Housing starts were better than expected during the month of March, raising the prospect that the real estate sector may not be hurting amid rising interest rates.

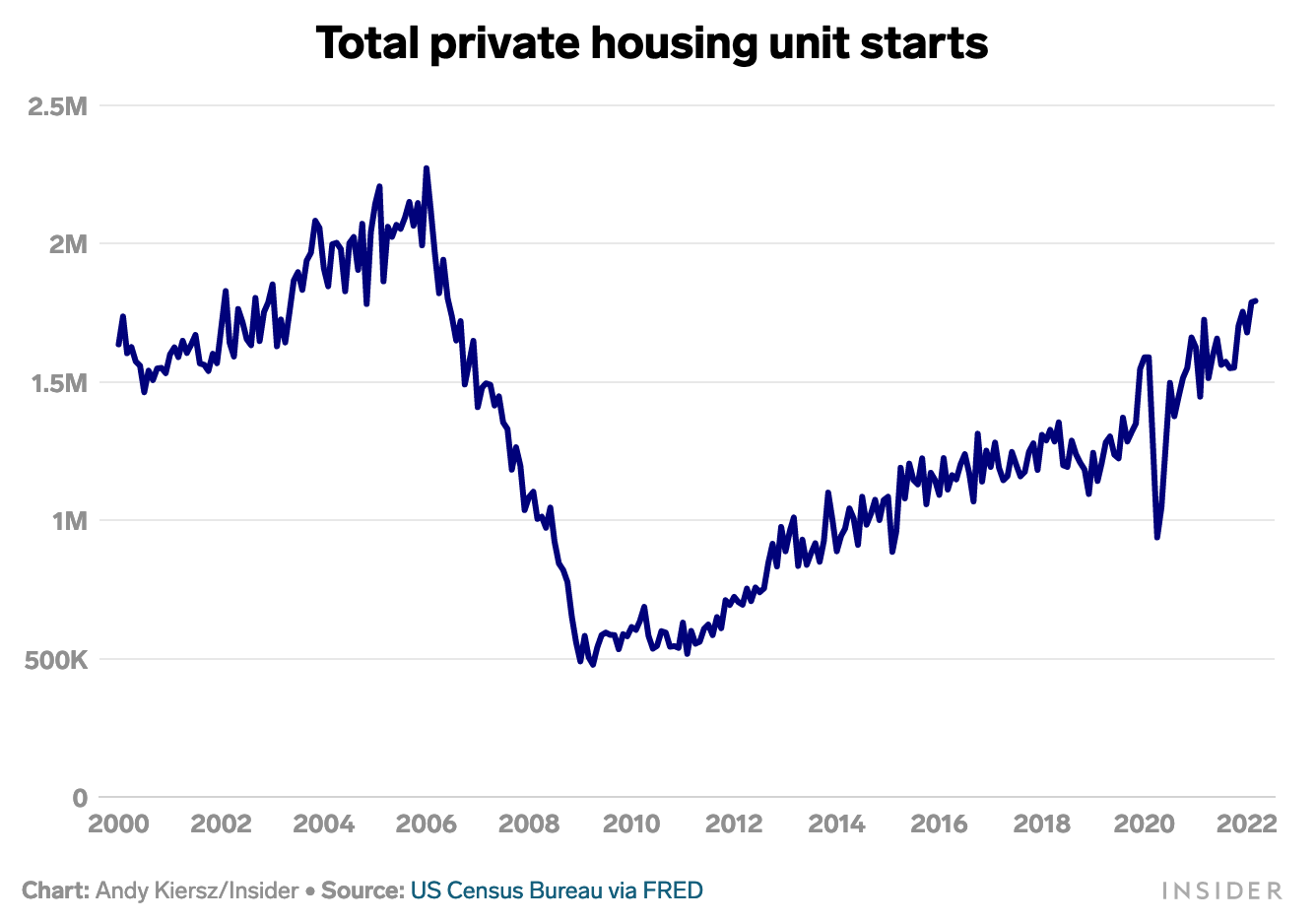

“US housing starts unexpectedly rose in March to a seasonally adjusted annual rate of 1.79 million units, the Commerce Department announced Tuesday morning,” a Business Insider article says. “Economists surveyed by Bloomberg expected starts to fall slightly to a pace of 1.75 million. The March rate marks the fastest since 2006 and a second consecutive monthly improvement.”

Real estate prices have been soaring since the pandemic. However, the positive data certainly gives hope to prospective homeowners.

“The uptick is a welcome sign for Americans struggling to buy a home in the supply-starved market,” the Business Insider article says further. “Home prices surged at breakneck speed early in the pandemic as strong demand quickly pulled nationwide inventory to record lows.”

“Bidding wars on the few homes still available boosted prices even higher,” the article adds. “The S&P Case-Shiller Home Price Index — which tracks prices nationwide — rose 19.2% in the year through January, landing just below last year’s record highs and well above the home inflation seen before the market bubble burst in the late 2000s.”

Trading Bullishness in Real Estate

In spite of the threat of rising interest rates, the Direxion Daily MSCI Real Estate Bull 3X ETF (DRN) is up close to 15% within the last few months. It will be interesting to watch how the rising rate campaign by the Fed will play out through the rest of 2022 and just how it impacts the real estate market.

As for DRN, the fund seeks daily investment results equal to 300% of the daily performance of the MSCI US IMI Real Estate 25/50 Index. The index is designed to measure the performance of the large-, mid- and small-capitalization segments of the U.S. equity universe that are classified in the real estate sector as per the GICS.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.