In a world where online shopping is a dominant force in retail, the sector has been an unlikely source of fuel for the transportation sector as evidenced in the correlation between the Direxion Daily Retail Bull 3X ETF (NYSEArca: RETL) and the Direxion Daily Transportation Bull 3X Shares ETF (NYSEArca: TPOR).

A tailwind of positive economic data from the Commerce Department with retail sales increasing by 0.5% in July has helped to propel the retail sector through the beginning of the third quarter. Retail ETFs like RETL have been the beneficiaries of an extended bull market where consumers are more apt to open their wallets.

That bodes well for retail shops who are expecting a robust shopping season, particularly with regard to back-to-school shopping. Multinational professional firm Deloitte is forecasting that this year’s back-to-school spending will increase by 2.2 percent to $27.6 billion, with the average spending per household rising to $510 from $501 last year, including $112 on school supplies–up from $104 the previous year.

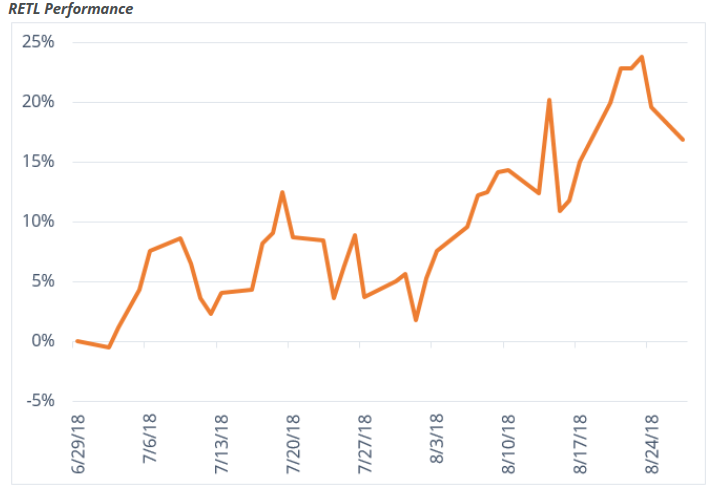

With investor exuberance ready to hop on board the retail ETF train, RETL experienced $14 million in inflows since the beginning of the third quarter. Based on Yahoo! Finance performance figures, RETL is up 23.72% year-to-date and 59.26% the past year. Since May, RETL has climbed above its 50-day moving average, touched down that level in early August and is now back above, which could be due to a boost from the back-to-school shopping season.

![]()

Related: Data Bodes Well for Retail ETFs