Interest rates have been rising since hitting their all-time low during the Covid Crash of 2020, largely due to higher inflationary pressures, and have helped push bond prices lower. Now that rates are back near levels last seen in 2018, and the Fed just updated its guidance surrounding rate hike plans, could traders start to see short-term opportunity in this downtrodden asset class?

A Flight-to-Maybe Trade

Treasury Bonds tend to perform better during periods of high equity market volatility and low economic growth because they are essentially a legal contract with the US government that promises to repay the lender. This presumably makes bonds a safer, more conservative asset class, compared to equities. However, Treasurys are far from a guaranteed trade, and sharp rise in inflationary pressures can be a major headwind for this asset class. For traders looking to position in accordance with a high-inflation environment, which is bearish for bonds, Direxion offers the Daily 7-10 Year Treasury Bear 3x Shares (Ticker: TYO) fund, which tracks 300% of the daily downside exposure to the ICE U.S. Treasury 7-10 Year Bond Index.

Below is a daily chart of TYO as of May 19, 2022.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com. For standardized performance click here.

Fed to the Rescue?

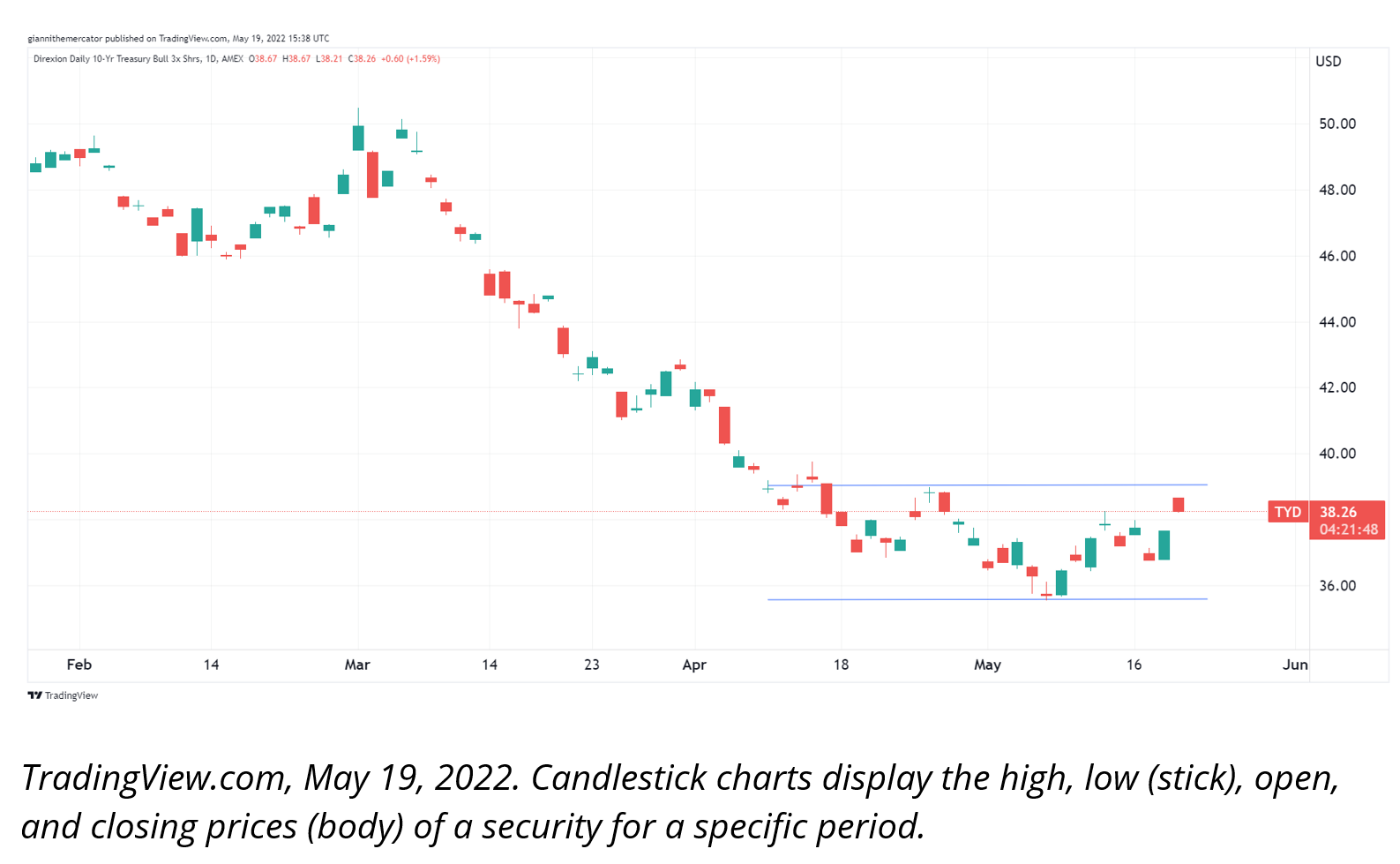

In response to rapidly moving inflationary pressures that are at multi-decade highs, the Fed has embarked on its most aggressive monetary tightening cycle in years. Despite being behind the curve, their goal with raising rates is to rein in inflation. The theory is that higher yields can increase global capital flows into the U.S. Dollar, which can then put downside pressure on commodity prices. If commodity prices decline, then so would inflationary pressures. It’s worth pointing out, however, that the U.S. Dollar and commodities have rallied together over the past few months, so the jury is out as to whether this will work. But these policies do require time to take effect, and for traders that think the Fed will be successful in lowering inflation, which could turn into a tailwind for bonds, Direxion offers the Daily 7-10 Treasury Bull 3x Shares (Ticker: TYD) fund, which tracks 300% of the daily upside exposure to the ICE U.S. Treasury 7-10 Year Bond Index.

Below is a daily chart of TYD as of May 19, 2022.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com. For standardized performance click here.

Be Wary of an Engineered Recession

