An election week should keep action-oriented oil traders happy. More volatility could be ahead, giving traders fair warning to brace themselves as the world watches the election results on Tuesday.

“Even though oil turned positive Monday, the big swings were reminiscent of the volatility that roiled energy markets early in the year,” a Wall Street Journal report said. “Analysts worry that slumping demand will combine with higher production to again oversupply the market and crash prices, prompting outsize moves in both directions.”

Of course, it all comes back to the election, which could have oil traders losing much sleep this week.

“Traders’ anxieties about a fall in oil demand as infection rates rise were supplemented by a cocktail of factors relating to supply and volatility around Tuesday’s U.S. election,” the report added further. “Many traders are bracing for more swings in riskier investments, with the memories of President Trump’s unexpected election win in 2016 still fresh.”

“It’s production numbers, it’s Covid-19 numbers, it’s the election,” said Robert Montefusco, a Broker at London-based commodities trading firm Sucden Financial. “There’s going to be a lot of volatility this week.”

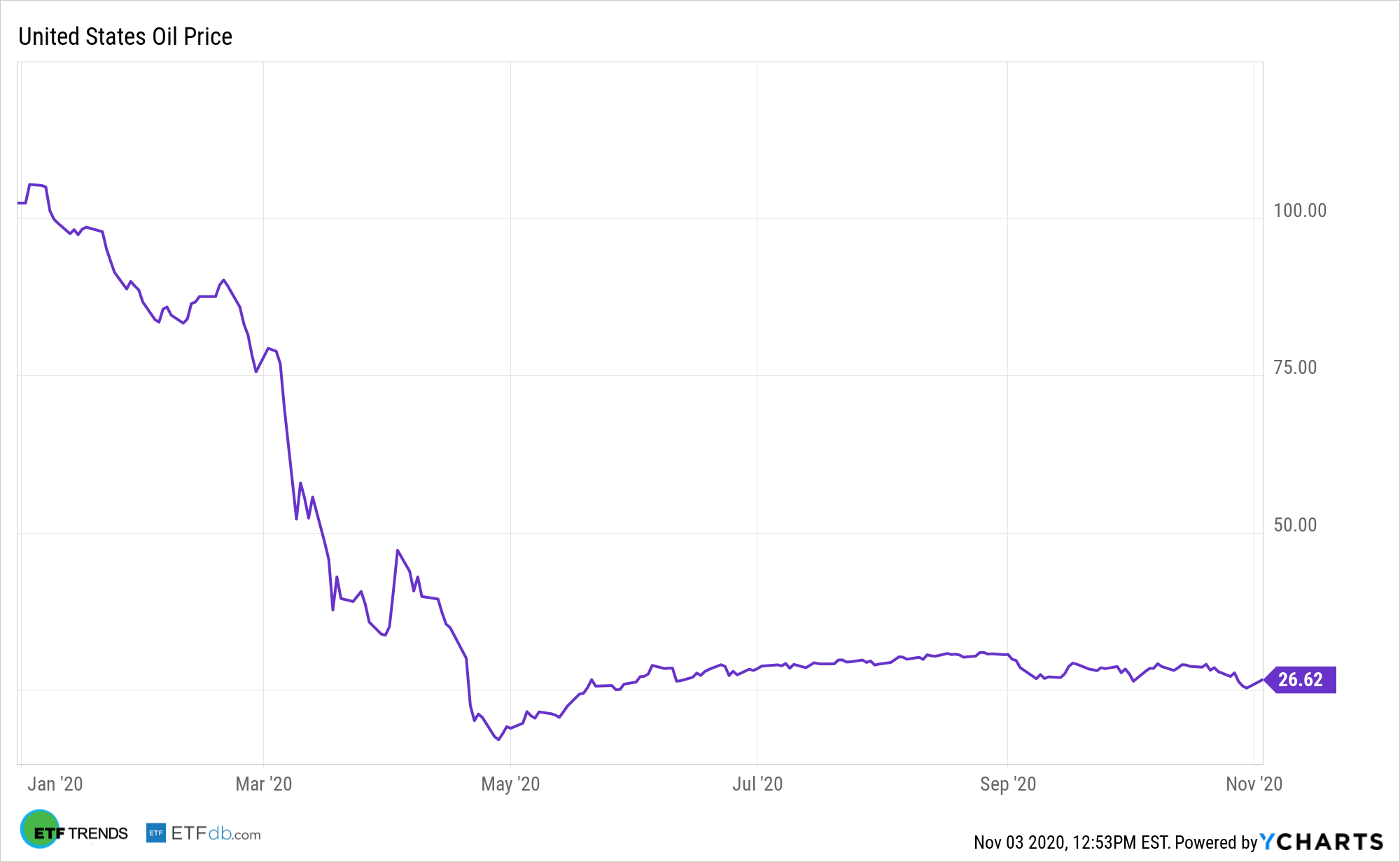

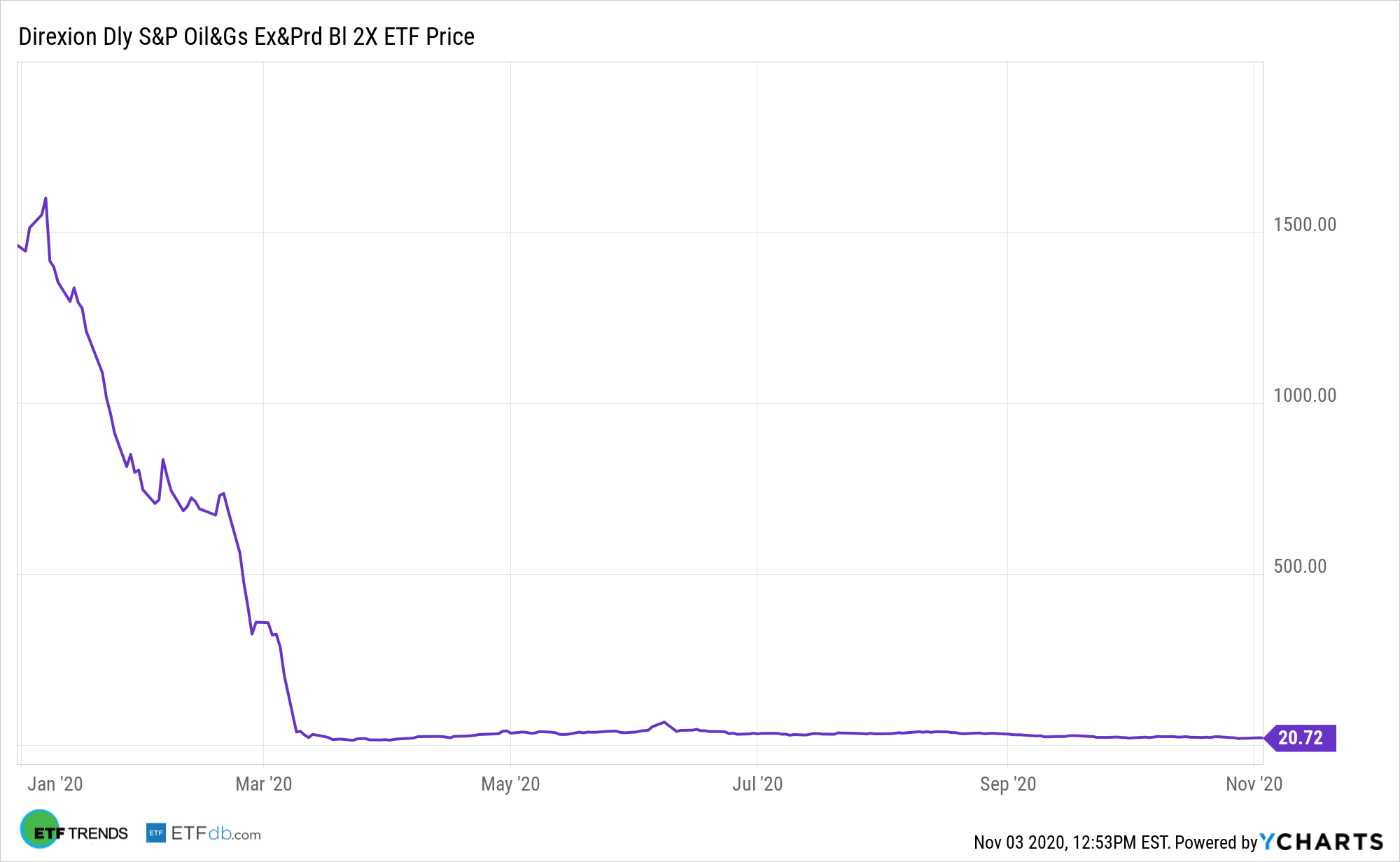

Traders who feel ready to pounce can use funds like the United States Oil Fund, LP (USO). Additionally, those looking to lever up their trades can use the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (NYSEArca: GUSH).

USO seeks the daily changes in percentage terms of its shares’ per share NAV to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the price of a specified short-term futures contract on light, sweet crude oil called the Benchmark Oil Futures Contract, plus interest earned on USO’s collateral holdings, less USO’s expenses. USO invests primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels.

GUSH seeks daily investment results, of 200% of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is designed to measure the performance of a sub-industry or group of sub-industries determined based on the Global Industry Classification Standards.

For more news and information, visit the Leveraged & Inverse Channel.