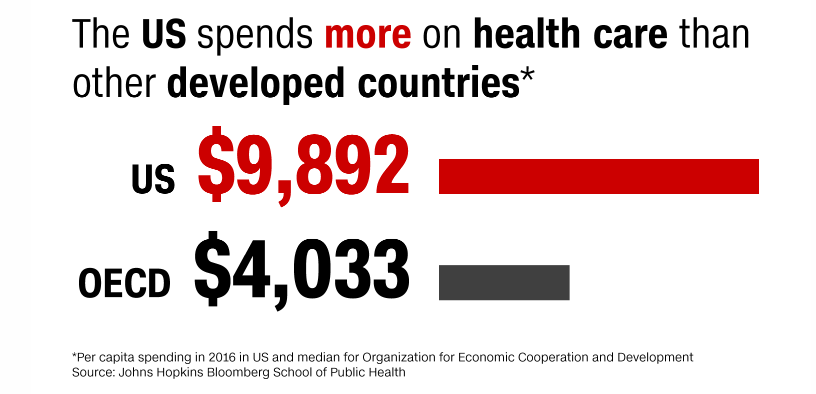

“It’s not that we’re getting more. It’s that we’re paying much more,” Anderson said.

As mentioned, a health care ETF like CURE can be used as a defensive play in addition to a short-term profitability tool. If volatility rears its ugly head again in 2019, health care can serve as a safe-haven sector for investors cycling out of their growth-oriented investments.

To start the year, CURE is up 2.81 percent year-to-date and 12.84 percent the last three years according to Yahoo Finance performance numbers.

For more market trends, visit ETFTrends.com