The verbiage set forth by the Fed seems to have shifted from bringing the economy down into a “soft landing” into a “safe landing.” While these may be semantical word games, they are key clues as to how the Fed may manage what increasingly appears to be an economy moving towards stagflation (low economic growth, high inflation). If they go all-in and sacrifice growth to tame inflation, we could look for even bigger bond market moves in the longer-part of the yield curve. Direxion’s Daily 20+ Year Treasury Bull 3x Shares (Ticker: TMF) fund, which tracks 300% of the daily upside movement in the ICE U.S. Treasury 20+ Year Bond Index, may provide an opportunity for traders. But if inflation starts to spiral out of control, Direxion’s Daily 20+ Year Treasury Bear 3x Shares (Ticker: TMV) fund, which tracks 300% of the daily downside movement in the ICE U.S. Treasury 20+ Year Bond Index, could give traders a means to capitalize on a sustained bond market rout.

Key Trading Catalysts To Watch

Traders in the volatile Treasury market are keeping apprised of the following short-term market drivers and catalysts:

- Interest rate surprises: An unexpected Fed decision to raise rates above or keep them below what is expected can spark sharp movements in the prices of Treasury bonds.

- Accelerating Inflation: Year-over-year increases as measured by the consumer price index will pre-empt Fed monetary policy decisions.

- Unanticipated events: Geopolitical events like more COVID lockdowns in China and escalation of the Russian-Ukraine war; or a unexpected earnings reports in equities may cause Treasury prices to spike in response to equity sell-offs.

- Treasury yields: Monitoring the relative increase/decrease versus historical highs/lows of 2-, 10-, and 30-year Treasury yields.

As with all Daily Leveraged and Inverse ETFs, they can be powerful ways to magnify short-term exposure — but only if you do your due diligence on their underlying holdings, have a strong investment thesis on the outlook for the Treasurys market, and have a high risk tolerance.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, for the Direxion Daily 20+ Year Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily 20+ Year Treasury Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, risks related to Shorting and Cash Transactions, and risks specific to investment in U.S. Government Securities. A security backed by the U.S. Treasury or the full faith and credit of the United States is guaranteed only as to the timely payment of interest and principal when held to maturity. The market prices for such securities are not guaranteed and will fluctuate. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

Distributor: Foreside Fund Services, LLC.