counter-tariffs, the U.S. stock market has remained resilient, and traders have kept their nerve while two of the world’s largest economies exchange blows.

Even though the sustained uptrend in the broad market has surprised some, the truly astonishing thing is that it is doing so without the help of traditional leaders like tech, internet and semiconductor stocks, most of which are down as a result of aforementioned trade fears. Instead, the market has found a few surprising sectors, like healthcare and utilities, to drive the market in the waning months of 2018.

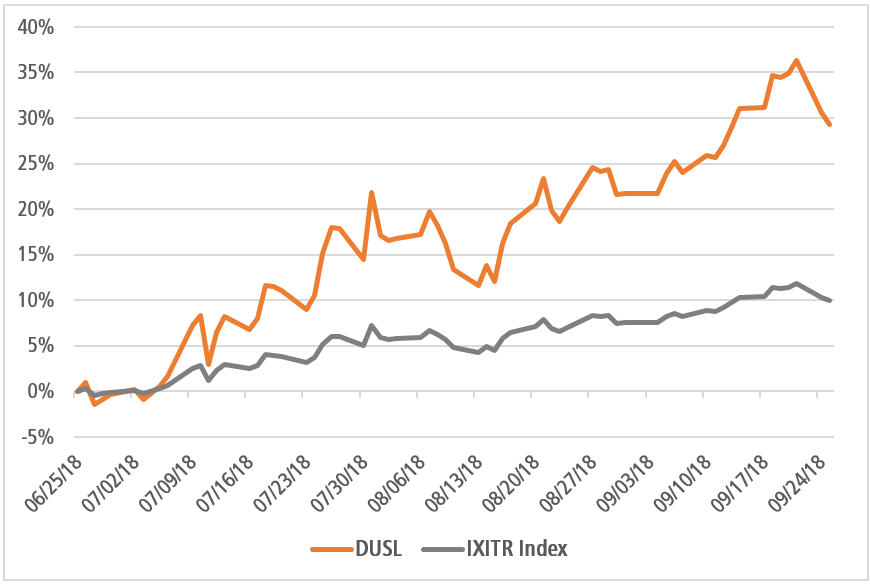

Perhaps the most surprising market sector to lead the S&P 500 are the industrial industries, which have pushed the Industrial Select Sector Index up 7.5 percent over the past 3 months.

![]()

Data Range: 6/25/2018 – 9/25/2018. Source: Bloomberg. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For standardized performance and the most recent month-end performance, click here.

While this uptick in industrials is seemingly just getting its legs, it’s prudent to get a sense of where this enthusiasm is coming from and whether momentum can carry the sector over the stormy waters of global trade. Below we’ll break down one of the three main industries that make up the industrial sector and determine if it can continue driving the market to new highs before the end of the year, or whether the industrial trade might break down, piece by piece. In this article we’ll take a look at Defense.

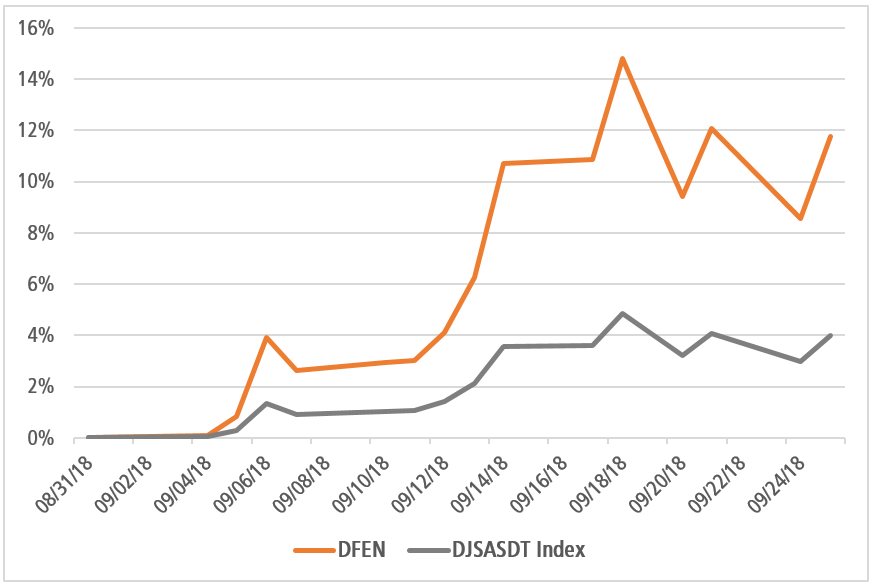

It was not until September that industrials started to diverge. It turns out that this split corresponds with a jump in the defense industry, something you can see in the chart for the Direxion Daily Aerospace & Defense Bull 3X Shares ETF (DFEN)

Data Range: 9/1/2018 – 9/25/2018. Source: Bloomberg. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For standardized performance and the most recent month-end performance, click here.