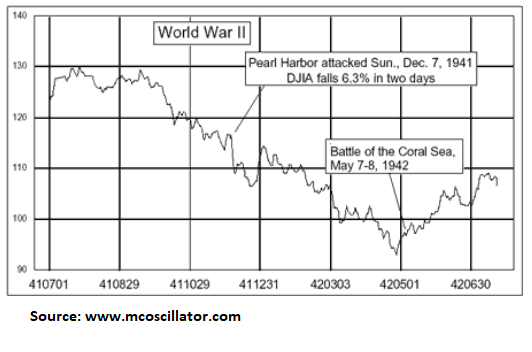

Pearl Harbor spurred the entrance of the United States into World War II, but here’s what happened in the markets following the attack:

- Following the attack on Sunday morning, the Dow fell by over 3% during Monday’s session–the same day that the U.S. would officially declare war on Japan

- The sell-off in the markets would continue on Tuesday with another 2.8% drop

- The Dow Jones Industrial Average plunged 6.5% in four days through Dec. 10, 1941

- The Dow rebounded after a month by 3.8%, but the sell-off pressure continued for the next 12 months

- The Dow reached its lowest level since 1934 following the attack on Pearl Harbor

Despite the declines in the capital markets, the resilience of Americans shone through and the Dow would eventually climb out of its hole following the Battle of the Coral Sea in 1942, which would eventually lead to a victory by the Allied forces against the Axis powers in 1945.

“We are confident in our devotion to country, in our love of freedom, in our inheritance of strength,” said Roosevelt during December 1941, just four days before Christmas and a couple of weeks following the attack. “But our strength, as the strength of all men everywhere, is of greater avail as God upholds us. (It will be) a day of . . . asking forgiveness for our shortcomings of the past, of consecration to the tasks of the present, of asking God’s help in days to come.”

Related: 3 Economic Challenges George H.W. Bush Overcame During his Presidency

For more market trends, visit ETF Trends.