Despite the Dow Jones Industrial Average looking at its fifth straight losing session last Friday, it’s easy to forget that the bull run in the stock market turned 10 years of age last weekend. Despite fears of a global economic slowdown, the major indexes are still up to start 2019.

The rise comes as investors are picking themselves after a tumultuous way to end 2018. The Dow fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent.

2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. In 2019, investors are no doubt reassessing their strategies for how to distribute their capital through the rest of the year.

“Bull markets don’t die of old age,” said Jason Ware, chief investment strategist and chief economist of Albion Financial. “I see no reason the bull market should abruptly end as long as the economy stays out of recession.”

Potential leveraged ETF plays in the Direxion Daily S&P500 Bull 3X ETF (NYSEArca: SPXL) and the Direxion Daily S&P 500 Bear 3X ETF (NYSEArca: SPXS) could have traders placing these ETFs on their watch lists.

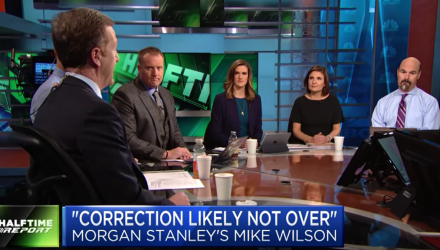

In the video below, Mike Wilson of Morgan Stanley, Meghan Shue of Wilmington Trust, and Amy Raskin of Chevy Chase Trust join CNBC’s “Fast Money Halftime Report” team to discuss what is weighing on the market and if the market correction could be ending soon.

For more market trends, visit ETF Trends.