Online shopping is no longer a niche component of the retail sector, and traders can keep playing its growth with leveraged funds such as the Direxion Daily Retail Bull 3X ETF (RETL).

The pandemic only accelerated that growth, especially within the past year. Social distancing measures have pushed previously hesitant shoppers into adopting online retail.

“When we think about the COVID-19 pandemic’s impact on how people shop — and on how retailers cater to their needs — it’s important to recognize that consumer preferences to ‘buy online, pick up in store’ and to take advantage of other digitally enabled solutions are not simply short-term shifts,” a MIT Sloan Management Review article noted. “In fact, the current period is more likely a tipping point in the digitization of retail and in the shifting power dynamics between buyer and seller.”

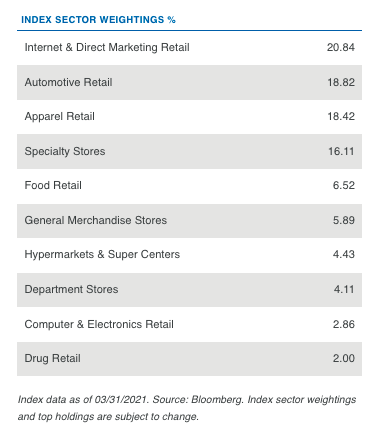

Sector weightings for the fund are below:

Overall, RETL seeks daily investment results of 300% of the daily performance of the S&P Retail Select Industry Index. With its triple leverage, RETL gives investors the ability to:

- Magnify short-term perspective with daily 3X leverage;

- Go where there’s opportunity, with bull and bear funds for both sides of the trade; and

- Stay agile, with liquidity to trade through rapidly changing markets.

Changing Consumer Behavior

The adoption of online shopping is shapeshifting consumer behavior. Not only are consumers purchasing goods and services online, they’re utilizing the internet in new ways.

“The traditional business-to-consumer retail model has unraveled in recent years, and COVID-19 has accelerated a push toward a new era of consumer-to-business relations,” the MIT article said further. “In this new model, consumers have become merchants in their own right, buying from a broad spectrum of retail channels, curating and promoting their own array of products via their social media accounts, reselling used goods through digital platforms, and setting the terms for how their purchases get to their doorsteps.”

“Consumers no longer rely on retailers the same way they did in the traditional model,” the article added. “Rather than trusting the same retailer for the best prices and the broadest selection, people are more likely to skip from source to source, powered by peer recommendations and price comparison shopping as they go.”

For more news and information, visit the Leveraged & Inverse Channel.